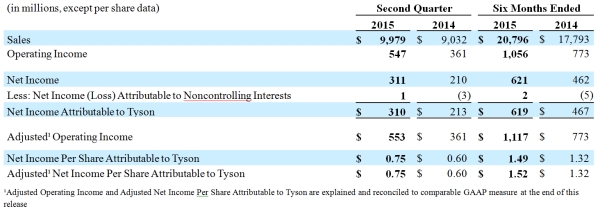

Tyson Foods, Inc. (NYSE: TSN), today reported the following results:

Second Quarter Highlights

- Sales increased 10.5% to approximately $10 billion

- Adjusted operating income up 53% to $553 million

- Adjusted EPS up 25% to $0.75 compared to $0.60 in second quarter of prior year

- Overall adjusted operating margin was 5.5%

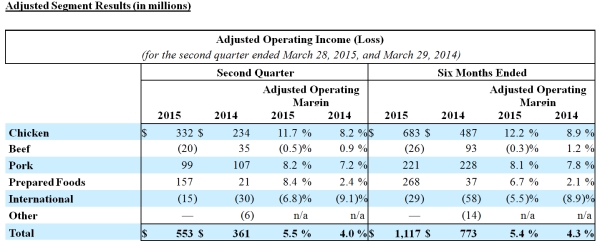

- Chicken segment operating margins of 11.7%

- Record Prepared Foods segment adjusted operating margins of 8.4%

- Pork segment operating margins of 8.2%

- Captured $77 million in total synergies during the second quarter

“This was another great quarter and better than we initially expected,” said Donnie Smith, president and chief executive officer of Tyson Foods. “Our fiscal second quarter is seasonally challenging, but we came in above our projections due to strong performances by our Prepared Foods and Chicken segments.

“Our branded, value-added portfolio of complementary products has allowed us to achieve the balance needed to produce consistent, sustainable growth. We have structured our company to capitalize on the tailwinds and to manage through the headwinds in the parts of our business that are subject to commodity markets. By producing innovative, protein-centric foods, we are uniquely positioned to meet consumers’ needs for all meal occasions and all day parts, at home and away from home.

“The acquisition of Hillshire Brands has played an important role in Tyson Foods’ transformation, and we are very pleased with the progress of the integration and synergy capture, achieving $77 million in synergies in the second quarter. Because we are ahead of pace in reaching our stated target of more than $225 million in fiscal 2015, we are raising our synergy target to more than $250 million for this year, $400 million in 2016 and $600 million in annual synergies by the end of fiscal 2017. In addition, we are reiterating our annual guidance of $3.30-3.40 adjusted earnings per share.”

Adjustments to Segments for the second quarter fiscal 2015

-

Prepared Foods operating income was adjusted for the following:

- Decrease of $8 million related to the legacy Hillshire Brands Company ("Hillshire Brands") plant fire insurance proceeds (net of ongoing costs).

- Increase of $5 million related to merger and integration costs.

- Other adjusted operating income increased by $9 million related to merger and integration costs.

Adjustments to Segments for the first six months of fiscal 2015

-

Prepared Foods operating income was adjusted for the following:

- Increase of $28 million of ongoing costs (net of insurance proceeds) related to a legacy Hillshire Brands plant fire.

- Increase of $9 million related to merger and integration costs.

- Other adjusted operating income increased by $24 million related to merger and integration costs.

Adjusted operating income and adjusted operating margin are presented as supplementary financial measurements in the evaluation of our business. We believe the presentation of adjusted operating income and adjusted operating margin helps investors assess our financial performance from period to period and enhances understanding of our financial performance; however, adjusted operating income and adjusted operating margin may not be comparable to those of other companies in our industry, which limits the usefulness as comparative measures. Adjusted operating income and adjusted operating margin are not measures required by or calculated in accordance with GAAP and should not be considered as substitutes for any measures of financial performance reported in accordance with GAAP. Investors should rely primarily on our GAAP results, and use non-GAAP financial measures only supplementally in making investment decisions.

Summary of Segment Results

- Chicken - Sales volume and average sales price were virtually unchanged in the second quarter of fiscal 2015. For the six months of fiscal 2015, sales volume grew as a result of stronger demand for chicken products and mix of rendered product sales. Average sales price increased for the first six months of fiscal 2015 as a result of market conditions and sales mix changes. Operating income increased due to improved sales mix in addition to lower feed ingredient costs which decreased $75 million and $185 million during the second quarter and first six months of fiscal 2015, respectively.

- Beef - Sales volume decreased due to a reduction in live cattle processed. Average sales price increased due to lower domestic availability of beef products. Operating income decreased as we were not fully able to pass along increased inputs from higher fed cattle costs, in part due to the seasonal reduction in beef demand as well as the relative value of competing proteins, in addition to increased operating costs.

- Pork - Sales volume decreased due to the divestiture of our Heinold Hog Markets business in the first quarter of fiscal 2015. Excluding the impact of the divestiture, our sales volume grew 3.2% and 2.4% for the second quarter and first six months of fiscal 2015, respectively, driven by better demand for our pork products. Live hog supplies increased, which drove down livestock cost and average sales price. While reduced slightly compared to prior year, operating income remained strong as we maximized our revenues relative to live hog markets, partially attributable to operational and mix performance.

- Prepared Foods - Sales volume increased due to incremental volumes from the acquisition of Hillshire Brands. Average sales price increased primarily due to price increases associated with better product mix which was positively impacted by the acquisition of Hillshire Brands. Operating income improved due to an increase in sales volume and average sales price mainly attributed to Hillshire Brands, as well as lower raw material costs of approximately $40 million and $30 million for the second quarter and first six months of fiscal 2015, respectively, related to our legacy Prepared Foods business. Additionally, profit improvement initiatives and Hillshire Brands synergies positively impacted Prepared Foods operating income by $70 million and $125 million for the second quarter and first six months of fiscal 2015, respectively.

- International - Sales volume decreased due to the sale of our Brazil operation during the first quarter of fiscal 2015 and weak demand in China. Average sales price decreased due to supply imbalances associated with weak demand in China and currency devaluation in Mexico. Operating loss improved due to the sale of our Brazil operation and better market conditions in Mexico.

Outlook

In fiscal 2015, we expect domestic protein production (chicken, beef, pork and turkey) to increase approximately 2% from fiscal 2014 levels. Grain supplies are expected to increase in fiscal 2015, which should result in lower input costs as well as decreased costs for cattle and hog producers. The following is a summary outlook for each of our segments, as well as an outlook on sales, capital expenditures, net interest expense, liquidity and share repurchases. Our accounting cycle results in a 53-week year in fiscal 2015 as compared to a 52-week year in fiscal 2014. Accordingly, the outlook is based on a 52-week year.

- Chicken – Current USDA data shows an increase in chicken production around 4% in fiscal 2015. More recent data indicates a greater increase in supply; however, we believe demand will more than keep pace with the supply change. Based on current futures prices, we expect lower feed costs in fiscal 2015 compared to fiscal 2014 of approximately $400 million. Many of our sales contracts are formula based or shorter-term in nature, but there may be a lag time for price changes to take effect. Based on the strong demand forecast and anticipated favorable pricing environment, we believe our Chicken segment's operating margin should be approximately 11% for fiscal 2015.

- Beef – We expect to see a reduction of industry fed cattle supplies of 5-6% in fiscal 2015 as compared to fiscal 2014. Although we generally expect adequate supplies in regions we operate our plants, there may be periods of imbalance of fed cattle supply and demand. While we believe our Beef segment will be profitable in fiscal 2015, it will be below fiscal 2014.

- Pork – We expect industry hog supplies to increase 4-5% in fiscal 2015 compared to fiscal 2014. For fiscal 2015, we believe our Pork segment's operating margin will be in its normalized range of 6-8%.

- Prepared Foods – We are proceeding with the integration of Hillshire Brands. In fiscal 2015, we expect to realize in excess of $250 million of synergies from the acquisition as well as our profit improvement plan for our legacy Prepared Foods business, with the majority to be realized in our Prepared Foods segment. We expect our operating margin will be in excess of 8% for the remainder of fiscal 2015, and the long-term operating margin for this business should be between 10-12%.

- International – The sale of our Mexico operation is pending the necessary government approvals, and we expect to receive a decision during fiscal 2015. Subject to governmental approval and completion of the sale, we would realize a gain on the sale. Excluding any potential gain associated with the pending sale, we expect the International segment’s adjusted operating loss to improve by approximately $25 million in fiscal 2015 compared to fiscal 2014.

- Sales – We expect fiscal 2015 sales to approximate $41 billion as we integrate Hillshire Brands and continue to accelerate growth in domestic value-added chicken sales and Prepared Food sales.

- Capital Expenditures – We expect fiscal 2015 capital expenditures to be approximately $900 million.

- Net Interest Expense – We expect fiscal 2015 net interest expense to be approximately $275 million.

- Liquidity – We expect total liquidity, which was $1.3 billion at March 28, 2015, to be above our goal to maintain liquidity in excess of $1.2 billion.

- Share Repurchases – We currently plan to repurchase a number of shares equivalent to the dilution expected to be realized from the current fiscal year grants under our stock-based compensation programs.

Report Abusive Comment