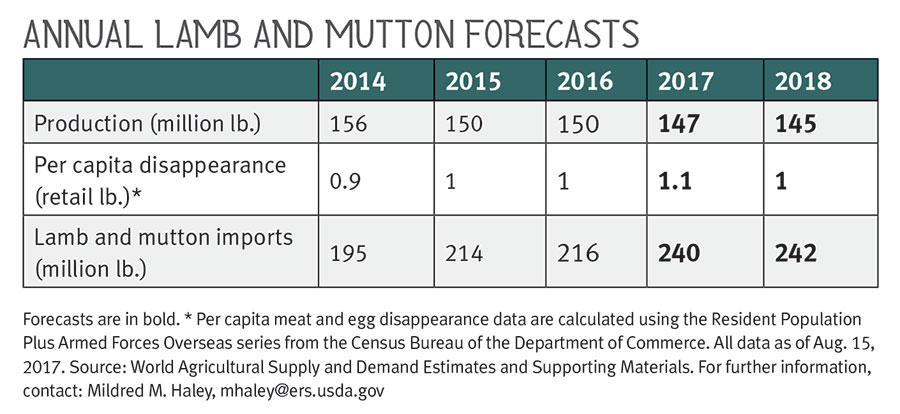

The forces of demand and supply continue to tussle, with strong demand seemingly the victor. Wholesale lamb and live lamb prices saw an upward trend in the first few months of 2017 after a couple years of downward pressure. Lower sheep inventory has translated to steady to lower domestic production year-to-year, yet increasing import volume has led to higher domestic lamb availability. While lamb supplies increase, demand remains strong.

Sheep and lamb inventory in the U.S. contracted by 2 percent in 2016 to 5.2 million head. In 2014 and 2015 inventory expanded; however, sheep numbers were down 3 percent in five years and down 15 percent in the 10 years since 2006. Due to increased imports, lamb and mutton consumption increased 5 percent in 2015 and 7 percent in 2016.

The updated demand index indicated that for the first time in 25 years, retail demand for lamb in 2015 (all cuts and sources) exceeded the 1990 base year reference level. In 2015, demand was up 7 percent over the previous year and up 4 percent compared with 1990. Demand increased again in 2016, up 3 percent over 2015, and up 7 percent over the 1990 reference year.

The U.S. maintains a majority market share at foodservice, but a lower share at retail. U.S. lamb accounts for about 34 percent of the retail grocery market, Australian lamb about 54 percent and New Zealand lamb about 12 percent. For the major retail cut categories, U.S. lamb tended to be priced higher than Australian and New Zealand lamb, indicating consumers perceived value differences between U.S. and imported lamb meat. A recent lamb demand study found country of origin is important to U.S. lamb consumers, and, by extension, that country-of-origin labeling is both a valid and a valuable marketing tool for the U.S. lamb meat industry (Marsh and Shiflett, 4/2016). NP

Report Abusive Comment