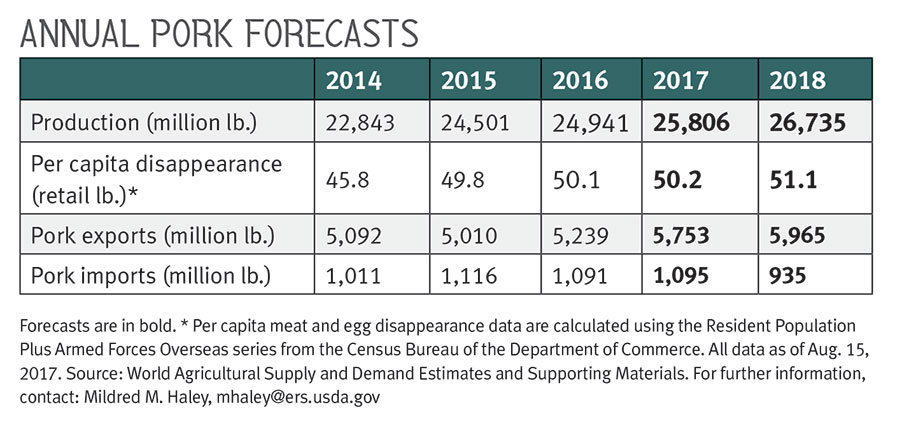

The U.S. protein industry is in expansion mode. With pork production expected to be up more than 12 percent in 2017, abundant supplies mean pork will continue to be a good value for both retailers and consumers.

Pork volume snapshot

Through August 2017, it has been a banner year for pork demand on both the domestic and international fronts. This year is forecast to once again break all production records, which translates into ample pork supplies through the fourth quarter and into 2018. These large pork supplies will create strong opportunity for retailers and, ultimately, consumers.

While both beef and chicken supplies also will be up, the potential for lower pork prices in the meat case make it a favorable choice for consumers. In the third and fourth quarters of 2017, we expect retailers to explore many promotional opportunities for pork. In short, pork may continue to offer a gross margin opportunity, thereby allowing retailers to both buy it at a value and sell it at a profit to consumers.

A retailer’s key to success this fall will be an aggressive price point and increasing weekly pork features. Undoubtedly, abundant supplies of meat are headed to supermarkets across the U.S., but pork may continue to be a sound economic choice for retailers to feature because of these favorable gross margin returns. Also, the pork category traditionally wins the upcoming holiday season.

The abundant supply of pork coupled with its versatility, great flavor and price point means the average shopper can expect to see pork featured at the meat case and through print promotion this year. Pork is a great option, offering consumers a good value for everyday meals.

Consider the holiday ham

Pork wins the holiday season as well. For consumers, it is a tasteful, center-of-the-plate offering; for retailers, pork means increased performance through sales value (i.e. dollars) and volume (i.e. pounds). In 2016 alone, ham was No. 1 in sales, with more than 259 million pounds of ham sold. For perspective, ham sales represented more than half of the pounds of meat sold at retail and more dollar sales than whole turkey during the fourth-quarter holiday time period.

To continue this success in the fourth quarter of this year, retailers should focus on the fresh-pork category and consider featuring pork shoulders, loins and hams for the remainder of 2017. The cuts will bring the best value to retailers and will help move a significant volume of pork during a period of increasing supply.

Looking deeper at hams, the No. 1 selling protein for the holidays, new merchandising options may hold the key to success for retailers looking to increase sales. The National Pork Board’s ham innovation research studied how retailers merchandise ham. The research identified new flavor profiles, assessed the size of the end product and defined ways to feature pork. Innovation in ham merchandising will result in consumers being offered more choices for their Thanksgiving and Christmas holiday meal planning.

For example, a leading retailer is introducing smaller portions of ham along with whole hams this year. The smaller portion size meets the needs of smaller households and those of Millennial shoppers. By decreasing the size of the ham, pork is introduced to a new segment of consumers that may have otherwise not considered purchasing it before.

For mid-tier consumers, pork loins are a great premium cut option. From the rack of pork to the boneless roast, the pork loin offers retailers versatility in merchandising. The abundant supply of pork will position the loin with consumers and retailers as a value product.

And for those value-based shoppers, shoulder roasts are ideal. Using slow cookers, preparing pork makes for an easy weeknight meal or a weekend potluck party. Pork shoulder can easily stretch the consumer dollar, is easy to prepare and translates into multiple meals.

Temperature + names + quality = repeat purchase

Consumer research has consistently shown Americans need to better understand how to prepare common cuts of pork to avoid overcooking, which leads to a less-than-optimal eating experience. The National Pork Board works closely with retailers to educate consumers on the correct cooking temperature, the names of pork cuts and the importance of quality attributes such as color and marbling. Shoppers who cook pork to the ideal temperature have a more consistent eating experience, and thus return to buy more pork.

For pork whole-muscle cuts — loins, chops and roasts — the ideal cooking temperature range is 145 degrees Fahrenheit (medium) to 160 degrees Fahrenheit (medium-well), followed by a three-minute rest. Ground pork, like all ground meat, should be cooked to 160 degrees Fahrenheit. This 145-degree temperature followed by a three-minute rest was approved by the U.S. Department of Agriculture (USDA) in 2011, and has proven to have improved the overall consumer eating experience. Additionally, it has allowed consumers to have greater confidence in pork’s food safety. Consumer research validates that the lower temperature range can improve consumers’ taste preferences for pork and encourage repeat purchases.

The National Pork Board worked with retailers to implement the changing of pork cut names. The simplified meat names, approved by the USDA in 2013, aligned the naming convention of pork and beef cuts to simplify the consumer experience. The new pork cut names match those already used in foodservice. Although still catching on across the U.S., this change has improved the overall consumer awareness at the meat case.

Finally, the National Pork Board funded and conducted research on pork quality and consumer preferences of pork quality attributes. The research goal is to provide a more consistent eating experience for all consumers leading to increased pork sales at retail and food service. Research has shown that consumers demand a consistent eating experience and that these experiences can result in more pork purchases.

In a year of high supply and lower prices, retailer success is critical to the pork industry. The National Pork Board looks forward to working with its retail partners to implement the tools needed to strengthen consumer demand and growth in pork sales. NP

Report Abusive Comment