By: Anne-Marie Roerink, President, 210 Analytics LLC

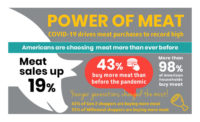

Twenty months into the pandemic, meat retailing remains in flux. Continually changing consumer consumption and buying patterns, high inflation and severe supply chain constraints have yet to create a new and lasting balance of supply and demand. IRI and 210 Analytics have teamed up since March 2020 to document the ever-changing marketplace and its impact on the meat department. The monthly meat and poultry analysis is made possible by Marriner Marketing.

Both everyday and holiday meat and poultry demand remains in flux. The IRI primary shopper survey points to some more normalcy for the Thanksgiving celebrations compared with last year. More people are planning on celebrating Thanksgiving this year, with 60 percent saying they will celebrate the holiday as usual, defined as the way they did before COVID-19. That will likely result in strong demand for turkey this year as the flagship Thanksgiving center-of-plate meat. As is, sales are off to a strong start. October 2021 dollar sales of whole bird turkey are 180 percent above October 2020 levels and +194 percent higher in volume. This aligns with the IRI shopper survey in which 36 percent of shoppers said they plan to start shopping earlier. This has been a trend all throughout the pandemic, making the full week before the holiday the biggest week for most departments, rather than the holiday week itself.

There is ample supply of whole bird turkey in the marketplace and consumers have more choice with the average number of items per store up 6.6 percent in October 2021 versus year ago. Additionally, prices for whole bird turkey remain favorable with the average price per volume at $1.42, which is down 4.8 percent from October 2020. The price per unit is up a bit, signaling larger birds in the marketplace than last year. The average price for one whole bird turkey is $21.55, which is up 2.6 percent. Specific preferences for certain sizes, brands or fresh versus frozen aside, finding turkey should be no problem this year.

Other survey findings are:

- 36 percent hosting or attending a party with guests beyond their own household and 25 percent preparing a special meal for just their own household.

- In addition to or in lieu of Thanksgiving dinner, 8 percent are also doing a “Friendsgiving” meal with friends.

- Only 9 percent are not planning on a special celebration this year.

- The average party size is also expected to be bigger this year, at an average of seven to eight people.

- 22 percent expect to spend more on Thanksgiving dinner than they did last year, in part because of inflation and in part because of a larger party size.

Meals continued to be home-centric in October 2021. According to the IRI primary shopper survey, the share of meals prepared at home is back to late spring, early summer levels, at 80.3 percent of total meal occasions. There are many drivers for the reversal, from the uptick in COVID case counts to rapidly rising inflation. While retail inflation is the highest in many decades, the cost for eating out rose even faster. Restaurant inflation typically results in more at-home meal preparation and it is likely we will see an enhanced reaction as many people were reminded of the potential savings and other benefits of home cooking in the past year and a half.

Other changes also point to a reversal in the normalization of shopping and consumption patterns. During the height of the pandemic, as many as 20 percent of trips were online. This dropped to a low of 11 percent in July. In October, the online share of trips increased to 15 percent. Yet online shopping remains a complementary trip for most consumers. Only 4 percent of survey respondents believe they will buy all their groceries online in the next month. This compares to 21 percent who will only buy some or a little online. This underscores the importance of a strong omnichannel strategy to optimize the share of total dollars, particularly in meat and poultry. Fresh sales in general under index in online baskets.

Inflation

The consumer price index increased 6.2 percent in October, the largest year-over-year increase in 30 years, according to the Labor Department. Food prices jumped 0.9 percent compared with September and rose 5.4 percent for the year. IRI-measured price per volume also shows that prices continued to rise over and above their elevated 2020 levels for food and beverages.

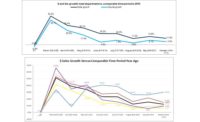

Meat and Poultry Price per Volume

The average price per pound in the meat department, both fixed and random weight, stood at $4.30 in October, up 12.0 percent from October 2020. Year-to-date, price inflation is more moderate, with an average price of $4.11, up 5.9 percent. Fresh meat has experienced above-average inflation, particularly in recent months. Prices in October were up 12.7 percent over the same month in 2020.

On the fresh meat side, beef had the highest year-on-year inflation in October, at +19.1 percent. Pork and lamb also increased by double digits, at +15.9 percent and +10.5 percent, respectively. Turkey is the only one of the fresh proteins to have more favorable pricing this year than last. That includes whole bird turkey which, as noted earlier, benefitted from an earlier start to holiday buying this year. Fresh exotic, which includes bison, kept the line on prices with an average of $8.19 per pound.

Meat sales during the first 10 months of 2021

Year-to-date meat sales are now between only one and two percent behind the record 2020 levels. When compared to the pre-pandemic normal of 2019, sales average between 16 percent and 19 percent above typical levels.

Importantly, while inflation certainly plays a role in these high dollar gains compared to the pre-pandemic normal, the retail supply chain continues to move more pounds through the system when compared to 2019. Year-to-date, meat department volume sales were down 6.8 percent compared with 2020, but still average 4.0 percent more than in 2019, with above average gains for processed meat, at +4.7 percent.

Assortment

After many months of reduced assortment in 2020, the number of items in the meat department trended up in the second quarter of 2021 only to come back down in recent months. In September 2021, the average meat department counted 532 items, which was down to the levels last seen in the third quarter of 2020. In October 2021, the average items per store dropped to 529. This is down nine items from 2020 and 29 from 2019. Both fresh and processed assortment was down in October. The average number of items in fresh were down 0.6 percent and processed was down 2.3 percent.

Fresh meat by protein

The overall gain in fresh meat sales was supported by beef, chicken, pork, turkey, lamb, and exotics. Only veal sales were down versus 2020 levels. Turkey and lamb generated the highest gains, with fresh lamb sales still sitting 47.2 percent over year-ago levels.

Processed meat

Processed meat grew over and above the 2020 and 2019 sales levels, driven by robust bacon, smoked ham, and processed chicken sales. Bacon and packaged lunchmeat are the two biggest sellers within processed meat and their gains easily offset the declines seen in hot dogs.

Grinds — renewed growth for ground beef

Grind sales have been strong these past three months. In the five October weeks, ground beef generated $1.2 billion, 11.0 percent over year ago and up 20.8 percent versus 2019. Ground pork recorded the strongest growth, at +12.8 percent year-on-year. While ground lamb sales are down, supply constraints may be influencing these results.

The next performance report in the IRI, 210 Analytics and Marriner Marketing series will be released mid-December to cover the November sales trends, including the Thanksgiving holiday.

Please thank the entire meat and poultry industry, from farm to store, for all they do.