From “Where’s the Beef?” to Five Guys Burgers and Fries, the stable, standard hamburger has come a long way over the last several decades. Today, particularly in the major metropolitan areas of the United States, the burger is experiencing a renaissance of sorts — and breaking new culinary ground in myriad ways.

Foodservice operators and burger processors have been pushing hard to meet demand for what’s different, as well as to help create innovation.

From specialty grinds and blends, to a more homemade/homestyle look and mouthfeel, to an ever-increasing range of toppings and bun types, the burger is no longer bound only to the imaginations of the fast-food restaurateurs — it seems everyone has (or wants) that specialty burger on their menu.

Darren Tristano, executive vice president, Technomic Inc., sees the beginnings of this macro trend reaching back beyond the recession of 2008-2009.

“It starts with the fact that burger chains like McDonald’s, Burger King and Wendy’s just haven’t put emphasis or focus on burger,” he explains. “They’ve focused on chicken, beverages, breakfast — everything but the burger.”

He adds that even burger launches such as The Baconator, The Steakhouse or the Angus Third Pounder, to name a few, have not indicated a strong dedication to evolving the burger segment.

“The bottom line is, customers don’t see these brands as producing a ‘great’ burger — they see them as producing a ‘good’ burger,” Tristano says. “What that has done is open the door for other restaurants to create great burgers.”

Then, when you add the impact the recession had on consumer discretionary spending, an entire new opportunity was created in the marketplace.

“During the recession, the burger became an affordable indulgence, because instead of spending $4 or $5, you could spend $6 to $8 and get something really great,” Tristano says. “Better than what you’d normally get at a fast-food restaurant. That allowed for the ‘better burger’ development [to grow] in fast-casual and even in full-service restaurants.”

Click here to read our Q&A with Raul Reyes, director of marketing, McDonald’s USA. This Q&A is online-only editorial content that you can find only at ProvisionerOnline.com. |

“There’s a very limited base of customers who can afford and will pay the $7.99 [for a premium burger],” he says. “There is still going to be that 18- to 30-year-old man who wants a less expensive burger and every day goes to his local joint for lunch. … There’s going to be moms just wanting something quick, good and quality but less expensive.”

Therefore, foodservice operators and burger processors cannot shun tradition, most experts say. Heather Lauer, brand manager for Cargill Value Added Meats Foodservice, agrees that there remains a deep-seated desire among consumers who want a straight-up hamburger, without all the fancy ingredients.

“Even the boutique burger shops around the country have a traditional option on the menu, [as they push] the boundaries on how they’re building their burgers,” she says. “[It shows] you can still push boundaries with your burger platform, but having that traditional build is also important for that particular consumer who’s searching for just a good, old-fashioned hamburger experience.”

Chef Anthony Hagans, executive chef at Harris Ranch Restaurant, believes the influx of higher-end burger joints isn’t a far cry from some of the past trends in restaurant themes — and it really does go beyond the burger itself.

“It’s the atmosphere and what kind of goes with it,” he says. “The same thing happened years ago with chicken wings places. Now they have these themed restaurants you go into and get burgers.

“But it’s the way the tables look; it’s the way the restaurant looks; that type of thing has really pushed that market. It’s the same beef patty they’re serving, it’s just the experience of how they’re serving it,” Hagans adds.

Burger processors have loads of options when it comes to capitalizing on the trends driving the marketplace currently, and the versatility of burgers has been great for the consumer, great for the foodservice operator and retail operator. Lauer says processors such as Cargill have a lot of factors to juggle when servicing those customers.

“We want to make sure that we’re offering product that will help with repeat traffic for our customers, and in order to do that, we have to have products that are juicy, that are tender, that are flavorful, that perform well with that restaurant’s [equipment],” she says. “Then, when you think about trends, such as sliders or Angus or even turkey burgers for the health enthusiasts, we’re just trying to make sure that we’re providing on-trend varieties — it’s not really difficult for us to stay on trend, we just want to make sure we’re doing it right.”

Another sign of quality to some consumers is that of the “hand-made” or “homestyle” burger — where the burger features a more coarse grind. While it has not been a skyrocketing trend, it is one that restaurants have pitched along with claims of freshness in their premium positioning. Girdhar says meeting any demand for such a burger shouldn’t be an issue for burger processors either — even though it does come with additional challenges.

“Whatever their specifications are, we can do it,” he says. “Really, it’s just a little bit of investment in a different mold plate, [and with] a larger grind size you have to make sure … you can use X-ray technology for some stray foreign materials. The technology is getting better to use those grinds, but at a price.”

Tristano and Technomic see continued shifting of the landscape in the burger section of the foodservice marketplace in coming years, revolving around consumers’ expectations of burgers as it stands today.

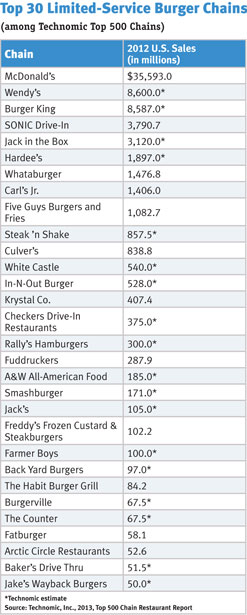

“The burger market has matured, and we’re expecting continued growth because it’s still a small segment,” he says. “Some chains, like Smashburger and Five Guys, still have plenty of units locked and loaded to open, so I think we’ll see some fallout for about three years. … We are expecting more of these restaurants to open and to take share away from maybe the full-service side.”

For burgers specifically, innovation at the plate level is nearly tapped out — most of the alterations nowadays revolve around the toppings, bun type and certain themed burger constructs, says Hagans.

“[We’ve] probably hit the peak of the mountain here,” he explains. “What I’m seeing now is people altering the bun type. And I think after you hit that, you’re pretty much done, unless you’re way out there with some really new idea.”