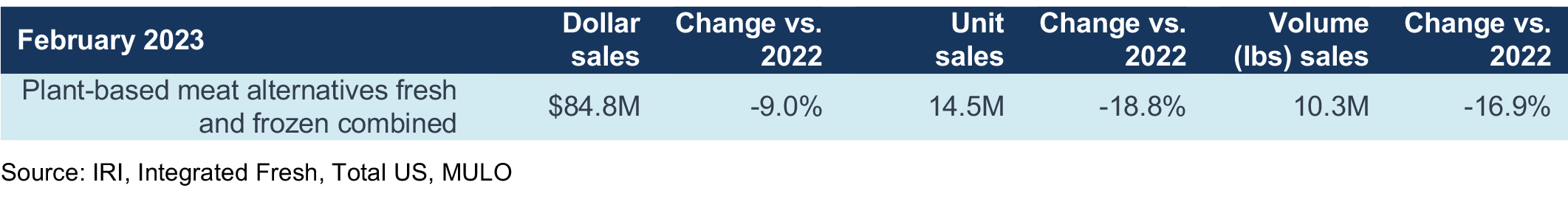

On one hand, retail sales for plant-based meat analogs are limp, with combined sales for refrigerated and frozen plant-based meat alternatives down 9% year over year in February 2023, according to IRI point-of-sales data. In addition to dollar losses (the category racked up $84.8 million in sales for February), units sold and volume for meat alternatives also fell versus year-ago levels.

Annually, dollars, units, and volume for combined frozen and refrigerated plant-based meat alternatives were also down versus prior year levels, according to IRI. Combined frozen and refrigerated plant-based meat alternative sales reached $1.2 billion from February 2022 to February 2023, down minus 3.3% from prior-year levels. Units and volume for combined refrigerated and frozen meat alternatives also fell.

The meat case, by comparison, is faring better. Pound sales for fresh meat fell a little more than 2% year-over-year in February, which combined with mild inflation resulted in a modest dollar increase of 0.3%. Processed meat was close behind, as volume sales dropped 5.3% from February 2022 levels, which combined with inflation resulted in a year-on-year decrease of 1.5% in dollar sales. Meat products’ dollar sales remain ahead of year-ago levels, but pounds are trending behind.

THE NATIONAL PROVISIONER PODCAST

Episode 152: Vice President of Marketing at Nestlé Professional, Fleur Veldhoven, discusses Nestlé’s new plant-based dining program

Fleur Veldhoven, vice president of marketing at Nestlé Professional, chats with The National Provisioner about Nestlé’s new partnership and the launch of its plant-based dining program for colleges and universities.

Despite the plant-based meat alternative category’s less-than-inspiring sales performance, new product development continues to be a priority for food marketers.

The National Restaurant Association’s 2023 Food and Beverage Awards, for example, could have been called the “Plant-based Food and Beverage Award.” Out of the 42 award recipients selected for menu innovation, exactly zero animal-based products made the list.

So while the current market for plant-based meat alternatives fizzles, marketers are bullish on its growth potential. Cargill is among those companies that see growth potential in the category. Melissa Machen, principal technical account manager, protein ingredients, for Cargill, and Diliara Iassonova, Cargill’s innovation architect for edible oils, share some insights on the category and where it’s heading.

How have supply chain challenges affected sourcing/supplying of textured soy and pea protein for use in meat analog production?

Melissa Machen: “In the plant-based meat alternative space, the availability of textured plant proteins has been challenged both by extrusion capabilities and supply. Nevertheless, it remains an exciting time, as new high-moisture extrusion methods come online, alongside existing dry extrusion processes. These capabilities will enable ingredient suppliers to get more functional performance from their extruded products, resulting in plant-based meat alternatives with better texture, firmness, and bite.”

Share some thoughts on plant-based protein product development -- formulation, protein selection, hydration, and related issues.

Melissa Machen: “Plant proteins are the backbones of these products, so finding the right botanical protein source is paramount. There are, however, a myriad of considerations. Are there allergen considerations or label claim goals to keep in mind? Nutritionally, are there parameters you are trying to meet, either from a grams-of-protein or PDCAAS (protein digestibility corrected amino acid score) standpoint? Finally, it’s important to consider the functionality of the protein. If you’re aiming to mimic a conventional meat product, you’ll need a texturized protein to deliver a firm bite and particle definition. If you need to add viscosity, gelling ability or want to ramp up the protein content, a protein isolate might be the appropriate option. Binding agents are also important to these formulations, and may include starches, hydrocolloid, and even some plant proteins. These ingredients help hold water in and keep the product together – essential functionality for plant-based meat alternatives. We have the most experience with soy protein, and it brings a lot to the table. Nutritionally, it is considered a complete protein. It has great functionality and a well-established supply chain. It’s available in a wide range of formats, from soy flour to textured options in a variety of shapes, sizes, and colors, and has a great value proposition. Pea protein is another regular in plant-based meat alternative formulations. While there can be variability from one ingredient supplier to the next, our partner PURIS offers pea proteins with a distinctly clean flavor, high solubility, good emulsification, and binding properties, making them easy to work with in a wide range of applications. Like soy protein, pea protein is available in both powdered and textured formats, and our offerings from PURIS provide a minimum 80% protein content. Vital wheat gluten is another good choice. Long a staple of the bakery industry, the protein-rich, plant-based ingredient is now finding its way into plant-based meat alternatives. With a 75% protein content on a dry basis, it can be a good way to get more grams of protein on the label. It also brings functional benefits to the formula, including aiding in cohesiveness and structure, assisting with water absorption and binding, and contributing much-needed firmness as plant-based meat alternatives cook. Water balance is typically one of the biggest challenges. You need enough water in the system to hydrate a texturized protein, but you still need firmness in your final texture. Too much water, and you end up with a soft, mushy product. Not enough water, and it’s dry and equally undesirable. Processability is another consideration. The binder ingredients and botanical proteins can be “thick” and difficult to pump through processing equipment. You need a formula that has the right viscosity to move through processing systems, but still delivers the desired firmness in the end product. Then, there’s flavor. Consumers expect a plant-based meat alternative to taste like its conventional counterpart. Most plant proteins come with inherent beany, grassy, or bitter notes, but ingredient suppliers are working hard to close those gaps. On the protein processing side, new approaches are yielding plant proteins with better flavor profiles. Complementing those efforts, developers are experimenting with flavor modulators, markers, and enhancers to improve their finished formulations. Cost also factors into formulation decisions. It takes a significant amount of technology to manufacture some of these plant proteins, and many plant proteins still have nascent supply chains. But there are more established options like soy and vital wheat gluten, which can bring great value to formulations.”

Diliara Iassonova: “Fat plays a significant role in consumer satisfaction with meat-alternative products. It contributes to product appearance, overall flavor, spice distribution and intensity, aroma during cooking and consumption, cooking experience (how much fat releases on griddle, or water and oil on a plate from the microwave), mouthfeel, succulence and intensity of the aftertaste.

Beyond its functional attributes, formulators will also consider its impact on nutritional panels and ingredient statements, which are also important to consumers. The complexity of functional targets for fat in meat-alternative solutions moved developers from mono fat systems like coconut, palm oil, or even cocoa butter to multi-oil formulations created for best performance in the product.

For example, in applications that require a visible fat piece, you’ll need a firm particle fat, like a coconut oil chip or flake, but you may also need a liquid oil. Inclusion of liquid oils such as canola, sunflower, soybean, or corn oil contribute to increased moistness, improved mouthfeel, and add positive impact on the nutritional panel by decreasing saturated fat and increasing polyunsaturated fatty acids. Some developers add high-stability specialty oils such as high oleic sunflower, high oleic soybean oil, or high oleic canola oil, leveraging their clean flavor and oxidative stability for the best overall flavor intensity and consistency. Perhaps most exciting, a new generation of “smart fats” is coming. Cargill and start-up CUBIQ FOODS are among the companies leading this effort, as we work together to accelerate commercialization of innovative fat technologies, such as Go!Drop. This specialized technology replicates animal fat in terms of visual appearance, mouthfeel, and bite, for a final product that offers improved sensory and nutritional properties when compared to plant-based meat alternatives that solely use traditional plant-based fats and oils. These advances include enhanced flavor, reduced total and saturated fats, and fewer calories.”

What consumer trends (retail or foodservice) are influencing the market for plant-based proteins?

Melissa Machen: “Plant popularity continues to have a solid fan base. Many consumers perceive plant-based products as healthier – both for themselves and the planet. Mainstream experimentation, the continuing protein halo, the growing connection to sustainability, and an influx of new and improved plant-based products will likely keep this trend alive for years to come. Still, these flexitarian consumers can be tough to satisfy – they’ve grown up loving meat, and they have specific expectations about what a burger, for example, should look and taste like, and these sensory issues have proven to be key barriers. Taste, in particular, is often the hang-up. While these products may not have to mirror their animal-based counterparts exactly, they still need to taste really good to earn repeat purchases. In addition, label considerations, nutritional factors, and environmental credentials will continue to grow in importance to consumers. Fortunately, advances in ingredient technology are addressing all these concerns, paving the way for a new generation of plant-based meat alternatives.”

Are plant-based meat analogs used more often for snacking products (vegan jerky, etc.) or for entrée ingredients?

Melissa Machen: “The current focus remains on entrées. Plant-based burgers, for example, have been a good space to work in because you can “build” around them with toppings to assist with flavor. The plant-based chicken-alternative space is another growing segment, especially in the nugget and strip space, as high-moisture extrusion technology enables us to deliver a much-improved finished product.

While we’ve seen a lot of innovation with plant-based proteins in chips, bars, and sports nutrition segments, it’s much less prevalent in the meat-snacking space today.”

How do you see the market for plant-based proteins aligning with the larger market for proteins (beef/pork/chicken/seafood etc.)?

Melissa Machen: “Certainly, we’re seeing lots of effort aimed at creating plant-based substrates that match the texture and taste of beef, pork, or chicken. Early on, manufacturers focused on burgers and mince-type products, but more recently, we’ve begun to see brands branch out and explore ethnic opportunities, such as plant-based pork alternatives aimed at Asian dishes. There’s also a much greater focus on nutrition, especially around total and saturated fats, as well as sodium levels. It’s no longer enough to offer a plant-based alternative; increasingly, flexitarian consumers are looking at how these products measure up nutritionally, too. Sodium, in particular, is a challenge, as the production processes for many plant proteins add sodium to the finished ingredient. This not only results in higher sodium levels in final product, but it also makes it more challenging to add flavor systems and seasonings as the sodium level in the plant protein base is already so high. Ingredient suppliers are working hard to tackle these nutritional challenges. Cargill, for example, has partnered with CUBIQ Foods to introduce innovative fat technologies that will help brands reduce total and saturated fat levels, and through our joint venture partner PURIS, offers pea proteins with significantly lower sodium levels.”

Diliara Iassonova: “It’s also becoming clear that despite earlier expectations that plant-based solutions would be competing and replacing animal protein volumes, plant-based solutions are actually playing a more complimentary role, diversifying vegetarian and vegan offerings and gradually gaining flexitarian consumers trust.”

.png?height=96&t=1647275041&width=96)

Report Abusive Comment