IRI is recording the growth of the convenience channel since 2020. Though c-stores struggled during the COVID-19 pandemic, the convenience channel is growing in various areas.

Kurian Thomas, chief operating officer of IRI’s Retail Practice, observed the major areas for growth for c-stores: the sales of prepared foods, alcoholic beverages, high quality foods and snacks and private brands.

Scott Love, senior vice president of retail client solutions at IRI, said that the surge of c-stores began a few years ago.

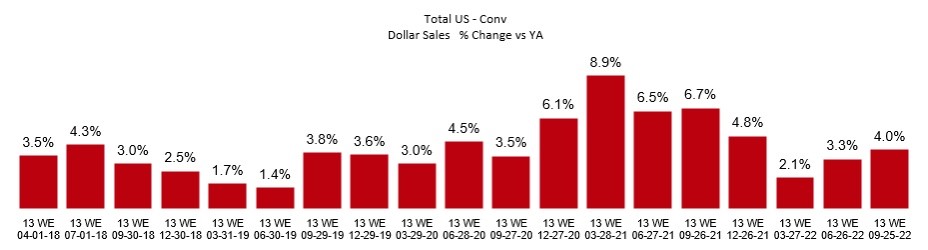

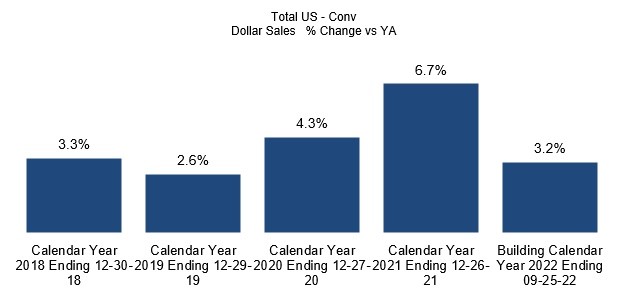

“The sales have grown each quarter since 2018 on a dollar sales change basis. The trend for YTD is 3.2% increase vs. 2021,” Love said.

Regarding meat snacks specifically, the effects of inflation have encouraged shoppers to buy private-label meat snacks.

“The inflationary pressure has impacted meat snacks and most categories in the channel,” Love said. “Private-label meat snacks are outpacing national brands on a dollar sales growth basis 22.5% vs .8% for national brands.”

Love noted that although it is not the norm for private-label to outpace national brands, that is the current trend in c-stores.

“Private-label is outperforming national brands YTD,” Love said. “Private-label growth is up 17.1% dollar sales vs. YA. National brands are growing but at a slower rate, 2.6% dollar sales vs. YA. YTD ending Sept. 25, 2022.”

Love attributes the shift from brand-name to private-label as an effect of inflation.

"So, people are offsetting inflation by . . . maybe they bought a premium product before and now they're buying a private label product," Love said. "So they're still buying that snack or that beverage, but instead of maybe being branded, it's private-label."

Though the convenience channel is experiencing overall growth, that has not always been the case. The COVID-19 pandemic led to a boom in e-commerce but negatively affected c-stores.

"So the convenience channel is kind of going through an interesting period," Love said. "Obviously 2020 was really damaging to the convenience channel. They lost a lot of trips. Sales were down."

The convenience channel is now growing and seeing improvements from the effects of the pandemic, but there is still more room for growth.

"That is growing, but it's not growing at the same pace as grocery or other channels," Love said. "So it's positive growth, but it's not at the same rate as some of the other channels in the industry."

The e-commerce boom has allowed for the convenience channel to grow, though. Because of the pandemic, consumers began to shop more online, leading to rapid growth in the e-commerce industry. This assisted in overall growth.

“The e-commerce growth has helped fuel overall growth and is experiencing double-digit growth vs. YA to date,” Love said. “There is more headroom for the convenience channel as the capabilities are rolled out more broadly.”

Though the convenience channel is growing, inflation has affected shoppers greatly, and these effects are visible in the rise of more affordable products in c-stores.

“Rising prices have impacted the basket composition for shoppers in the convenience channel YTD,” Love said. “We are seeing shoppers trade down from premium to private-label and more value-based products."

Even as consumers opt for more affordable options, convenience stores are still offering more high quality foods and snacks.

“The convenience channel has evolved with more premium offerings across the store,” Love said. “This is seen in organic and other premium offerings.”

Though c-stores are performing well, the number of snacking items in c-stores is not growing overall.

"The number of items on the snacking side overall in the store is down," Love said. "On the kind of meat snacks, alternative snacks, there is an increase on the salty snacks side, but alternative snacks, it's coming down some."

Love also discussed how plant-based and meat alternative snacks are not projected to grow much, since consumers are opting for lower-cost products as a result of inflation.

IRI does not currently have available data on prepared foods like deli meat sandwiches, and there is not yet a projected growth forecast for 2023.

Visit https://www.iriworldwide.com/en-us to learn more about the growth of c-stores.

-(780-×-439-px)-(780-×-439-px)-(5).jpg?1665690977)

Report Abusive Comment