In a roomful of cattle feeders, an Oklahoma State University livestock marketing specialist had everyone’s full attention as he said there is no way around it: In the next two to three years, the already short supply of feeder cattle will only get tighter.

OSU Breedlove professor Derrell Peel described in August the feeder cattle situation and the circumstances leading to it at the eighth annual Feeding Quality Forum in Omaha, Neb., and Garden City, Kan.

With a U.S. cattle inventory at levels not seen since 1952, Peel said, “We’re much smaller than we ever intended to be.”

Drought and other circumstances led producers to liquidate their cow herds 15 out of the last 17 years, despite recent market signals to expand. Yet, Peel expects that to change.

Throughout much of the U.S., drought conditions have improved, opening the door to herd rebuilding. Instead of looking for the likeliest animals to cull, many producers will begin looking for the best heifers to keep.

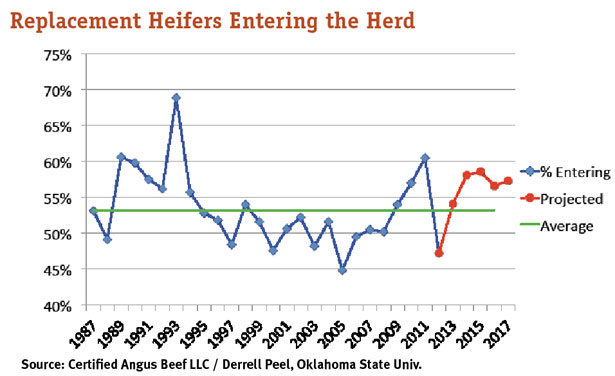

“For the next several years, I would expect the [heifer replacement] percentage to be above average,” Peel said. “And that has implications to what happens to feeder supplies in the short run.”

Growing the cattle population is the ultimate solution to the limited feeder supply, but it is not an instant fix. Until a heifer starts calving, each replacement kept is one less animal available for feeding. Cattle feeders already competing for a piece of that small supply know, but they don’t relish the fact, and, “it will get worse before it gets better.”

Even so, Peel is optimistic about the growth rate of the national herd. Many producers were forced to cull heavily during the drought, but they did not do it at the expense of herd quality. Many heifers were kept, and older cows were sold.

“We’ve probably got this herd as young and productive as maybe it has ever been,” Peel said. “When we do start to expand, we have the capability for a year or two to expand faster than what we could have probably seen otherwise.”

Growth will still take time. Peel expects it to be 2017 before herd numbers can even recover to 2011 pre-drought levels. Strong markets for feeders will continue to pull in a share of animals and moderate herd growth.

Cattle imported from Canada and Mexico make up only a small portion of the feeder cattle market, but Peel said the industry cannot expect extra animals from these sources to help supplement its own limited supply.

Mexico contended with its own extreme drought and liquidated much of its herd, with many of those animals entering the U.S.

“Last year we got just short of 1.5 million head of cattle from Mexico,” Peel said. “That is not a sustainable number. Those exports were at the expense of their ability to produce in the future.”

Already the results are evident, with 450,000 fewer head imported from Mexico, year-to-date compared to last year.

Furthermore, with Canada rebuilding its own national herd, those imports will remain relatively low.

All these factors lead Peel to believe the coming years will see the number of feeder cattle fall even further than the 3.5% decline projected by the end of this year.

Even though overall herd numbers have been declining since the 1970s, the number of cattle on feed has not followed the same pattern. The industry has been able to keep those numbers up by feeding cattle more intensively and at a younger age so cattle move more slowly through the feeding process. For every calf on feed during the early ’70s and ’80s, there were three more available to replace it. By last year, less than two calves were available for every one calf on feed.

Years of cheap corn prices made it profitable to buy smaller calves to feed over a longer period of time.

“The question is, what has to go on to go forward, because over the last few years, that hasn’t been true,” Peel said. He projected price relationships between cattle weights and cost of gain, given a range of corn prices that should trend lower. All these circumstances may lead to other unusual premiums.

“I think there is a good chance that when we get really low with herd expansion, we will see much less discount on heifers relative to steers,” Peel speculated. “You may even see heifers bring premiums this year because the breeding female demand on top of the tremendous demand for the feeder animal will be there.”

Such strong market signals for more feeder cattle would typically send producers into high gear to expand their herds and calf crops, but for many American cattlemen today the situation is not that simple. Most producers are more than 62 years old, and at this point in life they are not looking to increase their workload.

“When you show a lot of older producers the potential that is out there from the cow-calf standpoint, they say, ‘Yeah, I see all of that, but it ain’t going to be me. It’s going to be someone else,’” Peel said, but wondered who that “someone else” would be? Getting into the cattle business is not an easy task.

The next generation of cattlemen cannot borrow enough money to get started, so Peel said it is up to the older ranchers to help get them in business. He suggested looking at different financial arrangements such as long-term contracts or lease arrangements to transfer equity to the next wave of producers.

No matter who takes on the challenge, the fact remains that the market needs more feeder cattle than are available today.

“Now the question is, ‘How far do we need to grow, and how fast can we do it?’” Peel said.

Quality Forum was co-sponsored by Purina Animal Nutrition, Roto-Mix, Certifi ed Angus Beef LLC (CAB), Feedlot Magazine and Zoetis.

Report Abusive Comment