Global demand for flexible packaging is projected to reach $210 billion in 2015, and forecast to grow at an annual average rate of 3 percent, reaching $248 billion in 2020, according to a new market report by Smithers Pira.

Flexible packaging has been one of the fastest growing packaging sectors over the past 10 years, thanks to increased consumer focus on convenience and sustainability, and this rapid development will continue to accelerate, the report has found.

This report — The Future of Global Flexible Packaging to 2020 — provides market sizes and forecasts broken down by substrate, packaging type, technology, end use and geography with detailed analysis of the key growth areas. Based on extensive new primary research, it is an essential guide to the global flexible-packaging supply chain.

|

|

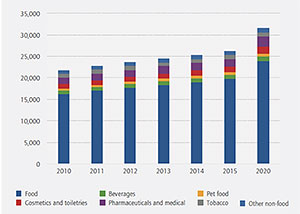

Figure 1: World forecast, consumer flexible packaging consumption by product, 2010-20 ('000 metric tons) |

Flexible packaging is the most economical method to package, preserve and distribute food, beverages, other consumables, pharmaceuticals and other products that need extended shelf life. It can be designed with barrier properties tailored to fit the products being packaged and their end uses, whereas other barrier packaging formats generally provide a one-size-fits-all approach. Flexible packaging can now be made in a wide variety of innovative shapes, sizes and appearances, and can include components such as handles and opening and reclosing features such as zips and spouts.

Flexible-packaging technology has advanced dramatically over the past 10 years and is now a consumer household mainstay, steadily moving into new markets and applications. Products have progressed from simple monolayer bags and wrappings to coextruded or laminated engineered multilayer and coated constructions, comprising multiple materials such as plastics, paper and metal foils, coatings and other additives. These developments provide properties such as high barrier to oxygen, extended shelf life and convenience, all of which are increasingly demanded in packaging for food, consumables and pharmaceuticals. The properties of flexible packaging can be tailored to provide specific combinations required for packaging a broad range of products.

The report shows that the global consumer flexible-packaging market value is estimated at $91.7 billion for 2015 and is forecast to grow at an annual average rate of 4.4 percent during the period 2015-20 to reach $114 billion. The market tonnage of this segment is estimated at 26.2 million metric tons in 2015 and is forecast to grow on average by 3.8 percent during the period 2015-20 to reach 31.7 million metric tons.

Indications are that world demand for consumer flexible packaging will continue its upward growth trend in 2015 and well beyond, especially as developing economies continue to expand. China is the largest national market for consumer flexible packaging, with a market tonnage of 6.07 million metric tons. Asia is the largest regional market with 40 percent of global market volume, followed by Western Europe and North America. Asia is also projected to be the fastest growing market for consumer flexible packaging over the forecast period, with an annual average rate of 6.6 percent in volume terms. India and China are the fastest growing national markets for consumer flexible packaging at 9.4 percent and 6.9 percent annual rates, respectively, over the 2015-20 forecast period. The growth rates for South and Central America have been revised downward because of the deteriorating economic situation and political tensions.

Food is projected to account for almost three-quarters of global consumer flexible and forecasts packaging consumption in 2015 (See Figure 1). Meat, fish and poultry account for the largest usage food sector for flexible packaging, followed by confectionery and baked goods. Flexible food packaging has been growing at an average annual rate of 4.0 percent in volume terms over the period 2010-15. It was the fastest growing end-use sector, with beverages and pharmaceuticals following close behind.

In terms of future growth, a number of new packaging materials will become commercialized over the forecast period. Packaging converters looking to reduce production and transport costs are benefiting from the increase in flexible packaging types, aided by the continual development of new pouch designs — particularly the potential for an all-plastic barrier pouch — and by growing consumer demand for convenience and packets that are easy to open and close. New processes and machinery will enable pouch-filling speeds to match those of bottles over time.

Advances in digital printing will provide opportunities for direct in-line printing as part of the conversion operation and developments in packaging and graphics to meet the requirements of brand-owners and consumers for rapid product changes, versioning, personalization and individualization. NP

Smithers Pira is the worldwide authority on packaging, paper and print industry supply chains, and provides strategic and technical consulting, testing, intelligence and events to help clients gain market insights, identify opportunities, evaluate product performance and manage compliance. The Future of Global Flexible Packaging to 2020 report is available now — for more information, please contact Bill Allen at +44 (0)1372 802086, via e-mail at ballen@smithers.com, or visit www.smitherspira.com.

State of the Industry 2015 segments

| Industry overview | Goes live Oct. 6 |

| Food Safety | Oct. 7 |

| Packaging | Oct. 8 |

| Beef (NCBA) | Oct. 9 |

| Beef (CAB) | Oct. 12 |

| Pork | Oct. 13 |

| Chicken | Oct. 14 |

| Turkey | Oct. 15 |

| Veal | Oct. 16 |

| Lamb | Oct. 19 |

Report Abusive Comment