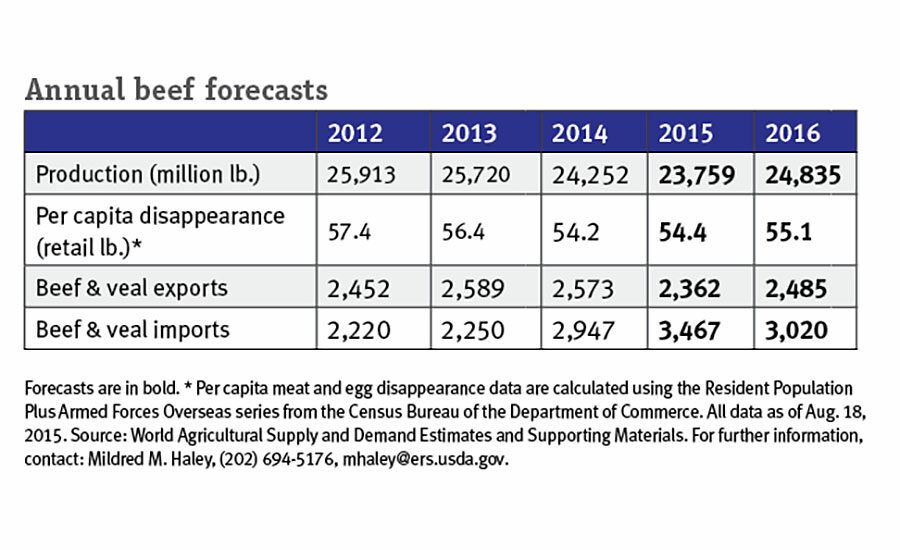

Following years of tightening beef supply — and subsequent record beef prices — America’s beef farmers and ranchers are expanding their herds. USDA’s cattle inventory report shows inventory numbers have increased 1.4 percent this year and for 2016, industry analysts are forecasting continued herd expansion, as long as Mother Nature continues to cooperate. This means more beef is coming to market later this year and into next. As a result, grocery retailers and foodservice operators will have more flexibility and options when procuring beef products.

Throughout this time of higher beef prices, demand for beef has grown. In 2014, the wholesale beef demand index increased 18 percent and retail beef demand grew nearly 7 percent. Consumers have remained willing to spend more for the beef they want, even more so than for other proteins. The Oklahoma State University Food Demand Survey shows that consumers are willing to pay 34 percent more for steak than a chicken breast and 66 percent more for steak versus a pork chop. This strong consumer desire for beef is what sent a signal to beef farmers and ranchers to increase production.

As businesses look to 2016, it’s important they continue to stay market driven. Knowing the consumer is willing to pay for quality and more supply is on the way, now is the time to explore easy ways to capitalize on what today’s consumer wants and what will keep him coming back for more beef, more often.

Marketing to Millennials

The Millennial generation has been widely reported on for quite some time, but when it comes to beef, “Millennial” is much more than a buzzword. Millennials are becoming the most powerful consumer group out there as their spending power is growing along with their desire for beef and willingness to spend more for it. This presents huge profit potential for foodservice and retail operators.

Millennials eat three or more servings of beef a week, and they’re not deterred by current prices. Eighty one percent of Millennials say the price of steak in a grocery store is “just about right” or “expensive and worth it,” while 80 percent of Millennials say the same for the price of steak in a restaurant.

Millennials value taste over price and define value not just as “low-cost.” They look at the whole picture to determine which food choices are a good total package for what they’re willing to spend. Operators should promote the attributes that Millennials factor into an item’s value — its taste, convenience, experience and nutrition — to drive sales among this influential audience. Beef delivers on all of these.

Understanding what makes these consumers tick, then marketing beef in ways that appeal to them, will allow businesses to drive frequent purchases of beef in their store or restaurant.

Here are four untapped opportunities to help the target consumer see how beef’s versatility and unique combination of nutrients gives each member of the family what they need:

1. Nutrition labeling

Consumers want and need guidance on nutrition, particularly at the point of purchase. Businesses should ensure they have the latest science and the tools to use in their sales and marketing efforts to meet this demand for information.

There are opportunities for stores and restaurants to not only educate staff on the nutritional benefits of animal proteins such as beef, but also make this information available on pack and on the menu to drive sales and loyalty.

In retail, on-pack nutrition labels increase beef sales up to 5.8 percent1, while 34 percent of consumers say they would be more likely to select a store based on the availability of nutrition information2.

In restaurants, the new menu labeling requirements that go into effect Dec. 1, 2016, will mandate that consumers have access to nutrition information. Many consumers say they consider beef to be healthy because it’s high in protein and low in carbohydrates. Putting nutrient information on the menu can work in the operator’s benefit by motivating consumers to buy beef by highlighting the nutrient content in beef. Some operators have also seen an increase in sales when offering healthier kids’ meals. Menuing healthful, innovative recipes that use lean cuts of beef can provide your youngest patrons with the essential nutrients they need and attract those Millennial families who say they’d like to see more healthy items on menus.

2. Telling beef’s story

A critical component of selling and marketing beef is to maintain customers’ confidence and trust in beef. One way to do this is to partner with the people who raise our food, to clarify the beef production process for consumers — and even your staff — to help them understand how their food is raised and where it comes from.

Most consumers want more information about how their food was produced, whether it be at the grocery store or at a restaurant; 78 percent say it’s very or extremely important for grocery stores and restaurants to provide information about the way the food they sell was grown or raised.

Food with a story is a huge trend, and beef presents great opportunities for stories that businesses can tell, ranging from its origin to production to the farmers and ranchers who raised the animals for beef.

To go back to the earlier point on the importance of marketing to Millennials, consider that when compared to other generations, the Millennial consumer is more likely to consider a food item’s story when deciding what — and where — to purchase food. Therefore, telling beef’s story is instrumental in attracting them to your store or restaurant.

3. Prepped, ready to go

Grocery foodservice is the fastest growing segment of the foodservice industry, and retailers should hurry to get ahead of this hot trend. While restaurants are expected to enjoy 4 percent annual sales growth through 2022, the sales of prepared foods from grocers is expected to increase by 10 percent annually.3

More and more consumers seeking fresh and convenient foods are turning to retailers. Nearly half of all adults favor made-to-order food stations in retail, and 45 percent of adults-only households shop the prepared foods department at least monthly, as do 31 percent of households with children4.

Beef’s culinary flexibility and nutritional value make it a powerful player in the prepared foods section.

Millennial shoppers in particular are keeping an eye out for more beef in this up-and-coming section of the store: 38 percent of Millennials say they would be more likely to shop the prepared foods section of a grocery store more often if it had great choices in beef (versus 32 percent of all U.S. adults).5

4. Adapting to digital

The foodservice and retail industries are evolving. Consumers no longer want to just eat or just shop, but rather have a dining or shopping experience.

Whether dining or shopping, digital platforms deliver on this unique experience consumers seek. By enhancing convenience and lending personal touches to the consumer experience, digital capabilities benefit both consumer and operator.

Consumers expect you to meet them where they are, and, increasingly, they’re online. Retailers can meet them online pre or post-visit and offer additional insight on their purchase, or with an incentive for customers to visit again (i.e. personalized discounts, etc.). Restaurants can also go digital by posting their menus online, and keeping up with online peer reviews (Millennial diners certainly are).

The recent market conditions surrounding beef have created challenges for retailers and foodservice operators, but consumers’ continued demand for beef has created many opportunities. Your customers want beef and they are willing to pay more for it. By leveraging these opportunities and consumers’ longstanding love of beef, businesses can motivate more beef purchases and repeat visits now and into the future. NP

- Endnotes: http://www.beefretail.org/nutritionlabeling1.aspx

- http://www.beefretail.org/nutritionlabeling1.aspx

- Rising Need for Convenient Prepared Orders, Mercatus, March 2015

- Retailer Meal Solutions, Consumer Trend Report, Technomic, 2012_page 90

-

Consumer Beef Index, The Beef Checkoff, July 2014_slide 56

State of the Industry 2015 segments

| Industry overview | Goes live Oct. 6 |

| Food Safety | Oct. 7 |

| Packaging | Oct. 8 |

| Beef (NCBA) | Oct. 9 |

| Beef (CAB) | Oct. 12 |

| Pork | Oct. 13 |

| Chicken | Oct. 14 |

| Turkey | Oct. 15 |

| Veal | Oct. 16 |

| Lamb | Oct. 19 |

Report Abusive Comment