October exports of U.S. pork were the largest in more than a year, and beef export volume also increased from a year ago, according to data released by USDA and compiled by USMEF.

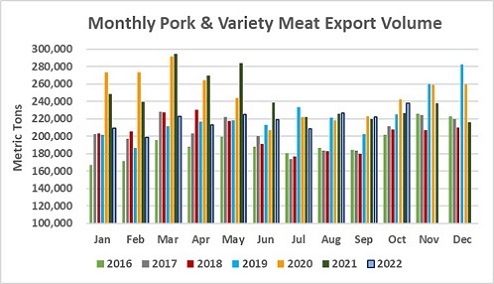

Pork exports reached 238,198 metric tons (mt) in October, up 5% from a year ago and the largest since June 2021. Pork export value increased 13% to $697.3 million, the highest since May 2021. For January through October, pork exports were 12% below last year at 2.18 million metric tons, valued at $6.26 billion (down 8%).

USMEF President and CEO Dan Halstrom noted that the October pork results were bolstered by outstanding growth in variety meat exports, which set a new value record at $126.2 million. Export volume was the second largest on record at more than 55,000 metric tons.

“The recent rebound in pork variety meat exports is tremendous news for the U.S. industry on a few different fronts,” Halstrom said. “While exports to China have regained momentum, our ongoing efforts to diversify destinations for pork variety meats are definitely paying dividends. Larger shipments also reflect an improved labor situation at the plant level, which has helped increase the capture rate for variety meat items.”

October beef exports totaled 125,466 metric tons, up 8% from a year ago. Export value was $929.8 million, down 3% from the large total reported in October 2021. In the first 10 months of 2022, beef export value increased 18% from last year’s record pace to reach $10.05 billion—topping $10 billion in a single year for only the second time. January-October export volume was 1.25 million metric tons, up 4% from a year ago.

“The October results were remarkable considering the headwinds facing U.S. beef, especially in our large Asian markets,” Halstrom said. “Key currencies such as the Japanese yen and Korean won had sunk to their lowest levels in decades versus the U.S. dollar, which obviously affected importers’ buying power. COVID lockdowns in China were also a concerning factor, especially for buyers in the foodservice sector. But despite all that, U.S. beef still performed very well in Asia and achieved solid growth in North America and the Middle East. With some recent improvement in exchange rates, beef exports are well-positioned to surpass last year’s records.”

Variety meat growth buoys October pork exports

Pork variety meat exports, which averaged nearly $10 per head slaughtered in 2021, were particularly strong in October at 55,271 metric tons—up 33% from a year ago, and the second largest volume on record. Export value was record high at $126.2 million, up 29%. While growth was driven primarily by record exports to China/Hong Kong (37,499 metric tons, up 51% from a year ago), exports also increased significantly to Mexico (11,941 metric tons, the largest since early 2020) and Japan (1,225 metric tons, the largest since 2018). October exports also trended higher to Central America, the Caribbean and Colombia. For January through October, global exports of U.S. pork variety meat totaled 426,232 metric tons, down 5% from a year ago (when pork variety meat exports reached the third highest annual total on record), valued at $1.03 billion (down 1% from last year’s record pace).

For pork and pork variety meat exports, October was another terrific month for leading market Mexico. While exports increased modestly in volume (84,915 metric tons, up 1% year-over-year), export value to Mexico reached a record $203.1 million—up 41% from a year ago. For January-October, exports increased 11% from a year ago in volume (781,717 metric tons) and 17% in value ($1.63 billion). Mexico’s demand for U.S. pork has remained very strong amid efforts to attract additional suppliers to the market. In May, Mexico temporarily suspended import duties on pork, beef and chicken from all eligible suppliers, leading to an increased presence of European pork. In mid-November, Mexico opened to pork from approved plants in the Brazilian state of Santa Catarina, provided that it goes directly into further processing.

October pork exports to China/Hong Kong climbed 37% from a year ago to 57,345 metric tons, valued at $141.3 million (up 39%). While driven in large part by strengthening demand for variety meat (see above), pork muscle cut exports to the region also increased 16% to 19,846 metric tons, valued at $54.1 million (up 37%). Though coming too late to impact October exports, China’s easing of some COVID restrictions is expected to eventually provide a boost for consumer demand, especially in the country’s beleaguered foodservice sector.

Other January-October results for U.S. pork exports include

- October exports to South Korea increased 25% year-over-year to 12,535 metric tons, while value climbed 26% to $43.7 million. This pushed January-October totals to 145,506 metric tons, up 5% from a year ago, while value increased 13% to $510.9 million. Earlier this year, Korea opened a 70,000 metric tons, duty-free quota for imported pork in an effort to ease consumer prices. But the impact on Korea’s competitive landscape has been minimal because imports from the U.S., the European Union and Chile already enter at zero duty. The move mainly benefited imports from Canada, Mexico and Brazil.

- October pork exports to the ASEAN region reached 4,700 metric tons, up 11% from a year ago, while value soared 47% to $15.9 million. In the Philippines, which accounted for most of this growth, President Ferdinand Marcos Jr. is still weighing whether to extend the executive order that has reduced duties on imported cuts for the past 18 months. Without an extension, Philippine tariff rates will return to normal levels—among the highest in the world at 30% in-quota and 40% out-of-quota—at the beginning of 2023. Despite a recent uptick in demand from the ASEAN, January-October exports to the region were still 47% below last year at 44,512 metric tons, valued at $131.1 million (down 41%).

- October exports to the Dominican Republic reached 7,218 metric tons, up 45% from a year ago, while export value increased 59% to $21.8 million. January-October exports to the Dominican Republic already set annual records, with volume totaling 65,856 metric tons, up 39% from a year ago, while value increased 42% to $174.7 million. The Dominican Republic temporarily suspended import duties on red meat and poultry in June, heightening competition in the pork market. But the decree suspending these import duties has expired, which means the U.S. is once again the only major pork supplier with duty-free access. Imports from other major suppliers are subject to the Dominican Republic's most-favored-nation rate of 25%.

- Pork exports to Colombia are on a record pace in 2022 but have faced significant headwinds in the fourth quarter, including a slumping Colombian peso. Exports took a step back in October, with shipments declining 32% from last year’s large totals in both volume (8,009 metric tons) and value ($21.4 million). Through October, exports to Colombia remained 4% above last year at 86,136 metric tons, with value up 3% to $207 million. It will be difficult, however, for shipments to match last year’s large volumes in November and December.

- October pork export value equated to $63.87 per head slaughtered, up 14% from a year ago. This pushed the January-October average to $60.18 per head, down 5%. Exports accounted for 28.3% of total October pork production, up from 26.5% a year ago, while the ratio for muscle cuts increased slightly to 23.4%. The January-October ratios were 27.1% and 23.4%, down from 29.7% and 26.1%, respectively, in the first 10 months of 2021.

Beef exports weather exchange rate storm to remain on record pace in 2022

Demand for U.S. beef in China/Hong Kong remained resilient in October, increasing significantly from a year ago despite China’s COVID-related travel restrictions and periodic lockdowns in several major metropolitan areas. China/Hong Kong was the leading destination for U.S. beef in October at 26,170 metric tons, up 21% from a year ago, while value climbed 19% to $240.8 million. January-October exports to the region increased 23% to 243,198 metric tons, while value was up 32% to $2.23 billion. China/Hong Kong is now the second-highest value destination for U.S. beef, trailing only South Korea. It is the third largest volume market behind Japan and Korea, but trails Korea by less than 1,000 metric tons.

Despite a very weak month for the Korean won, October beef export volume to Korea still increased 10% from a year ago to 24,183 metric tons. But export value definitely reflected the exchange rate pinch, declining 6% to $199.4 million. Through October, exports to Korea were 4% above last year’s record pace at 244,052 metric tons, while value was 20% higher at $2.32 billion—just short of the full-year record ($2.38 billion) reached in 2021. While the won has strengthened to some degree since October, the economic situation in Korea remains fragile. Over the past two weeks, Korean businesses have dealt with a nationwide trucker strike that has slowed cargo movement and created significant supply chain disruptions.

October beef exports followed a similar pattern in Japan, where the yen was also in a deep slump versus the U.S. dollar. Shipments to Japan totaled 23,600 metric tons, up slightly from a year ago, but export value sank 18% to $163.4 million. Beef variety meat exports (mainly tongues and skirts), which had declined sharply in August and September, rebounded to 4,492 metric tons (up 12%) but remained lower than a year ago in value ($40.9 million, down 12%). Despite a significant decline in 2022 export volume (46,141 metric tons through October, down 13%), Japan is still the leading value destination for U.S. beef variety meat exports at $462 million—an increase of 19% over last year’s record pace. Through October, beef and beef variety meat exports to Japan totaled 260,318 metric tons, down 4% from a year ago, while export value increased 5% to just over $2 billion.

Other January-October results for U.S. beef exports include

- October was another strong month for beef exports to the ASEAN, where shipments to the Philippines and Cambodia have already set annual records and exports to Singapore and Thailand are on a record pace. For January through October, exports to the region increased 18% from a year ago to 55,845 metric tons, while value soared 61% to $400 million. October exports to the Philippines reached 3,251 metric tons, more than five times last year’s low volume, while value quadrupled to $20.2 million. For the first 10 months of the year, exports to the Philippines increased 79% to 21,879 metric tons, while value climbed 132% to $147.3 million. U.S. beef faces significant tariff disadvantages in the region, making this growth even more impressive.

- Led by a rebound in Japan and growth in Mexico, Egypt, China, the ASEAN, Korea and Canada, October exports of beef variety meats totaled 25,118 metric tons, up 12% from a year ago, while export value increased 8% to $105 million. Through October, variety meat exports were slightly above last year in volume (250,521 metric tons, up 1%) while soaring 22% in value to $1.05 billion.

- Surging demand in the foodservice and hospitality sectors has driven beef exports higher to the Middle East, where January-October shipments reached 56,259 metric tons, up 10% from a year ago, while export value jumped 52% to $256.7 million. In Egypt, the leading destination for U.S. beef livers, a strong October pushed January-October exports slightly above last year at 40,155 metric tons, while value soared 38% to $78.6 million. For beef muscle cuts, export growth was driven by sharply higher shipments to the United Arab Emirates, Kuwait, Qatar, Saudi Arabia and Egypt.

- Beef exports to Canada reached 9,332 metric tons in October, up 20% from a year ago, while export value increased 12% to $67.4 million. Through October, exports to Canada were 3% above last year’s pace at 87,501 metric tons, while value increased 14% to $706.4 million.

- While beef exports to Taiwan remain on a record pace in 2022, October shipments declined year-over-year for the second consecutive month—falling 12% to 4,373 metric tons, while value was down 22% to $46.1 million. But through the first 10 months of the year, exports to Taiwan were still up 8% to 56,152 metric tons, valued at $651.6 million (up 22%).

- October beef export value equated to $424.82 per head of fed slaughter, down 3% from a year ago, but the January-October average was still up 17% to $459.50. Exports accounted for 15.3% of total October beef production and 13.1% for muscle cuts only, up from 14.3% and 12.4%, respectively, in October 2021. The January-October ratios were a record high at 15.4% and 13.2%. These were up from 15% and 12.8%, respectively, a year ago.

October exports of lamb muscle cuts trend higher

Exports of U.S. lamb muscle cuts edged higher year-over-year in October at 202 metric tons, up 18%. Export value totaled $1.26 million, also up 18%. Through October, lamb muscle cut exports increased 67% to 1,878 metric tons, valued at $11.11 million (up 60%). This growth has been driven mainly by the Caribbean, led by the Netherlands Antilles, Dominican Republic and Bahamas. But in October, exports were bolstered by larger shipments to Canada and Taiwan.

Complete January-October export results for U.S. pork, beef and lamb are available from USMEF’s statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

Notes:

- Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

- One metric ton (mt) = 2,204.622 pounds.

- As noted the past several months, USMEF has raised concerns in recent years with USDA about export data collected by the Department of Commerce for lamb variety meat to Mexico. Reported volumes have declined dramatically since July, suggesting that the data reported in prior months and years were disproportionately high. USMEF is therefore focusing year-over-year comparisons on lamb muscle cuts only.

- U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place).

Sources: USMEF; USDA

-(780-%C3%97-439-px)-(780-%C3%97-439-px)-(2).jpg?height=200&t=1665177134&width=200)