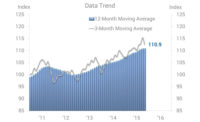

Average U.S. beef production during the 12 months through May was up 3.9 percent from the previous year and at its highest level in more than six years. The annual pace of growth ticked up with the last two months of data, marking a tentative transition to an accelerating growth trend.

Slowing growth in U.S. beef consumption per capita and statistical trends within production, however, suggest the transition is temporary and that production will likely revert to an overall slowing growth trend later this year. Drought conditions may lead producers to slaughter cattle earlier in the year. This could explain the recent tick up in the growth rate and further suggests a decelerating trend will resume in the near term.

Recent tariffs imposed by China will make it harder for U.S. beef producers to compete for market share there; however, Chinese tariffs will likely have a smaller impact on the U.S. beef market relative to the pork market. U.S. beef has only been allowed in China since mid-2017, when a 2003 ban was lifted. In the first half of 2018, China accounted for 0.7 percent of U.S. beef exports compared with 6.6 percent of U.S. pork exports.

NAFTA negotiations pose a potentially more significant risk to the U.S. beef market, as Mexico and Canada accounted for 23.8 percent of U.S. beef exports during the same time. NP

Report Abusive Comment