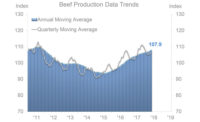

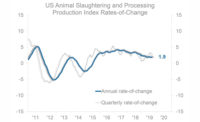

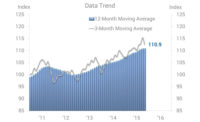

Average U.S. beef production during the 12 months through May was up 1.5 percent from one year ago and at the highest level in more than seven years. Growth is slowing. Beef producers may be feeling constrained by U.S. beef exports to the world, which were down 0.9 percent in the second quarter compared with the same quarter one year ago. Softening beef exports are likely benefiting domestic consumers through relatively low prices; producers are increasingly forced to sell domestically as export markets dry up. Inflation as measured by the U.S. Consumer Price Index for Beef (0.6 percent) is about a third of overall food and beverage inflation (1.9 percent) as measured by the U.S. Consumer Price Index for Food and Beverages.

The beef market will likely face additional hurdles in the upcoming quarters because of deteriorating macroeconomic conditions. Downward pressure in consumer markets into mid-2020 is suggested by our proprietary ITR Retail Sales Leading Indicator. Expected slowing growth in U.S. Total Retail Sales into mid-2020 could hinder the production of food, including beef, during that time. Upward momentum in the U.S. economy and in U.S. Food Production is expected during the second half of 2020. It is important to have a contingency plan ready in case business cycle decline is worse than anticipated. Companies should also develop a plan for maximizing growth potential during the next business cycle upswing. With proper planning, you can find ways to maximize growth and mitigate risk in any phase of the business cycle. NP

Editor’s Note: This is a quarterly economic update provided by ITR Economics, published exclusively in The National Provisioner.

Report Abusive Comment