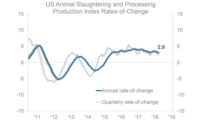

Average U.S. animal slaughtering and processing production during the 12 months through September was up 1.9 percent from one year ago. The production annual rate of change has steadied around the current level since early 2019. Annual pork production, up 3.2 percent from one year ago, is growing at a faster pace than poultry production (up 1.7 percent) and beef production (up 1 percent).

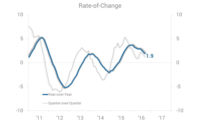

The U.S. animal processing market is likely benefiting from a severe reduction in Chinese pork production because of an outbreak of African Swine Fever. The outbreak began in August 2018 and continues to spread to other Southeast Asian countries. Despite increased tariffs, quarterly U.S. exports of meat and meat preparations to China are rising. Exports to China during the three months through September were up 370 percent from the same three months one year ago, with large increases in both pork and beef exports. China’s meat shortage could benefit the U.S. meat processing industry while the U.S. macroeconomy is on the back side of the business cycle. Softening market conditions are evident in annual U.S. food production, which peaked in June, and U.S. food services and drinking places retail sales, which are in a slowing growth trend. Business cycle decline in the industrial economy is expected into the middle of 2020 but is expected to be relatively mild. The labor market is expected to remain tight through at least 2021. Look for ways to increase employee retention to save on hiring and training costs, and consider investing in labor-saving technology. NP

Report Abusive Comment