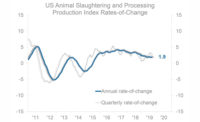

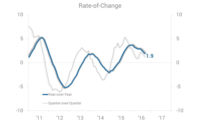

Average U.S. animal slaughtering and processing production during the 12 months through September was up 2.9 percent from the prior year. Annual average production is at a record high, but the pace of year-over-year growth has gradually diminished from an April 2017 peak of 4.2 percent. ITR Checking Points indicate slowing growth will likely persist into at least early next year.

Slaughtering and processing production has historically had a strong relationship with overall U.S. food production, which has recently transitioned to a slowing growth trend. Food production is expected to remain on the back side of the business cycle (slowing growth, followed by mild contraction during the second half of 2019) through at least the end of next year. This suggests the annual growth rate for slaughtering and processing production could move lower throughout at least 2019 as well, with some contraction in the annual average possible.

Within slaughtering and processing production, pork production and poultry production have grown at a relatively steady pace in recent quarters, up 3.6 percent and 3 percent year over year, respectively. Beef production is growing at a slowing pace, up 3.3 percent year over year as of August (latest data available).

Both U.S. exports and imports of meat are in slowing growth trends, as the World Meat Price Index three-month moving average has declined since late 2017. U.S. exports of meat and meat preparations to China are faring worse than overall U.S. meat exports, with annual exports to China down 9 percent from the year-ago level. Tariffs continue to pose a downside risk to the meat export market with China; however, the current declining trend, off a March 2017 annual-total peak, predates the 2018 tariffs. NP

Report Abusive Comment