|

Although frozen foods make up the largest part of the market in countries such as the U.S. and Germany, chilled meals have emerged as a major force to be reckoned with over the past 25 years or so, as chill-chain distribution has developed internationally. There is also a significant market for canned and ambient lines in some countries.

The U.S. has not only the largest ready-meals market in the world in value terms, reflecting both population size and the highly developed state of the processed and convenience-foods market, but also one of the highest per-capita consumption levels, at more than 22 pounds. The UK ranks just behind the U.S. in ready-meals per-capita consumption terms, at just under 22 pounds, but market value is obviously much lower, reflecting the smaller population size, and the market structure is considerably different.

The UK ready-meals market is now dominated by chilled meals, where sales are more than three times those in the frozen market. Moving to continental Europe, the market for ready meals tends to be much less developed, with chilled meals generally much less significant and many countries still having large and well-developed canned and ambient meal markets, particularly France and Spain.

Innova Market Insights recorded a 4% rise in global launch numbers in the ready-meals category in the 12 months to the end of June 2011, although the total includes a wide range of prepared foods not necessarily regarded as ready meals in all cases.

Pasta and noodle products accounted for the largest number of introductions, with prepared lines alone accounting for over one-fifth of total launches. Rice products were also popular, with 13% of the total, just ahead of main dishes with just over 10%.

As might be expected, Europe had the largest number of ready-meals launches overall, reflecting the large number of countries and cuisines and the relatively highly developed convenience-foods market. Overall, Europe accounted for more than half of total ready-meals introductions recorded over the 12-month period, with Western Europe taking the vast majority of that.

The diverse, dynamic and highly fashion-conscious Asian market accounted for about 18%, just ahead of North America with 15%.

A review of global launch activity recorded on Innova Market Insights over the 12 months to mid-2011 highlights key product trends, including ongoing interest in healthy options, more authentic-style ethnic recipes, more emphasis on natural, organic and locally sourced ingredients, and more interest in restaurant-quality products for in-home dining or home entertaining as an alternative to eating out.

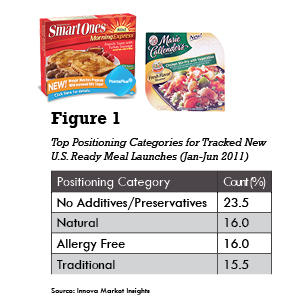

Convenience obviously continues to be the key platform, used by 80% of ready-meals launches recorded in the 12 months to the end of June 2011, yet nearly 38% of launches also used a health positioning of some kind. Particularly common were passive health claims (i.e., “food minus”), such as low-calorie, natural, organic, etc., but also more active claims, such as vitamin- and mineral-fortified, added-calcium or with omega-3/

Rising interest in “naturalness” has been a feature of the food and drinks market as a whole in recent years, although it is much more challenging in some product sectors than others. Ready meals, with a highly processed image, might be seen to be a good example of this, although recent launch activity appears to indicate that it has taken on the challenge, with more than 17% of global launches marketed as being additive- and/or preservative-free and nearly 5% as natural, meaning more than one-fifth of total ready-meals launches were positioned as additive-/preservative-free, natural or both. This compares with more than 11% of launches positioned as vegetarian, 9% as ethical, nearly 8% as low-fat or low-calorie or both, and just under 7% as organic.

The majority of launches on a vegetarian platform are in Europe, particularly Western Europe, with its share several percentage points ahead of its share of ready-meals launches as a whole. This was also the case for Asia, where more than one-fifth of launches recorded were positioned specifically on a vegetarian platform, while in the U.S. the converse was true, with just 10% of launches on a vegetarian platform, behind its share in ready-meals launches as a whole.

Poultry was generally the most popular meat-based ingredient in ready meals, ahead of beef, and there has been ongoing activity across a whole range of formats and types, with a strong focus on ethnic lines, hand-held products and bowl meals.

Microwave options continue to dominate, with popular new options including frozen steamer meals, such as ConAgra’s Marie Callender Flavor Steamer range designed specifically for steam-cooking in the microwave in five minutes or less using ConAgra’s proprietary tray-in-tray packs. The range includes Sesame Chicken, Chicken Teriyaki and Chicken Stir Fry with Vegetables. Marie Callender’s Home Style Creations line also uses innovative technology, designed with a built-in-strainer for cooking pasta in the microwave before mixing with sauces.

Heinz, meanwhile, has been developing its frozen microwave breakfast line under the WeightWatchers Smart Ones branding, featuring reduced-fat and reduced-calorie options of traditional breakfast favorites, such as Stuffed Breakfast Sandwich, Ham & Cheese Scramble and English Muffin Sandwich.

Rising interest in premium, super-premium and restaurant-quality meals has also been evident in the market, particularly in the more developed processed food markets in North America, Europe and Austral-Asia. However, in terms of launch activity, this has been less clearly visible in terms of product positioning globally, with just 4% of total launches positioned on a premium or indulgence platform, rising to nearer 8% for markets such as the U.S. and Australia. This relatively low level may simply indicate a focus on offering higher quality and more authenticity in standard lines, however.

Despite difficulties in some parts of the market, product activity in ready meals seems to be continuing unabated in the face of continuing demand for convenient meal solutions among time-pressed consumers.

The downturn in consumer spending in many countries and increasing concerns over the health aspects of convenience foods may have a negative effect on the market in some countries over the next few years. Nonetheless, overall the market is well placed to take advantage of consumers cutting back on eating out and take-out, moving rather to a range of in-home options, including individual portion meals, family packs and upmarket options for in-home special meals and even informal entertaining.

Report Abusive Comment