August was another outstanding month for U.S. pork and beef exports, according to statistics released by USDA and compiled by the U.S. Meat Export Federation. Pork exports reached their highest monthly volume of the year at 186,068 metric tons, and the second-highest value total of all time at $531.2 million. Beef exports set an all-time monthly value record at $514.2 million on a strong volume of 116,405 mt. Both pork and beef exports are on pace to set new value records in 2011 and to eclipse the $5 billion mark for the first time ever.

August pork exports were 27 percent higher than a year ago in terms of volume and 44 percent higher in value (surpassed only by the record $553.6 million, set in March 2011). This performance pushed year-to-date exports to nearly 1.44 million metric tons valued at $3.82 billion – an increase of 16 percent in volume and 23 percent in value over last year’s pace. August exports equated to 27.3 percent of production with a value of $56.27 per head, compared to 22.4 percent and $40.87 in August 2010. For the year, pork exports equated to 27.3 percent of production with a per head value of $53.98.

August exports to Japan, the leading value market for U.S. pork, were 28 percent higher than a year ago in volume (40,887 metric tons) and 37 percent higher in value ($168.4 million). For the year, exports to Japan were 13 percent ahead of last year’s record pace in terms of volume (328,353 metric tons) and 16 percent higher in value ($1.27 billion).

South Korea continues to be a bright spot for U.S. pork as August exports more than doubled last year’s volume total (10,268 metric tons) and more than tripled the value ($31.2 million). For the year, exports to Korea were 142 percent higher in volume (146,627 metric tons) and 192 percent higher in value ($374.5 million). These totals have already set new full-year records for Korea, topping the previous highs set in 2008 of 133,532 metric tons valued at $284 million.

Exports to China also continued to surge, with a record August volume (35,636 metric tons) pushing this year’s volume up 336 percent (188,622 metric tons) to go along with a 237 percent increase in value ($316.8 million). Exports to Canada were up 9 percent in volume (131,004 metric tons) and 14 percent in value ($464.2 million). August export volume to Russia was the second-highest of the year at 8,213 metric tons. Though export volume to Russia (49,143 metric tons) was down about 12 percent for the year, value was up 22 percent to $149.4 million. Another market showing exceptional growth was Australia, up 18 percent for the year in volume (45,865 metric tons) and 39 percent in value to $147.4 million (less than $1 million short of the full-year value record established last year). Exports to Central-South America were up 22 percent to 44,980 metric tons with volume up 33 percent to $113.4 million. Existing trade agreements have assisted exports to this region and ratification of the Colombia and Panama FTAs will foster further growth.

Mexico continues to be the top volume destination for U.S. pork at 344,875 metric tons – down 3 percent from last year’s record pace. August volume of 44,641 metric tons was steady with last year but up 13 percent from July, and the value of August’s exports to Mexico rose more than 10 percent. For the year, export value to Mexico was up 2 percent to just under $654 million.

“It is gratifying to see U.S. pork exports performing so well in key Asian markets and in so many countries across the globe,” said USMEF President and CEO Philip Seng. “Many regions of the world are facing very tight pork supplies and exports from many pork-producing countries are stagnant. The efficiency and resourcefulness of U.S. producers have allowed our industry to fill this need, and through aggressive campaigns such as the global pork butt initiative we are moving a wider range of cuts than ever in overseas markets. This has solidified our position as the world’s leading pork exporter.”

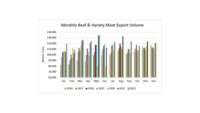

Despite slipping slightly from July in terms of volume, a strong August performance pushed beef exports 26 percent higher for the year in volume (857,680 metric tons) and 39 percent higher in value ($3.58 billion). August exports equated to 14 percent of total U.S. production with a value of $214.11 per head of fed slaughter. (This compared to just under 12 percent and $159.59 per head last year.) For the year, beef exports equated to 14.2 percent of production with a value of $200.75 per head.

Though down from the record pace established in July, beef exports to Canada remained very strong at 19,945 metric tons valued at $114.6 million. This was 44 percent higher in volume and 55 percent higher in value than in August 2010. For the first eight months of the year, Canada has been the leading value destination for U.S. beef at $709.7 million (up 54 percent from last year and already a new full-year record) and second only to Mexico in volume at 130,657 metric tons (up 33 percent).

Mexico was the volume pacesetter for U.S. beef at 169,963 metric tons and second in value at $646 million. These totals were up 6 percent and 24 percent over last year’s pace, respectively. August export value of $93.4 million was easily Mexico’s highest monthly total of the year.

The Middle East continued to shine as a region of tremendous growth for U.S. beef, with totals through August running 37 higher than last year in volume (113,229 metric tons) and 46 percent higher in value ($220.7 million). Egypt was the mainstay market in the region but growth was also strong in the United Arab Emirates, Saudi Arabia, Kuwait and Qatar – markets aggressively targeted this year by USMEF.

Asian markets were also an excellent source of growth for U.S. beef exports, including Japan (up 38 percent in volume to 109,051 metric tons and 44 percent in value to $583.6 million), Korea (up 49 percent to 110,017 metric tons and 41 percent to $485.6 million), Hong Kong (up 66 percent to 33,827 metric tons and 98 percent to $151.2 million) and the Philippines (up 21 percent to 9,003 metric tons and 37 percent to $25.6 million). Taiwan was the exception to this trend, dropping 7 percent in volume (22,642 metric tons) and 6 percent in value ($123.1 million) due to regulatory changes that have created an uncertain business climate for importers.

The Central-South America region increased purchases of U.S. beef by 50 percent in volume (17,320 metric tons) and 66 percent in value ($49.8 million) over last year. Chile, Peru and Guatemala have been the primary centers of growth in the region, but exports should be further bolstered by free trade agreements with Panama and Colombia.

“We are very excited about the growth of U.S. beef exports, not only in traditionally strong markets but in emerging destinations as well,” Seng said. “Despite significant trade barriers in Asia, we continue to achieve outstanding success in most of our key markets. And even in Taiwan, where a large decline was predicted, the U.S. industry’s efforts with importers, distributors and retailers have helped U.S. beef maintain a strong presence. We have also targeted the hotel and restaurant sectors in growing tourist destinations such as the Middle East, Hong Kong and the Philippines, and those efforts are paying significant dividends.”

After a somewhat slow start to 2011, U.S. lamb exports have climbed 72 percent ahead of last year’s pace in terms of volume (14,901 metric tons) and 42 percent higher in value ($21.2 million) These were the largest January-August export totals ever achieved by U.S. lamb, and exports are already near the annual volume record of 13,934 metric tons set in 2006. Mexico, Canada and the Caribbean continue to be the mainstay markets, but exports are also showing promise in Central America and the Middle East.

Complete export statistics through August are available online at www.usmef.org

Source: USMEF