Market Snapshot | U.S. Animal Slaughter & Production

Home » market snapshot

Articles Tagged with ''market snapshot''

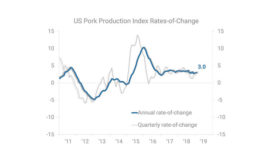

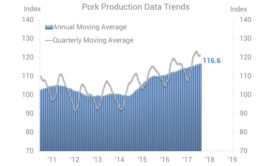

Market Snapshot | U.S. Pork Production

China market offers potential relief to U.S. pork industry

Read MoreMarket Snapshot | U.S. Animal Slaughter & Production

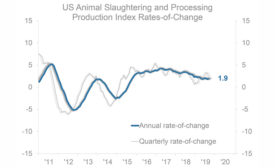

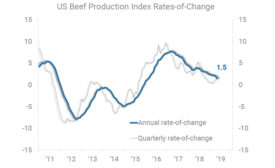

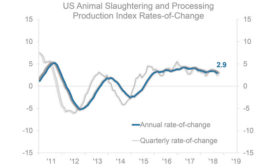

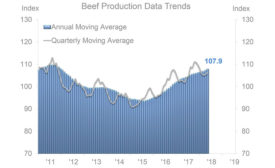

U.S. animal slaughter & production market

Record highs reached, but slower pace persists

Read More

Market Snapshot | U.S. Pork Production

U.S. pork market: Despite favorable conditions, proceed carefully

July 6, 2018

Market Snapshot

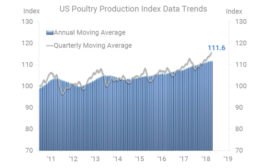

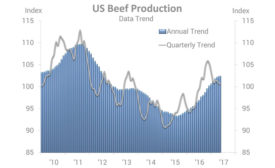

U.S. animal slaughter & production market snapshot

Expectations rise, carry short-term growth

Read More

Get our new eMagazine delivered to your inbox every month.

Stay in the know with The National Provisioner's comprehensive coverage of the meat and poultry processing industry.

SUBSCRIBE TODAY!Copyright ©2024. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing