According to the latest Rabobank quarterly pork report, global recession is affecting pork demand and increasing volatility. A small upside in trade is expected for this year, and the re-opening of China is raising opportunities but also uncertainties.

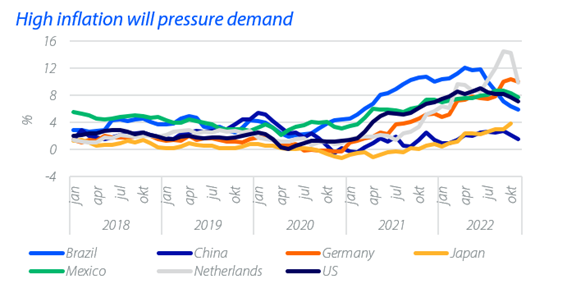

The slowing economy is weighing on demand for pork, raising uncertainties and volatility in the industry. Despite being considered less impacted than more expensive proteins, pork is still facing some pressure on consumption due to challenged household incomes, increased savings and a potential decline in specific channels. According to the report, managing inflation remains a priority for many governments, requiring careful calibration of interest rates to maintain consumer and business confidence.

Rabobank Global Pork Quarterly Q1 2023: High inflation will pressure demand

Rabobank Global Pork Quarterly Q1 2023: High inflation will pressure demand

A limited upside for trade in 2023 is expected as supply tightens in exporting countries and rises in importing countries. “Trade is expected to increase modestly in Q1 2023, but it may find growth difficult to sustain through the year, given slow production in major exporting regions like the EU and [U.S.],” explains says Chenjun Pan, senior analyst - Animal Protein at Rabobank. By contrast, Brazil, which continued to grow exports in 2022, is expected to increase production and exports this year. At the same time, the further recovery and growth in local production in Southeast Asia and China will mean demand for imports will ease, particularly in the second half of 2023.

The reopening of the world's largest pork market, China, will impact the global supply-demand balance. “The timing and extent of a demand rebound is uncertain, and will be uneven [...] due to ongoing [COVID] waves, macroeconomic headwinds, and weak business confidence,” says Pan.

The report also highlights several key factors to watch in Q1 2023 and beyond, including feed grain prices and volatility due to drought in Argentina, poor [U.S.] harvests, lower ending stock globally and demand uncertainties. Additionally, herd health, including incidents of African swine fever (ASF), PRRS and PED, post-COVID consumer demand recovery in China, macroeconomic conditions and the competitiveness of pork in retail and foodservice channels are also noted.

Source: Rabobank

Report Abusive Comment