|

Life is no different in the protein-processing industry — processors are bombarded by a continuous stream of information, guidance and demand — some of it on-point, some of it misguided.

Successful processors are those that can filter out the noise, identify the truly meaningful opportunities and take advantage of them quickly and with minimal upheaval.

JTM Food Group, a Harrison, Ohio-based supplier of fully cooked foodservice and industrial protein and food products, is one such processor, unafraid to use its unique capabilities and strengths to capitalize on trends, helping its customers and consumers in general.

Launching the “Assault”

Over the course of 51 years, JTM had built for itself a reputation as a high-quality supplier of protein-based products to schools across the nation. However, in recent times, customers and the industry in general have begun to view JTM in a different light, explains Brian Hofmeier, senior director of School Sales.

“Many people used to say that JTM makes taco meat,” he says. “But now, when we talk to foodservice directors, national groups and even USDA, we’re viewed as one of the national leaders in reduced-fat/reduced-sodium technology, not only for schools but also for military, health-care and other markets.”

Becoming a leader certainly doesn’t happen overnight, and Joe Maas Sr., vice president of manufacturing and production, acknowledges that the company can thank its ability to adapt quickly for its success recently.

“Reducing fat was a huge trend a number of years ago, and we started our reduced-fat program,” he says. “We started cooking, draining and rinsing our protein products, and, recently, as we did with fat 10 years ago, we saw that we really needed to start reducing the sodium in the products that we manufacture.”

Hofmeier adds that JTM didn’t blink an eye when it came to reducing fat or reducing sodium in its product line, a credit to the leadership of the four Maas brothers who own the company and promote the family-business culture through the workforce.

“They get it that sometimes, it’s the right thing to do and you need to just do it,” Hofmeier says. “We rolled [reduced-sodium products] out at the same prices we sold the original products, and we’ve pretty much held true to form with that. … As a company, we made those investments because it’s the right thing to do.”

JTM started what became branded as its “Assault on Sodium” program with a measured approach, rolling out one reduced-sodium beef taco filling and three reduced-sodium beef meatball items. The products ran for one year without any overt announcement to the change in the sodium content.

“We wanted to look at customer acceptance of the product, because if you’re going to all of a sudden take your entire K-12 school-lunch product line and reduce the sodium across the board by 25 percent, you really want to make sure you’re going to have customer satisfaction and customer acceptability,” Hofmeier adds. “We didn’t make a big splash, it was stealth health.”

After having no issues with the four reduced-sodium formulations, and subsequently announcing to its customer base the results of its “stealth health” trials, JTM set its goal of reducing sodium 25 percent on average across the board — including its substantial line of cheese-based products and fast-growing macaroni & cheese product line.

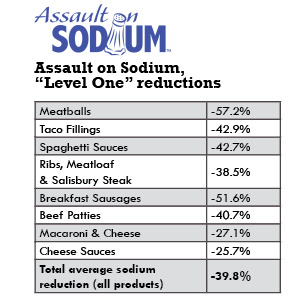

With the cheese products posing the greatest challenge to the goal, JTM happily announced a year ago that it had achieved a 39.8 percent average sodium reduction across all its products — including a 57.2 percent reduction in meatballs, a 51.6 percent drop in breakfast sausages and a 27.1 percent reduction in macaroni & cheese (see table on page 24), among other reductions.

Certainly, Hofmeier says, these results surpassed JTM’s expectations, but the Assault on Sodium wasn’t simply about reaching particular percent reductions of the ingredient.

“Our other goal was what we called ‘equilibrium of palatability,’ which is basically that it had to taste the same,” he adds. “We found from the customer base that everybody wants to do better, wants to offer a better product, but nobody ever wants to give anything up.”

The simple logic behind that demand, he explains, is that students don’t want to notice that their foods taste different, or worse for that matter.

“Kids don’t eat ‘lower-sodium, reduced-fat taco meat on a whole-grain tortilla served with reduced-fat cheese and no-fat sour cream’ — they eat ‘tacos,’” Hofmeier says. “Adults want to serve the former, but kids just want to eat tacos or burritos. Kids mostly care about taste.”

Fortunately, JTM was able to meet many of these requirements around sodium based on its work a decade or so prior with reducing the fat in its protein items, Maas adds.

“We had to figure out as a company how to make food taste just as good as the full-fat, full-sodium product, yet sell it, produce it inline and be profitable without charging more,” he says. “We built an entire process in the plant to cook, drain and rinse product in line and run it at the same speed, and that makes a huge difference [in cost].”

Today, Hofmeier says, JTM is advancing its Assault on Sodium — at a national school show this year, the company announced its Level Two program, which aims to bring sodium levels down 45 percent on average across the board.

“Some items like taco meat, we might be able to pull 80 to 90, maybe 100 mg of sodium out of it,” Hofmeier says. “Other items like mac & cheese, we’re going to have to come out with a completely different SKU, because although we can reduce the sodium, … you are going to give up a little flavor when you pull out an additional 300 mg of sodium from Level One macaroni & cheese to Level Two.”

At presstime, in fact, JTM was preparing to begin testing on its “Level Two” macaroni & cheese, which has 428 mg of sodium, down from the 728 mg in the “Level One” version. JTM will test the item in schools, knowing that students’ taste buds have the final say.

“Kids have a much more sensitive palate, and things that we think don’t taste salty at all, or are on the edge of tasting very good, a student might find it to be too salty,” Hofmeier explains. “We’ve seen that for years and have learned not to trust ourselves and to trust the ultimate customer, the students.”

Reinforcements in other segments

Using its unique process and ability to turn on a dime, as well as the company’s foresight in building out its facility in Harrison to accommodate future growth, JTM’s prospects look bright moving forward.

Although JTM has done well to serve schools across the country, Hofmeier sees plenty of opportunity in this channel. He says that JTM sells onto the menus of approximately half the schools in the nation, leaving a wide group of potential new customers in its sights. Furthermore, Hofmeier aims to place more of JTM’s wide variety of items on the menus of current customers.

“Our goal is to be on the menu every single day in some way — cheese, beef, pork, Asian sauce, cheese sauce on the side; we even started making reduced-fat, reduced-sodium alfredo sauce for customers,” he says, highlighting JTM’s successful sauce business. “We’re not selling them the meat that day, but maybe we’re selling them the sauce.”

JTM has parlayed its success in reduced fat and reduced sodium into the additional foodservice channels and customers it serves, explains Scott Bonta, general manager of Sales & Marketing.

“We’ve essentially doubled down on or extended the strategic initiative of the reduced fat, reduced sodium in the school line across our entire product line,” he says. “We have a health-care strategic initiative that is very consistent with the Assault on Sodium. We’re taking probably 40 of our commercial items and reducing the fat and sodium in those items, in part because of our health-care business.”

Hofmeier says the health-care and military segments are a bit more challenging than schools because of a lack of standardized requirements in those segments.

“Schools have a very set roadmap on nutrition,” he adds. “When you get to the military, they know they want to lower the fat and lower the sodium, but they’ve yet to come out with that list of goals, and in the health-care world, it’s kind of the same way.”

Nonetheless, Bonta agrees, there is opportunity in those channels for JTM.

“The military has a ‘Go for Green’ health-care initiative, and we’re very much a part of that, so it’s really across all our lines of business,” he says. “With the leadership of the school division, we’ve just extended that strategy across all our lines of business.”

As the demand for lower-sodium products trickles through the different levels of foodservice, eventually reaching the end consumer and becoming a retail demand, Hofmeier believes JTM has set itself up well over the long term.

“Even your food giants are really starting to adjust sodium levels, because you can see where it’s going,” he says. “You’re better off to have already done it or be part of the solution now than be dragged along and be the person that has to catch up on all these specifications.”

JTM, in fact, has already prepared to be a leader, rather than a follower.

Winning the battle and the war

A new product and a new processing room at the Harrison plant highlight JTM’s readiness to extend the Assault on Sodium to entirely new areas of the food battlefield. When the Maas family approved the addition of a new cook/drain/rinse processing room to the tune of $5 million to $6 million, they showed a commitment to tap into the potential for their unique CrumbleCreations product.

CrumbleCreations were created about five years ago, when a few JTM customers requested that the company sell them cooked meat only, without the added ingredients and sauces. Jack Mass Jr., vice president of Sales and Research & Development, explains that JTM agreed and began cooking, draining and rinsing ground beef and selling it to customers in five-pound boil-in-the-bag/steam-in-the-bag pouches. Currently, the company sells fully cooked, plain ground beef, ground beef with an extender, and plain ground turkey, all individually quick-frozen.

Production capacity on the product had maxed out in the large kettle room that the Harrison plant houses, and JTM renovated a portion of the facility to devote to the process. Furthermore, at presstime, JTM was in development on an extended turkey crumble, an all-meat pork crumble and an extended pork crumble; and pepperoni, Italian and Mexican flavors for beef, pork and turkey crumbles. The pepperoni flavor, Maas says, is targeted toward foodservice customers looking to offer pizzas featuring the beloved pepperoni flavoring without the high salt content found in traditional pepperoni pizza.

“Due to the Healthy Hunger-free Kids Act for schools, they’re being pressed to lower the fat,” he explains. “Well, the one thing you can’t do on pizza is take all the cheese off it, because then it’s not pizza. … Something like [a ground pepperoni crumble] might allow them to pull 9 or 10 fat grams off that pizza.”

CrumbleCreations also allows JTM to capitalize on the growing demand for items that fit into a “speed-scratch” foodservice kitchen.

“Everybody wants to say they make it themselves, but no one wants to actually make it,” Maas adds. “Also, you have to remember, in the fast-food and mid-scale or lower-end restaurant chains, with the high turnover rate, it’s really much easier to buy your meat already cooked, then add a spice pack, a No. 10 can of diced tomatoes and some beans, mix it all together, and it’s chili — as opposed to starting the whole process from scratch.”

If these trends continue to grow, JTM’s expansion has given it plenty of capacity to meet the needs of customers interested in offering CrumbleCreations to its employees. Maas says his current production slate filled only 8 percent of the capacity of the new CrumbleCreations addition at presstime — meaning there is plenty of opportunity for JTM and its customers to take advantage of this trend.

Yet the future of the company does not hitch itself solely to the fate of the CrumbleCreations line. Maas admits that product line will be a key item toward building out the company’s reach, but its traditional kettle-cooked bagged entrée line is the bread and butter of the operation and still has room to grow. In non-meat items, JTM sees much promise in its bread operation, as well as its ability in the soups and sauces category.

Going back to Joe Maas’ statement on the flexibility of the company to capitalize on the newest trends, JTM’s reputation as a leader in the production and development of nutritional foods ought to carry it to new opportunities across a variety of segments, from schools and foodservice to co-manufacturing and retail.

Report Abusive Comment