Photos courtesy of Foster Farms

It wasn’t long ago that the demand for organic food crossed over from fad to trend.

Organic is a term that has stuck with consumers, and today, demand for organic meat and poultry has grown enough that more conventional, traditional protein processors have stood up and taken notice.

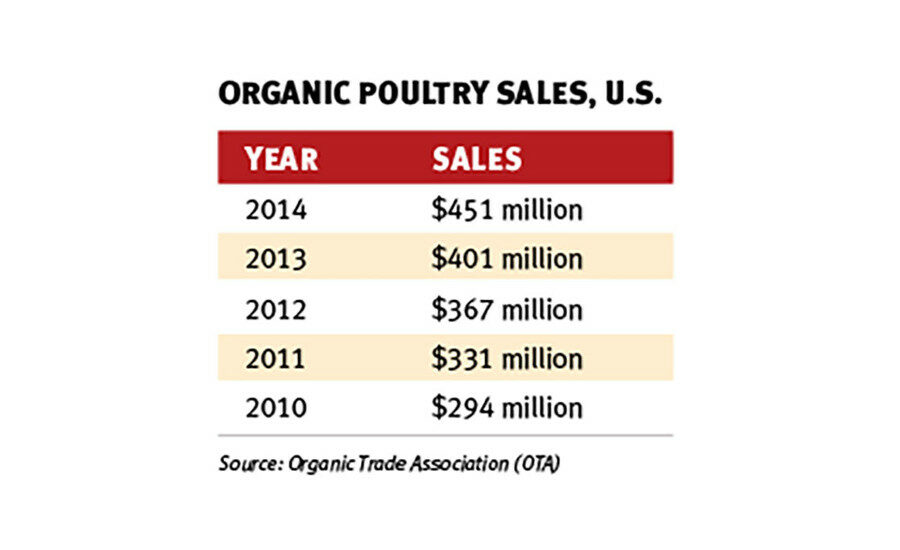

There’s no denying the growth in the category. According to data from the Organic Trade Association (OTA), sales of organic poultry have risen year after year, from $294 million in 2010 to $451 million in 2014. In the last year alone, sales growth for organic poultry grew 12 percent from 2013, and poultry specifically accounts for roughly 60 percent of the total organic meat, fish and poultry segment, according to OTA data. Poultry’s rise in sales mimicked an overall U.S. organic food sales gain of 11 percent in that same period.

Better education of what “organic” means has helped consumer demand grow at a very steady pace.Poultry processors, including Livingston, Calif.-based Foster Farms, have been producing organic poultry for years (more than a decade for Foster Farms); and others are now moving a portion of their broiler production toward meeting the need in their markets.

Yet, to consumers, the fact that Foster Farms offered organic poultry may have been a “best-kept secret,” as the company did not offer those products under its parent “Foster Farms” brand — until now.

Bryan Reese, senior vice president, Sales, Marketing and R&D, for Foster Farms believes the time is right to make this move — and the statistics above support their case.

“For many, many years, we’ve produced organic chicken under a different brand, and our employees are happy that we’re finally doing it under the Foster Farms brand,” he says. “Also, our consumer base has told us time and time again, ‘I’ve been wondering why you hadn’t done organic chicken before,’ so we feel confident in this decision.”

In June 2015, Foster Farms announced a complete revamp of its brand lineup — redesigning its brand logo and rolling out three sub-brands under the primary Foster Farms nameplate: Fresh & Natural, Simply Raised (featuring antibiotic-free chicken) and Certified Organic.

Foster Farms believes it can be a leader in the industry, by which this one small step of mainstreaming its Foster Farms Certified Organic and Simply Raised products potentially becomes a giant leap for the conventional poultry consumer.

“What we really want to do in offering these product lines is give consumers choice, clarify what all these products are about and create more of a dialogue between the company and the consumer,” explains Ira Brill, director of corporate communications for Foster Farms. “This is the exact right time for us to enter the market with [these options].

“If you went back two or three years ago, there were a lot of consumers who were confused about what organic chicken meant,” he adds. “But today, because of the growing dialogue about and interest in food, they have become more cognizant of what these terms mean.”

Although Foster Farms, Brill says, “expects to be the leader in any segment it enters, and organic and antibiotic-free chicken apply,” the company won’t go sprinting into the segment, guns blazing. The investment required to develop an organic or antibi-otic-free production system — time, money and effort — remains high.

“This is a multi-year process that touches every point of the supply chain,” Brill says, adding that Foster Farms believes its effort will grow the overall market for organic and antibiotic-free products. The company found that consumers trust the USDA organic certification, and Foster Farms has tailored its entire program to the Agricultural Marketing Service’s National Organic Program (NOP). Under the NOP, organic begins on Day One of life for the birds, and anything and everything that touches or enters the birds’ environment (or bodies) must be certified organic.

“There are layers of certification that are not just here on the farm or with our birds,” says Charles Corsiglia, DVM, manager of veterinary services for Foster Farms. “The feed mills that provide our feed have to have organic certification — it has to be validated all through the process.”

Even the infrastructure and bedding material must be certified organic and then validated, says Diana Shaver, live production superintendent for Foster Farms.

“The birds cannot have exposure to anything chemically treated, so with new construction, we would use a lot of greenboard for longevity and water-resistance,” she says. “But the birds cannot be exposed to that, so we either have to cut out sections, completely cover them or use a product that may not last as long.”

Producers are required to be meticulously thorough on the smallest of details in developing organic farm site plans. Items that might not seem to be as crucial on a conventional farm — such as the placement of outdoor power poles, for example — need to be well-planned and properly located.

“A lot of those power poles are treated heavily with chemical preservatives,” Shaver explains, “so we have to design the layout of the houses on the property in such a way that these birds would never be exposed.”

Once a producer begins meeting the requirements to be USDA-certified organic, it cannot claim the certification without completing a three-year “test run” of sorts. Thus, the investment in getting certified organic is a long-term commitment that not every producer can take on or turn around quickly.

“A producer like Foster Farms, however, can put the resources into creating a holistic, organic environment, which is really what the plan ultimately requires,” Brill says. The effort doesn’t end the moment a company becomes certified. Feed-ingredient sourcing, for example, can be a continuous puzzle taken apart and often reassembled with new pieces.

Whereas a conventional nutritionist will have a wide variety of ingredients available based on the season, a nutritionist for a certified-organic program has limited options to choose from because those ingredients also must be organic-certified.

“Simply put, organic feed ingredients are limited,” Brill says. “For conventional birds, there is a greater number of feed options.”

Reese looks at the meticulous validation needed as a positive way to reach out to consumers — particularly those who are fully behind organic products.

“There is a nucleus within the consumer base for organics that tend to be the evangelists for organic products, and they really want to know all of those finer details of the program,” he says. “The bulk of the organic base doesn’t need that level of detail; so, our approach in both organic and antibiotic-free is to make the information available for those who want it, but not necessarily have it be the primary communication.”

The strategy has worked thus far, and Reese says the company continues to expect a rise in sales around the new product lines. By the end of 2015, Foster Farms’ organic and ABF poultry products are expected to make up better than 20 percent of the overall retail business, and Reese adds that the company will be the largest producer of both types of product in the West.

“Ten years ago, we were doing organic to meet a small consumer base, but now it’s becoming large enough to be critical to the overall business,” Reese explains. “Some of the investments we’ve made are around maintaining the quality standards we’ve set for the brand, and we have to take a very methodical, measured approach to our growth, which is what we’re doing.”

Brill believes Foster Farms’ leadership position in bringing organic and ABF chicken to mainstream simply reinforces consumer perception in the company as a trusted brand and innovator in the chicken industry.

“Foster Farms has been successful for 75 years because it has been able to always anticipate consumer trends and provide the product that consumers want,” Brill says. “And I think the organic and ABF product now coming out under such a well-known brand name in Foster Farms will probably spur growth even further.”

Taking the message to the mainstream, educating that consumer and providing higher-quality product options that consumers demand is the mission undertaken by Foster Farms — one that could pay dividends in a challenging West Coast meat marketplace. NP

Report Abusive Comment