If you want an industry outlook, the answer is largely going to be determined by who you ask.

An economist will provide data to demonstrate the costs of raising a pig and getting it to market, or sales and trade figures for different primals, to explain why cutout values are where they are.

A chef or someone in research and development will talk about the latest trends moving through the menu adoption cycle, the flavors that are starting to take off in the meat case, or the innovative product that’s going to simplify life in professional and at-home kitchens.

“These are absolutely valuable perspectives to our industry,” says Jarrod Sutton, vice president of Domestic Marketing for the National Pork Board, “and they give us a needed sense of direction on a real-time basis. Obviously, changes in the international trade environment make selling more pork domestically a priority. But having a longer-term strategy is equally important. We have to be thinking five, 10, 20 years down the road to make sure pork is positioned for success in the future.”

According to Sutton, long-term success will be driven by a deeper understanding of the domestic consumer.

“The people who put pork on their plate are getting younger, they’re more diverse and they’re more connected to what’s happening in their neighborhood and across the globe than ever before,” Sutton says. “We need to understand how consumers are using technology as much as we need to understand their attitudes and behaviors about pork.”

At the center of this effort is the most extensive gathering of consumer insights the Pork Board has undertaken. Of particular interest: the Millennial and Hispanic consumer segments.

According to the U.S. Census Bureau, Millennials — those born from 1982 to 2000 — total 83.1 million people, or 25 percent of the U.S. population, and outnumber baby boomers. Meanwhile, almost one in five people in the United States, or 55 million, is Hispanic, the largest ethnic minority.

“To understand future challenges and opportunities for pork domestically, it’s critical to better understand these key consumer segments,” Sutton says.

Consumer attitudes, behaviors

With the goal of building a deeper understanding of consumer attitudes and behaviors, the Pork Board collected insights during the last year using data from several sources — online pork conversations, pork shopping behavior and a three-part survey conducted with more than 10,000 participants.

To find out what people were saying about pork online, the Pork Board teamed with LRW-MotiveQuest, who looked at conversations on popular blogs, message boards and websites over a three-year period.

One finding that wasn’t a surprise when examining online conversations: everyone talks about bacon. More than 30 percent of online conversations about protein sources are about pork, and a third of those involve bacon specifically.

“Bacon, sausage and ham are driving the conversation online,” Sutton says. “When you look at what consumers are talking about, fresh cuts — chops, loins, roasts — aren’t top of mind. That’s an area we’re going to dive into to try to understand opportunities there.”

It’s one thing to talk about pork, but what consumers say they do doesn’t always match up with their behavior.

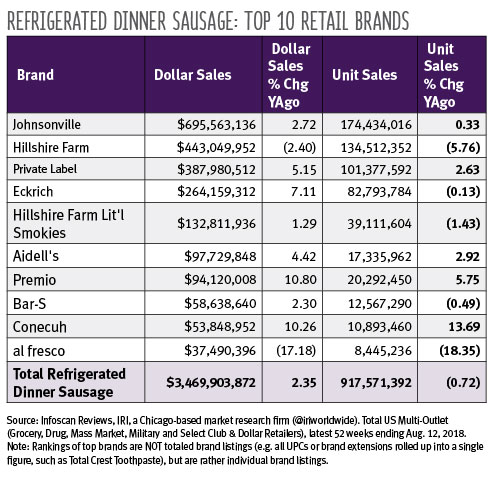

To discover what is actually happening at checkouts, the Pork Board turned to data analytics company InfoScout, which has a panel of shoppers who take pictures of their store receipts and upload them into InfoScout’s databases. InfoScout looks for trends based on the shopper’s demographics:

- What pork products do they buy?

- How often are they buying?

- What portion size?

- What other items are in the basket when they buy pork?

“This is an incredibly powerful tool,” Sutton says. “It’s a much more accurate look at how consumers buy pork, and there’s no self-editing of any information. We know exactly what’s in shoppers’ carts when they buy pork.”

These insights can help identify trends and opportunities for retailers.

“There is so much data available to analyze today,” Sutton says. “The more we know about overall shopping habits, the more we can identify merchandising and promotional opportunities that will appeal to specific consumers.”

The current phase of research is now focused on analyzing more than 10,000 consumer survey responses about buying attitudes, preferences and behaviors regarding pork.

“A typical opinion survey will sample about 1,000 people. By oversampling, we’re able to take a deep dive into key consumer categories. We’ll be able to analyze the Hispanic and Millennial segments, looking at behaviors and opinions. The data will be incredibly specific in terms of demographics and geographic locations, and the insights will be of tremendous value to food producers, retailers and foodservice companies that we work with daily.”

Understanding Digital Behavior

“The average person in the United States checks (their phone) 150 times a day,” says Steve Lerch, an account executive with Google, who is working with the Pork Board to define its digital marketing strategy. “That’s not just teenagers or Millennials — that’s everyone. We experience our world today, including the most important moments of our lives, through our phones.”

The digital world is transforming how people decide what to eat and what they feed their families, and the trend is only accelerating.

“Marketing has changed drastically in a short time,” Lerch says. “If your marketing strategy looks the same as it did 10 years ago, five years ago or even two years ago, you need to ask yourself if it still makes sense.”

“Nearly every sale starts with a search,” Sutton says. “We’re working to make sure we understand how consumers’ searches can impact their decisions to buy pork.”

According to Lerch, nearly one-third (31 percent) of all food/beverage sales are influenced in the digital space. When people make food decisions, flavor is the No. 1 consideration (39 percent), followed by comfort (19 percent) and “I grew up eating it” (13 percent).

“The Pork Board can’t control the price of pork chops or whether a consumer has fond memories of eating ham at Christmas,” Sutton says. “But we can influence perceptions about nutrition, share the proper end-point cooking temperature of chops and show people how to easily make ribs in an Instant Pot. By focusing our marketing dollars, we can make an impact.”

For the past year and a half, the Pork Board has worked with Google to put all this knowledge into practice through new digital marketing tactics.

Google’s ability to connect brands with YouTube creators was a natural fit for the Pork Board as it connects with families and other groups of consumers.

In September, the Pork Board launched a second YouTube influencer campaign with a focus on grilling and cooking chops to a proper end-point internal temperature of 145°F. Both campaigns identified different segments of influencers — YouTube creators whose content specifically appeals to busy parents and families, “foodies,” those with a focus on health and nutrition.

“In our first campaign that began in June, we identified three “family” creators who have a combined following of 2.9 million followers,” says Sutton. “By comparison, our proprietary YouTube channel has about 20,000 followers. Immediately, you recognize how this amplifies the message and brings it to people who wouldn’t normally see it.”

The other advantage of using YouTube creators is the built-in credibility these influencers have with their audiences. According to Google, 40 percent of YouTube subscribers say the creators they follow understand them better than their friends do, and 60 percent of Millennial subscribers would make a buying decision based on a recommendation from their favorite creator.

Three more YouTube campaigns are planned in 2018, with the Pork Board leveraging relationships with major retailers to help build pork sales.

“We’re identifying influencers who shop at these retailers and warehouse clubs to drive more pork sales by year end,” says Sutton. “As an added benefit to those retailers, we are able to pass on the re-marketing information to allow them to define opportunities to re-engage viewers with additional marketing and promotional opportunities.” NP