The more things change, the more they stay the same. Consumers continue to embrace increased convenience, recipes and marketing with protein. The only twist is they now want all of that in new formats such as third-party delivery, meal kits and in-store advice.

There’s certainly no shortage of customers. Meat-eaters number heavily among us (85 percent), while 66 percent worry they aren’t getting enough protein, according to HealthFocus data. Their reasons for wanting more protein may include weight management, energy and muscle growth.

“Chicken continues to be the most commonly ordered/purchased followed by beef, but pork continues to trend thanks to a variety of factors from great marketing by the pork industry to the broader use of pork in many world cuisines,” says Maeve Webster, president of Menu Matters, based in Arlington, Vt.

In fact, 70 percent of consumers eat chicken as an entrée or ingredient at home or away from home once a week, according to Technomic research.

“Chicken continues to lead, due to its affordability and versatility, per our 2019 Poultry Consumer Trend Report,” says Anne Mills, senior manager of consumer insights at Technomic, based in Chicago. “But consumers are integrating more plant-based proteins in their diets more and more. A separate study of consumers who eat seafood and vegetarian or vegan foods found that 16 percent of consumers are ordering vegetarian dishes more often.”

This characteristic rises to 24 percent among 18- to 34-year-olds, as younger consumers are more likely to follow vegetarian, vegan or flexitarian diets than older consumers, Mills says.

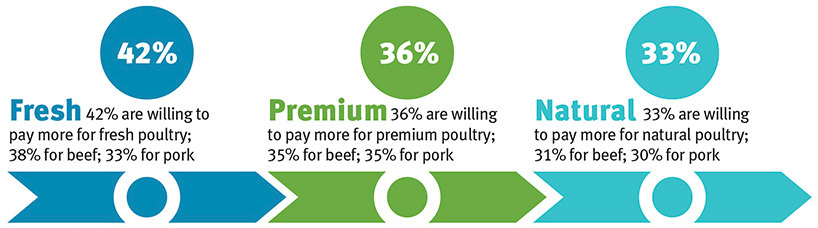

WILL CONSUMERS PAY MORE FOR MEAT?

Yes, some consumers are willing to pay more for claims that denote health/quality.

SOURCE: Technomic

Flexitarians are primarily vegetarians but eat animal protein on occasion.

“The majority of all age cohorts eat some animal protein, though flexitarianism as well as vegan and vegetarianism are higher among younger generations — though still remain the minority,” Webster says.

In contrast, fish and seafood are more appealing to older consumers than to younger consumers, Webster says.

“We continue to see an important share of the population only purchase seafood in restaurants,” says Anne-Marie Roerink, principal at 210 Analytics, based in San Antonio, Texas. “Shoppers don’t have a high confidence level in their ability to prepare seafood. At the same time, the health and well-being megatrend is emphasizing the integration of more seafood in the diet.”

Health and sustainability concerns may be affecting beef and pork sales. About 61 percent of consumers eat beef once a week at home or in a restaurant, and pork is eaten weekly by 38 percent, according to Technomic. Those are strong numbers, but slightly down for the past two years, according to Technomic’s Center of the Plate: Beef & Pork report.

Experimenting with flavor

Protein remains the perfect vehicle for experimenting with new flavors, while holding on to comfort recipes.

“In meat and poultry, chicken has the universal shopper interest,” says Roerink. “Chicken has done a great job in positioning itself as a healthy, lean protein that works as center of plate or a meal ingredient. Millennials, in particular, buy chicken for health, versatility and easy of cooking reasons.”

Chicken runs the gamut of being prepared simply to fried. Looking forward, chicken still has ample room to experiment with coatings, sauces, spices and prep styles. Technomic’s Center of the Plate: Poultry report expects to see more options such as pepper jack cheese, lemon, avocado, poblano and honey on chicken dishes, citing Ignite menu data. The report shows 50 percent of younger consumers (18- to 34-year-olds) say they’re interested in trying chicken entrees with new or unique flavors.

According to Technomic’s Center of the Plate: Beef & Pork report, beef and pork dishes are well suited for ginger and Asian flavors, and Pan-Asian dishes (including Thai, Vietnamese, Japanese and Korean cuisines) should increase on restaurant chain menus as a result.

Fast-growing steak FSRs are also focusing on regional treatments, noted the report.

“At the same time, the strong economy is prompting some premiumization within beef, both in the restaurant and retail worlds,” Roerink says. “Following some flat years, premium cuts are growing sales in both dollars and volume.”

Beef eaters are also comfortable ordering side dishes made with beef (70 percent), the Technomic report shows.

“Beef is seeing great success in the continued better-burger craze in both restaurants and retail, and has been very effective at blends to create variety and fun,” Roerink says. “Virtually all restaurants and retailers carry a variety of flavors, from beef/pork blends to beef and mushroom blended burgers.”

Protein purchases at retail tend to be very different than those in restaurants for many consumers, particularly in seafood. Most popular purchases are shrimp, salmon and tuna, although restaurants are serving more unique species, according to Mintel’s Fish and Shellfish – US, November 2018 report. Many shoppers also view shelf-stable and frozen seafood as healthy choices, Mintel’s report notes.

While many consumers associate turkey with the holidays, its lower consumption numbers during the rest of the year may be because of a lack of options. Consumers want more turkey-centric dishes available year round (42 percent) and say they would order turkey more often at restaurants if it were available (40 percent), according to Technomic’s Center of the Plate: Poultry report.

The plant-based revolution?

It’s hard to ignore the rise of plant-based meats — but also possible not to overstate their popularity with consumers. Carnivores, after all, may just like having more choices.

One could be forgiven for assuming plant-based meats are more than a niche market. Not many days go by without reading about the plant-based revolution in the news. Beyond Burgers, Impossible Burgers and Better Burgers are sold in grocery stores and restaurants, while fast-food chains including Burger King, White Castle, Qdoba, Del Taco, Carl’s Jr. and Taco Bell are also providing non-meat options. Even Tyson, Perdue, Smithfield and other traditional mega meat processors are working on plant-based meats.

In fact, U.S. plant-based sales reached $4.5 billion in April 2019, according to a SPINS report commissioned by the Good Food Institute and the Plant Based Foods Association, an increase of 11.3 percent in one year. Overall food sales improved 2 percent during the same period.

“To truly understand what the consumer is looking for, it’s important to look at trend lines and headlines,” says Anne-Marie Roerink, principal at 210 Analytics, based in San Antonio. “In meat and poultry, the vast majority of sales (about 83 percent) is still conventional. Yet when you ask a consumer about production attributes, claims and aspirations, just about everyone says they are looking for better for me, better for the planet, better for the animal, etc.”

It’s important to realize that as it relates to some of these attributes — such as organic, humanely raised or source of origin — there is a difference between reality and aspiration.

“The same is true about plant-based meat alternatives,” Roerink says. “Despite the media attention they have gathered, meat at retail generates $90 billion in sales vs. less than $1 billion for plant-based meat alternatives (including items in the freezer). But, [giving] credit where credit is due, sales and unit sales are growing at double-digits.”

Younger consumers are more likely to experiment, while women and families are open to adding more plant-based proteins to their diet, according to Mintel’s Plant-based Proteins – US, May 2019 report.

“It’s both Gen Z and Millennials — with their higher focus on health, the environment and social responsibility — who are twice as likely to have an interest in meat alternatives,” Roerink says. “Now blended items such as mushroom burgers have much wider cross-population appeal and seem to be a bridge to health and sustainability that more people are interested in.”

Regardless of any other attribute, taste is always the trump card and that’s true across all cohorts. Plant-based companies have invested time and money into re-creating the mouth feel and taste of consumers’ favorites proteins.

“Younger consumers are certainly more receptive to the Beyond Meat and the lab-based analog category, but I don’t know how long that buzz will really last,” says Maeve Webster, president of Menu Matters, based in Arlington, Vt. “Their nutritionals are horrible and the lack of real, full disclosure about ingredients — not to mention the extreme processing required to create these products — all fly in the face of what is generally most appealing to younger consumers.”

Shoppers are definitely looking for health claims denoting natural, additive-free proteins, but the jury is out on how they will embrace other plant-based substitutes. “Certainly, we’re seeing more plant-based proteins like Beyond Meat,” says Anne Mills, senior manager of consumer insights at Technomic, based in Chicago. “Innovation is extending beyond red-meat substitutes to include plant-based substitutes for chicken and seafood for the sustainability benefit.”

Price remains another challenge with plant-based products, because they do carry a higher price tag. “Oftentimes, people do care about things like environmental sustainability, animal welfare and fair trade, but they don’t always vote with their wallet,” Roerink says.

That being said, all these production attributes, from grass-fed to antibiotic-free, have delivered significant growth for the retail meat industry in the last five years, says Roerink.

“Together with convenience-focused items, items/claims that are perceived to be better-for-me are popular for those who are able to pay the price differential, which is why you continue to see higher uptake in higher-income, more urban areas.”

Ordering convenience

While consumers are more open to experimenting with flavors and dishes, they may need guidance in meal prep. Ready-to-go meals or meal kits — whether from a retailer, restaurant or third-party vendor — help educate and provide convenience.

“Some retailers are trying programs aimed at cooking convenience, such as the ready-chef-go meals, where all the consumer has to do is place the packaging in the oven or microwave,” says Roerink. “Others are trying to grow people’s confidence levels with step-by-step instructions through things like meal kits.”

Fresh-meat purchases lag behind other items when consumers order groceries online for delivery or pick up, however, says Roerink. “Consumers have greater comfort with processed items, such as brats or bacon, and with brands they have bought for years,” Roerink says. “They trust the brand and trust their store and are willing to outsource meat selection to someone else. But for things like steak and roasts, many consumers say they want to look at themselves before buying.”

Millennials are the driving force behind grocery e-commerce. “In this case, particularly older Millennials who are in the pressure-cooker stage of their lives, juggling kids and careers,” Roerink says. “They seek convenience in every step of the process, from shopping to preparation.”

Restaurants are seeing tremendous growth in their ordering business, with virtually all growth coming from the third-party delivery companies, Roerink says.

“Interestingly, this has led to a jump in business for both breakfast and lunch,” Roerink says. “Consumers are actually using the third-party delivery company as a way to do research to determine what’s for dinner. Of course, restaurants have the advantage of the meat being cooked and ready to eat, just like consumers would eat it in the restaurant.”

So, there isn’t a big comfort barrier to overcome with online ordering and pickup/delivery.

“Millennials, with their greater love for technology and eating out, are the driving force behind online ordering and delivery/pickup — typically two to three times more likely to order through apps, websites or third-party delivery companies,” Roerink says.

Q&A with Before the Butcher’s Danny O’Malley

If a burger tastes like a, well, burger, does it matter if it’s made from plants? Apparently not, as consumers drive interest in plant-based meats. We talked to Danny O’Malley, “presiplant” and founder of Before the Butcher (acquired by Jensen Meat Company’s private investors this summer), to learn why plant-based meats are resonating with consumers.

Q: What are consumers demanding in this segment?

A: Overall, people are concerned about health, so they are eating more plant-based products. Also, the trend of eating healthier lends itself to all age groups. The more challenging and far-ranging trend — from children to seniors — is caring about the health of our environment, the planet, which will affect our generation and future generations. Worrying about the health of our planet is universal — and international. Also, how animals are treated from farm to fork. Young kids see videos of how animals are slaughtered and don’t want to eat them.

Q: Why has the plant-based burger segment seen hot growth lately?

A: It’s interesting that in the U.S. a burger is synonymous to Americans in a big way. Burgers are a universal staple in the U.S. diet. We eat them quite frequently. You can get them almost anywhere. If you look at how we make products, mimicking a burger is not easy — but still less challenging than steak, for example. We’re making something similar but different. Our burger is different than a veggie burger though in that it’s meant to mimic the bite, umami, chew and texture of burgers.

So, starting with burgers is an ice-breaker for the industry. They open up our eyes that we can make foods for meat eaters. We appreciate our vegan and vegetarian customers, but these products are made for meat eaters. Not only are they better for me and the planet, but remind me of what I love in a burger.

Now people are aware of the plant-based category and are excited to see more variety, which is important. We will get to the point where we are saturated with plant-based burgers. So, plant-based turkey burgers, chicken burgers and sausage are good options to provide, too.

Q: Why is it perceived to be “better” in the eyes of consumers?

A: Our nutrition matches up to beef burgers. But we added fat by using coconut oil, so there’s no saturated fat. All plant-based companies are making strides in healthier ways of producing products. The great thing about what we do is take the plant to the plate. As we move forward, consumers will demand more options. We can provide healthier ways to eat.

Q: What do you expect to see in this segment in the next few years?

A: What’s really cool is that consumers have already accepted these products. Our challenge is being able to make products fast enough to keep up with consumer demand. Beyond Burger (where O’Malley previously worked for three years), for example, is pretty exciting — special and unique – to the market. So many players are jumping in in a big way. It’s exciting to see the expansion of what we can do. We will see whole meats like steak, which is a challenge, and other varieties like pork, bacon, pepperoni and hot dogs.

The big story in the news right now is the Amazon rain forest, and consequently some big concerns about how we manage our food systems, environment and health of our planet. Plant-based products help to eliminate some of those challenges as we go forward. It’s no longer an option but a necessity to improve the health of our planet.

Willing to pay more

Younger consumers are also more willing to place a premium on healthy options and positive corporate behavior, and pay more for these attributes — to a degree.

“If the value proposition is clear, labeling is transparent and the story or practices are compelling, I do believe consumers will pay more,” Webster says. “However, at some point these are going to switch from ‘trending’ or alternative products and will be considered table stakes.”

At that point, consumers won’t be willing to pay more because they’ll believe these options should be the norm, she says. “You’re already seeing that type of backlash happening with milk alternatives in restaurants and the pushback to upcharges for those options even though those products cost more for the operators,” Webster says. “There’s going to be a real tension between what consumers expect the industry to provide and the realities of the costs associated with those products.”

Interest and action are definitely two different things as they relate to trending attributes. “It’s not always about willing, but more about being able,” Roerink says. “This is where the Aldis of this world come in. Much of their meat and poultry carries these popular attributes and in-store signage addresses ‘buying fancy meat at affordable prices.’”

At the same time, many conventional supermarkets are more prominently addressing animal welfare in seafood and some are starting in animal welfare, as well, Roerink says.

Typically, the more information people have that addresses all things from sustainability and production to health and nutrition, the more willing they may be to make room in their budget. “And perhaps over time, price differentials will come down based on growing offering, in which case we’ll likely see a smaller gap between aspiration and reality,” Roerink says.

Consumers view protein as a healthy addition to their diets — and are willing to pay more for quality, premium claims — but still appreciate a little guidance with preparing restaurant-quality meals at home, if they don’t order restaurant delivery in the first place. NP

Report Abusive Comment