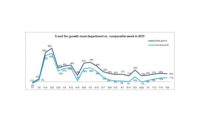

Two months into the COVID-19 pandemic, grocery shopping continues to evolve, and the meat purchase along with it. Throughout the nonstop evolution of shopping patterns, there has been one constant: the meat department has been the undisputed sales leader of the perimeter. While the prior week sales gain of 50% seemed tough to beat, the prominent coverage of plant closures in the consumer media drove yet another wave of shoppers stocking up on meat and poultry. For the week ending May 3, meat department dollar sales were up 51.3% and volume increased 37.2%. Year-to-date through May 3, meat department dollar sales were up 23.3%, boasting double-digit growth for eight weeks running. Year-to-date volume sales through May 3 were up 17.1% over the same period in 2019.

Dollar versus Volume Gains

Pounds have been trailing dollars for years, but the gap between volume and dollar sales remained wide —signaling pressure on pricing due to tightness in the supply chain. The latest four weeks ending May 3 versus the comparable period in 2019 showed double digit volume/dollar gaps for beef, turkey, exotic meats and many processed meats, with the widest gap for turkey at 12.3 percentage points. Chicken had the smallest gap of the bigger proteins, at 5.4 percentage points. Bacon, buoyed by ample supply given lacking foodservice demand in recent weeks, is the only area where dollars and pounds increased at the same rate.

|

Latest 4 weeks ending May 3, 2020 versus comparable weeks in 2019 |

Dollar gains |

Volume gains |

Volume/dollar gap |

|

Total meat |

+39.4% |

+26.4% |

-10.9 |

|

Fresh beef |

+45.5% |

+34.6% |

-5.4 |

|

Fresh chicken |

+29.5% |

+24.1% |

-9.9 |

|

Fresh pork |

+50.6% |

+40.7% |

-12.3 |

|

Fresh turkey |

+35.4% |

+23.1% |

-9.1 |

|

Fresh lamb |

+6.9% |

-2.2% |

-10.0 |

|

Fresh exotic |

+54.7% |

+44.7% |

-5.2 |

|

Fresh veal |

+9.6% |

+4.4% |

-16.9 |

|

Smoked ham/pork |

+1.0% |

-15.9% |

-10.0 |

|

Sausage |

+41.8% |

+31.8% |

-15.8 |

|

Frankfurters |

+35.3% |

+19.5% |

-43.0 |

|

Bacon |

+50.4% |

+50.0% |

-0.4 |

Source: IRI, Total US, MULO, 4 weeks ending May 3, 2020

During the past two weeks, many stores put purchase limits in place for certain cuts or a limit for the total number of meat packages that could be purchased per customer. But supply is likely to continue to impact the dollar and volume performance in weeks to come. “Pork production rebounded 15% from historically low levels last week, but continues to trail 2019 by 24%,” said Christine McCracken, Executive Director Food & Agribusiness for Rabobank. “The beef industry has been slower to recover, with a +6% improvement since last week, and is still 32% below 2019 volumes. Nearly all U.S. plants should be operational in the coming week, but labor shortages continue to limit industry volumes to 70% to 80% of normal. Labor challenges have forced the closure of plants in Europe and Brazil in the past week. U.S. protein inventories are depleted, with retail and foodservice buyers drawing on the same limited supply.”

The limited supply is felt at retail. Many consumers commented on the sparse inventory levels during the week of May 3 on the Retail Feedback Group Constant Customer Feedback system. “The chicken was mostly out. I know that you cannot control what people are going to hoard and it is hard to keep items in stock through no fault of your own. There were only some wings and some drumstick and one lonely whole chicken. I was looking for fresh chicken breasts.” Another wrote in, “A poor selection of meat in the refrigerated cases. Everything looked sparse. Some meat has not been available for two weeks, such as pork chops.”

The supply chain woes have affected wholesale and retail prices. McCracken explained, “Beef prices spiked to new highs this week and more than double year-ago levels, driven by ongoing strength in chucks and rounds.

Tight pork supplies helped buoy prices to levels not seen since 2014. Renewed interest from foodservice drove sharply higher pork belly prices, that doubled in the past two weeks, while loin prices were up 39% over the same period. Chicken prices are also stronger on tighter supplies of beef and pork. Prices of boneless breast meat were +23% week over week, as the industry lacks labor to debone and as supplies of ground beef have become scarce.

Shoppers called out higher meat prices and fewer meat features on CCF. “Prices seem extraordinarily high, so I only bought hamburger, whereas I would have liked to have gotten a roast. I do understand what is going on and realize the price of meat will probably go much higher if it can be procured at all,” noted a shopper on CCF. Another wrote, “With the pandemic there is less red meat and poultry and the prices keep going up. Probably due to mass buying. Items that were in the ad were not available.” IRI’s measure reflecting the average number of items per store remained significantly down, at 309.2. This is 35 fewer items than the same week last year.

|

Average weekly items per store selling |

3/1 |

3/8 |

3/15 |

3/22 |

3/29 |

4/5 |

4/12 |

4/19 |

4/26 |

5/3 |

|

334.7 |

334.0 |

353.2 |

329.8 |

307.6 |

318.1 |

318.0 |

313.6 |

309.6 |

309.2 |

Source: IRI, Total US, MULO, average weekly items per store selling

IRI’s retail price per volume insights also show significant upward pressure on retail prices for the week ending May 3 versus the same week in 2019 for beef, pork and lamb. The upward pressure on the price per volume for turkey eased somewhat compared to the four-week view.

|

Average price per volume versus the same period year ago |

1 week ending May 3 |

Four weeks ending May 3 |

||

|

|

Average |

Change vs. YA |

Average |

Change vs. YA |

|

Total meat |

$3.81 |

+10% |

$3.70 |

+10% |

|

Fresh beef |

$5.38 |

+11% |

$5.35 |

+8% |

|

Ground beef |

$4.25 |

+13% |

$4.15 |

+10% |

|

Fresh chicken |

$2.46 |

+5% |

$2.46 |

+4% |

|

Fresh pork |

$2.83 |

+9% |

$2.84 |

+7% |

|

Fresh turkey |

$3.34 |

+4% |

$3.09 |

+10% |

|

Fresh lamb |

$8.42 |

+13% |

$7.95 |

+9% |

|

Fresh exotic |

$4.39 |

+3% |

$4.27 |

+7% |

Source: IRI, Total US, MULO, 1 week and 4 weeks ending May 3, 2020

Meat Gains by Protein

The overall 51.3% meat department gain was fueled by double-digit gains for all proteins. Beef and pork saw the highest percentage dollar gains, which were also their highest since late March.

The fresh meat performance far exceeded that of other perimeter departments yet again. While produce increased 17.3%, in-store bakery and deli-prepared continued to struggle, which drove an overall perimeter gain of 22.3%.

A Detailed Look by Area

Ground proteins were frequently among those items with purchase limitations starting the week of May 3. Popular due to their versatility and ease of preparation, grinds achieved big gains over the week ending May 3 versus the comparable week in 2019:

- Ground beef increased 51.0%

- Ground turkey, +53.9%

- Ground chicken, +53.9%

- Ground pork, +39.3%

Total meat department sales exceeded $1.6 billion for the week, with continued gains for the big three, that have seen double and triple-digit increases ever since the week of March 15. Beef and chicken, the two largest proteins, saw the largest increases in terms of dollars during the week of May 3 versus the comparable week in 2019. In absolute dollars, beef sold an additional $268 million, with ground beef generating 36% of these additional dollars, or +$95 million. Chicken generated $74 million more during the first week of May versus the same week in 2019. Processed meats, sausages, frankfurters and bacon continued to do extremely well also.

|

|

2020 Weekly $ sales gains versus comparable 2019 week ending… |

$ |

|||||||||

|

|

3/1 |

3/8 |

3/15 |

3/22 |

3/29 |

4/5 |

4/12 |

4/19 |

4/26 |

5/3 |

5/3 |

|

TOTAL MEAT |

-1% |

+8% |

+80% |

+92% |

+36% |

+41% |

+43% |

+17% |

+50% |

+51% |

$1.7B |

|

Fresh |

|

|

|

|

|

|

|

|

|

|

|

|

Fresh beef |

0% |

+9% |

+73% |

+91% |

+37% |

+38% |

+42% |

+26% |

+58% |

+59% |

$720M |

|

Fresh chicken |

+1% |

+9% |

+71% |

+55% |

+28% |

+29% |

+19% |

+28% |

+39% |

+33% |

$303M |

|

Fresh pork |

-5% |

+8% |

+89% |

+102% |

+31% |

+31% |

+37% |

+46% |

+61% |

+59% |

$183M |

|

Fresh turkey |

0% |

+10% |

+97% |

+128% |

+60% |

+49% |

+60% |

-0.6% |

+43% |

+53% |

$54M |

|

Fresh lamb |

+1% |

+4% |

+55% |

+55% |

+9% |

+29% |

+108% |

-43.1% |

-3% |

+27% |

$10M |

|

Fresh exotic |

+5% |

+15% |

+131% |

+123% |

+47% |

+63% |

+80% |

+18% |

+58% |

+75% |

$4M |

|

Processed |

|

|

|

|

|

|

|

|

|

|

|

|

Smoked ham/ |

-6% |

+4% |

+121% |

+236% |

+124% |

+245% |

+179% |

-67% |

-29% |

+87% |

$26M |

|

Sausage |

0% |

+7% |

+97% |

+112% |

+40% |

+47% |

+39% |

+28% |

+53% |

+50% |

$151M |

|

Frankfurters |

-1% |

+11% |

+123% |

+127% |

+45% |

+50% |

+35% |

+29% |

+42% |

+36% |

$67M |

|

Bacon |

-6% |

+1% |

+82% |

+103% |

+35% |

+47% |

+49% |

+32% |

+67% |

+59% |

$139M |

Source: IRI, Total US, MULO, 1 week % change vs. YA

Market Shifts

Significant differences are observed when comparing dollar protein shares between the first week of March, when sales were much in line with 2019 and the early part of 2020, and the week ending May 3. While shares are influenced by holidays and differ from week to week, pork and beef’s share continues to be elevated in the one week and year-to-date views, whereas chicken’s share is down in both. The same look at volume shows the effect of pricing and the meat industry being out of balance at a macro level in terms of supply and demand.

|

Dollar sales |

Volume sales |

|||||

|

|

Week ending 3/1/20 |

Week ending 5/3/20 |

Building calendar year 2019 |

Building calendar year 2020 |

Week ending 3/1/20 |

Week ending 5/3/20 |

|

Beef |

53.3% |

56.5% |

53.6% |

54.9% |

37.0% |

39.4% |

|

Chicken |

27.5% |

23.8% |

26.9% |

25.9% |

40.5% |

36.2% |

|

Pork |

12.9% |

14.3% |

13.2% |

13.3% |

16.5% |

19.0% |

|

Turkey |

4.4% |

4.2% |

4.4% |

4.6% |

4.8% |

4.7% |

|

Lamb |

0.9% |

0.8% |

0.9% |

0.9% |

0.4% |

0.3% |

|

Veal |

0.1% |

0.1% |

0.1% |

0.1% |

0.1% |

<0.1% |

|

Exotic |

0.3% |

0.3% |

0.3% |

0.3% |

0.2% |

0.3% |

Source: IRI, Total US, MULO, % of total fresh dollars | “All other” not reflected

Channel Shifts

Meat departments across channels and banners have seen tremendous sales and engagement during the pandemic, but out-of-stocks at primary stores also drove consumers to explore different channels and outlets. Important beneficiaries of new engagement were grocery stores as well as limited assortment powerhouse ALDI, according to IRI research. “Meat departments at grocery stores gained big since the onset of the pandemic with an 11% gain in new buyers for the four weeks ending March 22 and a 5% increase for the four weeks ending April 19 compared with the same time periods in 2019,” said Kristen Muzrall, Consultant at IRI. “Even more impressive was ALDI’s 21% increase in the number of households buying across meat categories during the four weeks ending March 22 and another 6% during the four weeks ending April 19. Walmart, too, did extremely well, particularly in April with an 11% increase in new buyers. COVID-19 has driven shoppers to purchase items they did not typically purchase, but also shop at new stores. This is likely to have longer-term implications on dollar share allocations.” In addition to new buyers, food formats of all types saw big surges in dollars spent per buyer throughout the pandemic. Muzrall added, “Behind the enormous surges in meat sales is the story of consumer engagement. Between March 8 and April 12, the grocery channel, Walmart and ALDI saw double-digit increases in new buyers and spending per buyer at least four out of five weeks.”

What’s next?

Prompted by the continued media coverage of meat shortages and rising prices, the run on meat continued the second week of May and will likely result in continued high gains for the week ending May 10. Additionally, Mother’s Day may have provided another small sales boost with restaurants in most states still closed or open with limited seating capacity. For the foreseeable future, it is likely that grocery retailing will continue to capture an above-average share of the food dollar with meat in a starring role.

210 Analytics and IRI will provide sales updates weekly, every Monday. Meanwhile, please thank the entire meat and poultry industry, from farm to store, for all they do to ensure supply during these unprecedented times. #MeatFeedsFamilies #SupermarketSuperHeroes

Source: 220 Analytics/IRI

Report Abusive Comment