The women’s World Cup has brought a lot of attention to the Southern Hemisphere, but there’s another reason for meat industry professionals to take a closer look at this area. Australia is an established global leader in the red meat trade, particularly when it comes to sustainable animal agriculture. Here in the U.S., Australia is the #1 source of lamb, topping both domestic supply and all other competitors. Australia punches above its weight in global beef exports as a top supplier of grass-fed and grain-fed beef to over 100 countries, supplying a full range, from premium chilled high-end Wagyu, to grass-fed beef and grain-fed beef cuts, to frozen burger trim.

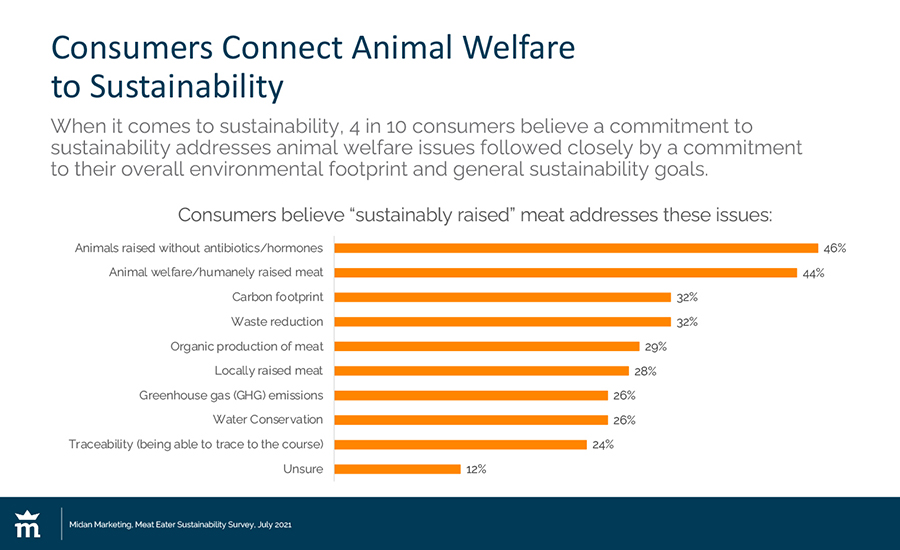

It’s not just the industry that’s looking to this region for Australian beef and lamb. As consumers in the U.S. and around the globe are increasingly interested in the sustainability of the produce they buy, they’re taking an interest too. But what does sustainability mean to consumers in regard to meat? Here’s what the data shows:

While a majority of consumers are thinking about sustainability when making meat purchases, younger consumers in particular are looking for reassurance that they’re making good choices for themselves, their families, and the planet. A Midan Marketing Sustainably Raised Meat report from July 2021 showed that 50% of consumers indicated that meat should only come from farmers that practice sustainable agriculture. That interest and demand only increases the relevance of raising claims, especially when they are backed by quality assurance programs, like no antibiotics, no added hormones, and grass-fed. Those programs are indicators of trust and quality in beef and lamb for U.S. consumers. Among the raising claims, grass-fed beef in particular benefits from its simplicity. It’s easy for consumers to identify with and understand, and ultimately, to pay a premium for. In fact, grass-fed and free-range are the most common responses when consumers are asked what “sustainably-raised" means to them.

In a time of beef herd contraction in the U.S., these “better for me, better for the environment” sustainable meats need to be sourced consistently, but from where? Australia is a suitable natural environment and export-focused country to provide these sustainable meats. The country has the natural resources and infrastructure to deliver to demanding markets in both quality and scale, both now and in the years to come.

Sustainable animal agriculture in Australia

The Australian red meat industry has reduced their emissions by 65% since 2005 and have set a target to become carbon neutral as a beef- and lamb-producing country by 2030. Aussie farmers have already:

- Reduced water use by 73% since 1985.

- Invested just under $110 million in sustainability initiatives.

- Improved genetics and animal management.

- Increased carbon capture in soils.

- Increased use of high-quality feed to improve productivity and reduce emissions.

Learn more here.

Meeting the next wave of sustainability goals will involve a host of measures from existing technologies and practices. Many of today’s Aussie beef farmers are focused on “regenerative agriculture” practices, like soil health, biodiversity, and tree planting. These practices help with carbon goals, and are also an investment in the long-term productivity and health of the farm. Natural forage like Leucaena and natural feed additives like asparagopsis (red seaweed) are reducing enteric methane emissions up to 80%.

“Consumers are looking to [‘shop their values’] and spend their food dollars on products they can feel good about[,]” said Sabina Kindler, North American business development manager, Meat & Livestock Australia. “The vision of the Australian beef industry is that consumers feel good about eating Aussie beef because it is a sustainable product, as well as being nutritious and delicious for generations to come.”

With these consumer trends at the forefront, foodservice, and retail buyers are looking for meats with sustainable credentials. Processors would be wise to seek out stable sources for sustainable meats as global demand increases.

The supply picture

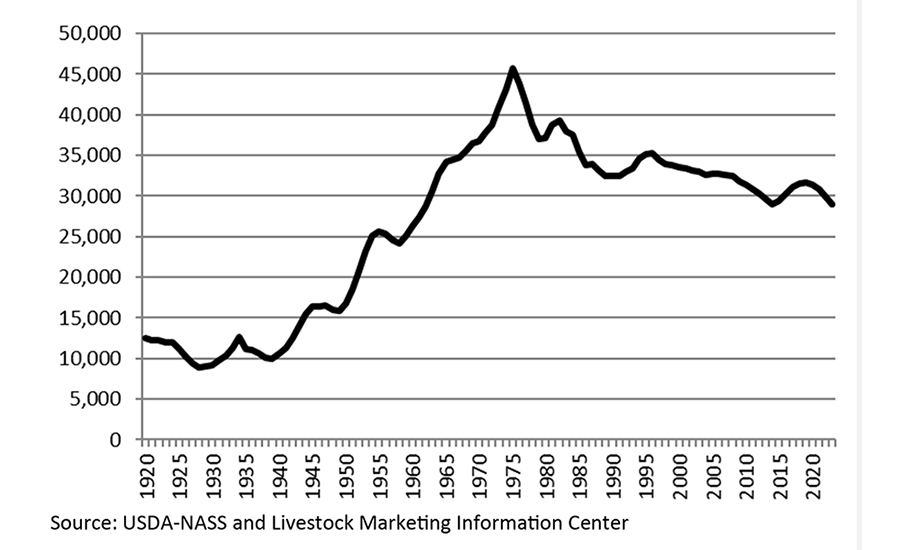

It will be no surprise to readers that domestic supplies for beef are forecast to tighten considerably in the coming months and years. A combination of drought, higher input costs, and strong cull cow prices has pushed the U.S. beef cow herd to its lowest level since 1962. A stubbornly high female slaughter rate in the U.S. limits the capacity for the herd to expand, pushing a rebuild phase further into the future.

U.S. beef cow inventory (1920 to 2023 – 1000 head)

Source: USDA-NASS and Livestock Marketing Information Center

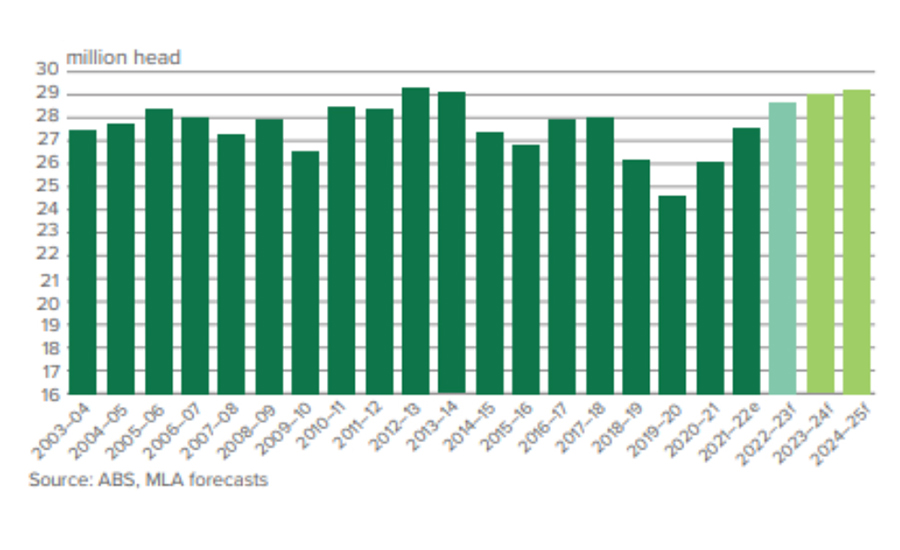

Meanwhile, in the Southern hemisphere, favorable weather conditions have allowed the Australian herd to recover from a drought cycle and increased the national herd to its highest level since 2014. In 2025, it is projected to reach a size not seen since 1978.

Australian national cattle herd (2003–2025 – projected)

Report Abusive Comment