September brought cooler temperatures around the country and kids returned to school. “With it, the share of meals prepared at home increased to 78.8%,” said Jonna Parker, team lead fresh for Circana, citing the September edition of the Circana primary shopper survey. "This upholds the patterns observed in 2021 and 2022, in which at-home meal preparation dips in the summer and increases month-over-month throughout the fall and holiday season.”

The strength of deli-prepared food continues to be very encouraging, Parker said.

“It reflects a marketplace in which consumers need a break from cooking every once in a while, but as part of the ongoing balancing act, it is deli that is increasingly winning those trips over restaurants," she said. "We know from our National Eating Trends study in 2023 that nearly 41% of all meals are ‘quick prep’, meaning more heat/eat and component assembly than traditional cooking.”

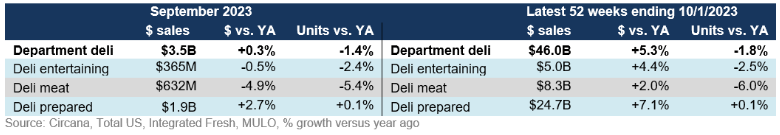

Deli-prepared foods generated $1.9 billion in September and improved unit sales above year-ago levels. This is in sharp contrast to deli meat that dropped 5.4% in units (packages sold) year-over-year. In the full-year view, the patterns are similar, with the deli-prepared section outperforming deli cheese, meat and entertaining.

As consumers still shift their dollars across items, brands, sizes, stores and restaurants, Circana, 210 Analytics and the IDDBA team up to document the marketplace impact on the deli industry.

Deli meat

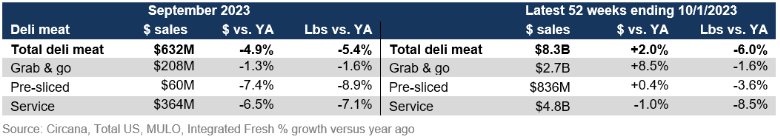

Deli meat sales (combined fixed and random weight) totaled $632 million in the four September weeks. This was down in both dollars and pounds, unlike the 52-week view that still shows dollar strength. Over the past few years, the share of deli meat generated by the service counter has dropped in favor of growing shares for grab and go and pre-sliced.

Packaged lunchmeat (included in meat department sales) reached $490 million in September 2023. After many months of substantial, but inflation-driven dollar gains, September became the second month in which sales dipped below year-ago levels. Packaged lunchmeat saw pounds drop 5.8% versus year ago in September versus a decline of 5.4% for deli meat.

Deli entertaining

Deli entertaining sales held steady in dollars and experienced mild unit pressure in September. In the 52-week period, spreads and holiday meal demonstrate the increased reliance on convenience during special occasions.

Deli prepared

“In today’s marketplace, the ultimate value is the combination of price with elements such as convenience, health, taste and experience,” noted Parker, adding that this is where grocery deli prepared foods play very strongly. Consumers did less at-home meal preparation in September, although it still sits at nearly 77% of all meals sourced in-home. It ended up being a big month for deli prepared. Winners include prepared meats and pizza, illustrating that deli-prepared foods can serve as a meal ingredient or replace the entire home-cooked or restaurant meal.

What’s next?

Looking toward the Thanksgiving and December holiday season, the majority of consumers expect to celebrate in similar fashion as they did last year. This includes similar expectations for the size and nature of home-cooked meals for family and friends. While unit pressure has had a profound impact on grocery sales for the past two years, holidays are an important reason to include more premium items and treats — underscoring the importance of suggestive selling in-store, online and utilizing social media.

Report Abusive Comment