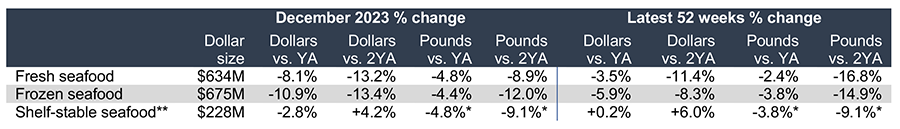

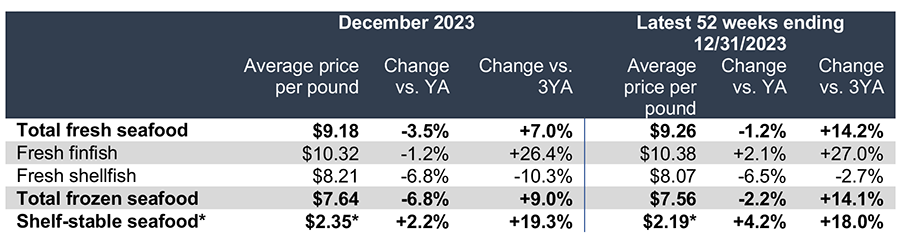

The seafood category began 2024 with prices down for frozen and fresh shellfish, according to Circana retail market research.

The cost for fresh seafood -- an average price of $9.18 per pound -- remained markedly elevated over the average price per pound for chicken ($2.99), pork ($3.11), and beef ($6.51).

On average, seafood is eaten once per week, with more than half (54%) of Americans eating more seafood now than they did two years ago (and 40% eating about the same, according to Circana market analysis for Alaska Seafood Marketing Institute in December 2023. Additional research via ASMI/Material+ shows that 74% of consumers wish they ate seafood more than they already do, with 66% saying easy recipes and cooking inspiration would help them do so.

“Health and taste/enjoyment continue to drive overall seafood consumption, with cost increasingly factoring into purchasing decisions in recent years,” said Megan Rider, domestic marketing director for the Alaska Seafood Marketing Institute. “Sales and promotions are the strongest purchase driver for seafood, and will continue through 2024 as shoppers balance value and taste.

Rider said pairing regular promotions with usage suggestions and cooking tips (for example, the ease of cooking right from frozen), is the best way seafood departments can encourage regular sales of seafood.

On the regulatory side, President Biden issued an Executive Order in December 2023 to fully ban Russian seafood products entering the U.S., regardless of where they may have been further processed.

“The ongoing situation with Russia has solidified U.S. consumers’ preference for seafood caught domestically,” Rider said, adding that the majority of consumers (66%) prefer seafood with a U.S. origin.

Finfish and shellfish

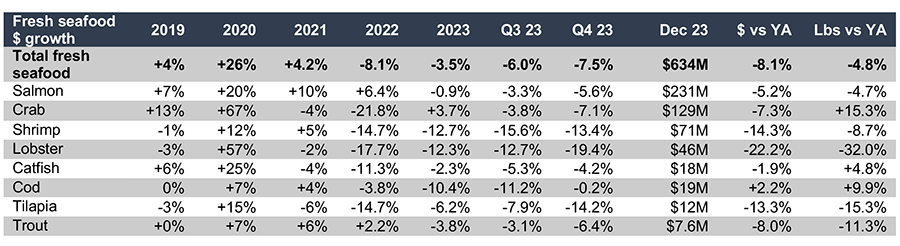

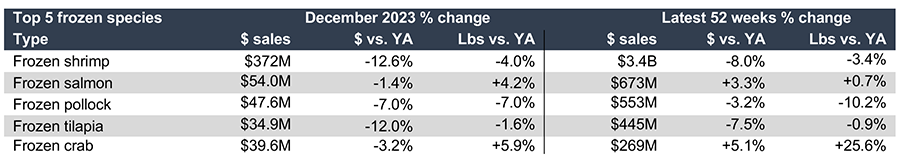

Total four-year seafood sale growth is balanced across finfish and shellfish, with frozen and refrigerated finfish experiencing 31% sales growth, according to ASMI. Salmon continues to be the most-consumed finfish in the U.S. Frozen and refrigerated shellfish that includes shrimp, the most-consumed type of shellfish in the U.S., as well as Alaska shellfish species like crab, experienced 23% sales growth.

Fresh, frozen, and canned

Comparing seafood’s fresh, frozen, and canned categories, just-released research from Circana for ASMI finds demand for all three categories is balanced, with the seafood category seeing an average of 30.2% sales growth over the past four years. Fresh/refrigerated is the most frequently purchased seafood, followed by frozen and then canned/shelf-stable products.

Tinned seafood grabbed consumer attention during the Covid-19 pandemic from consumers looking for shelf-stable proteins, according to Global Seafood Alliance. Popular TikTok videos are making tinned seafood trendy, with Circana finding sales of tinned fish increasing from $2.3 billion in 2018 to more than $2.7 billion in 2023.

“The tinned fish trend is still alive and well,” Rider said. “We’re continuing to see expansion of tinned seafood offerings branching into new species, as well as new flavor variations for tried-and-true tinned species like salmon.”

She added that specialty tinned fish continues to perform well at retail, especially products that tap into flavor trends or offer limited-time deals. Additionally, wild seafood is overall preferred 4-to-1, with consumers favoring products clearly marked as wild being more desirable.

Value-added seafood

Flavor trends and the growing desire for cooking inspiration and convenience is driving new value-added seafood product development.

“For example, a pre-marinated miso-glazed sablefish hitting store shelves in 2024, helps introduce consumers to lesser-known species while making meal planning and prep easier,” Rider said.

Flavor trends for seafood products are following many of the major flavor trends across the food industry, she said, including increased global influence (especially of Asian flavors like miso), flavor fusions (most notably sweet and spicy), and refreshing flavors like botanicals and citrus (grapefruit and yuzu, for example).

An example of this type of new product innovation is recently introduced microwavable salmon bowls from Scott & Jon's, a provider of premium, convenient seafood meals, come in two restaurant-inspired flavors featuring Atlantic salmon. The Honey Sesame bowl includes rice, vegetables, and a sweet and savory honey sesame sauce, and the Mediterranean Herb bowl offers a medley of fresh herbs, quinoa, brown rice, and vegetables.

.png?height=50&t=1647275041&width=50)

.png?height=96&t=1647275041&width=96)

Report Abusive Comment