From a holistic perspective, total poultry across the store had moderate dollar growth but volume declines for all U.S. outlets combined for the 52 weeks ending Nov. 2, says Meagan Nelson, associate director at Nielsen, in Chicago.

“Chicken was the positive driver up in both dollars and units,” she says. “On the other hand, turkey has continued downward trajectory — down 1.2 percent in dollars and 3.7 percent in units.”

IRI, in Chicago, reports chicken sales grew 1.2 percent for the 52 weeks ending Oct. 6 in total U.S. outlets, which is at a faster rate than the meat department as a whole. Chicken volume basically remained flat with 0.2 percent gains.

“Chicken has outperformed the total meat department over the last three years in both dollars and pounds as the popularity of chicken continues to grow,” says Chris DuBois, IRI’s senior vice president for strategic accounts.

IRI also reports turkey sales are in a slump with a sales decline of 3.7 percent for the year ending Oct. 6, which is a faster rate of decline than its three-year compound annual growth rate of minus-1.5 percent.

Additionally, IRI tracks duck sales at less than $50 million a year compared with $12 billion for chicken.

Mintel International, also in Chicago, reports the poultry category stayed flat in 2019 with a 0.7 percent increase, equal to its growth in 2018. Gains were primarily fueled by the chicken segment, which grew 1.8 percent, while turkey and other poultry declined by 0.4 percent.

“Minimal movement is expected over the next five years,” says Kaitlin Kamp, Mintel’s consumer insights analyst for food and drink. “Products with convenience or all-natural positioning are doing well, while legacy meal-kit/meal-ready poultry products struggle, likely as competition in both the plant-based and meal-kit space grows.”

Within fresh meat poultry, Nielsen sees chicken thighs doing particularly well, up 5.3 percent in dollars and 0.9 percent in units. Nielsen also records healthy growth from value-added chicken up 3.7 percent in dollars and up 8.2 percent in units, though it is a small part of chicken overall (1.8 percent share of sales).

The days of chicken breast driving overall sales growth appear to be gone in the short term, IRI’s DuBois says. “All of the growth last year came from fajita/kabob cuts, thighs/boneless thighs and chicken wings,” he says. “Each of these categories grew three to six times faster than chicken overall. Ground chicken continued to grow at double-digit rates as well.”

Whole-bird sales for chicken continued its multiyear decline trend as well. “Consumers want cooking to be easier, and that is solved by either more convenient cuts to use or through prepared foods such as rotisserie chicken,” DuBois says. “Legs and boneless breast were also some of the slowest growing major cuts.”

The shift toward more dark-meat chicken cuts is not just a 2019 phenomenon.

“I’d fully expect processors to continue to drive this growth as they rebalance volume across cuts,” DuBois says. “They still have the need to sell all parts of the chicken, and now that the U.S. consumer is showing more interest in dark meat, I’d expect more continued innovations in dark-meat cuts that translate to more shelf space in the meat department.”

DuBois also expects organic chicken to grow at about 10 percent for the next several years. “This is a pocket of growth that addresses a real consumer demand and represents almost 8 percent of total chicken sales,” he says.

For turkey, declines are coming across most cuts, but whole turkey is driving 66 percent of the unit decline, Nielsen’s Nelson says. “We do see growth again in value-added products with turkey value-add up 12.4 percent in dollars and 13.6 percent in volume,” she says.

Overall, 2019 did not result in the full turnaround the turkey industry has been hoping for since the end of the 2015 avian influenza outbreak, says Beth Breeding, vice president of communications and marketing for the National Turkey Federation (NTF), in Washington, D.C.

“Markets have been slow to recover from this disruptive event, and the industry is still working its way through supply and demand imbalances,” she explains. “However, we have seen some encouraging signs that we hope will set the industry up for a positive 2020.”

For example, turkey export sales are up 7 percent from 2018, and NTF sees that area as an opportunity for continued growth in 2020 given the global demand for protein. Additionally, while cold-storage volumes have trended higher than average in several categories for the industry, thanks in part to greater export volumes, the industry saw a 6 percent reduction in turkey cold-storage volumes at the end of September compared with 2018, NTF reports.

In addition, it does appear the turkey industry may be beginning to see a return to more normal seasonal patterns in turkey markets for the first time in a few years. “As of Nov. 15, average prices for frozen hens and toms are up more than 17 cents over last year, and we see that as a good sign,” Breeding says.

The industry is adjusting to market demands as well. Poult placement overall has declined in 2019 compared with 2018 which correlates to a slight decrease in the number of turkeys processed, approximately 2 percent, Breeding says.

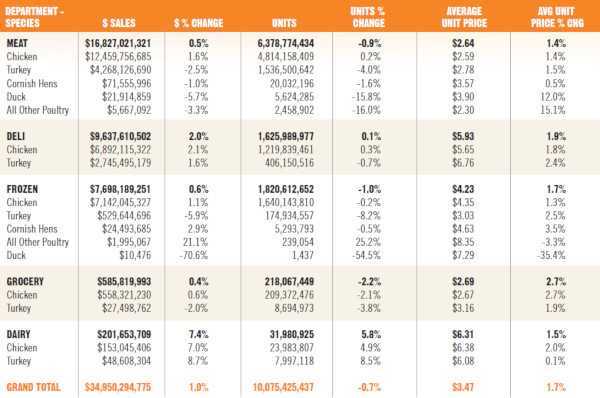

RETAIL POULTRY SALES BY DEPARTMENT

Source: Nielsen. All Nielsen tracked outlets not including convenience. The data reflects 52 weeks ending Nov. 2, 2019. View full-size chart

Innovation and convenience

Restaurants typically lead the way on consumer trends, and last year saw a push for better-for-you poultry menu options, including antibiotic-, hormone- and steroid-free claims, says Anne Mills, senior manager of consumer insights for Technomic, a Winsight Co., in Chicago.

“We’re seeing more operators offer ‘free’ poultry, including free-range poultry and poultry without antibiotics or hormones,” she says.

For example, Wendy’s revamped its chicken tenders, which are now made with 100 percent chicken breast and no artificial flavors. Atomic Wings also promotes U.S. Department of Agriculture (USDA)-certified organic and humanely raised along with antibiotic-, hormone- and cage-free chicken as central to its overall menu and concept positioning.

Still, boneless chicken preps are growing, leading tenders, nuggets and other similar offerings to proliferate on the menu, Mills says. Ingredients finding their way into chicken dishes more frequently include options such as pepper jack cheese, lemon, avocado, poblano and honey, Technomic reports.

In addition, duck has trended recently and has actually grown on Top 500 menus during the last few years, Technomic reports. “Preference skews to higher-income diners, but this doesn’t limit opportunities to pricier chains,” Mills says.

Consumer demand for innovation is leading operators to turn to new flavors as well as batters and coatings for chicken to drive cravings and differentiate. This includes simple batters featuring a handful of spices to complex, sometimes over-the-top coatings, Mills says. For example, KFC added to the sweet and spicy trend with the Hot Honey Extra Crispy Chicken limited-time offer.

In addition, new sauces and dips are being paired with chicken tenders. For example, Slim Chickens is an emerging chain that has built an entire concept around hand-breaded chicken tenders and scratch-made dipping sauces. Global influences also are being featured to spice up poultry dishes. Technomic’s Ignite menu data lists several global flavors as mainstream for poultry dishes, including Latin American for chicken and Mediterranean for turkey.

Chicken also is a growing menu item at breakfast. Wendy’s new breakfast menu includes chicken sandwiches, and McDonald’s will roll out chicken breakfast options nationwide this year after testing items in select locations.

Additionally, turkey is growing beyond deli-style sandwiches and burgers. “Turkey-based appetizers, including soups, stews, chilis, nachos, quesadillas and sliders, are ripe for innovation, as is turkey as a twist in comfort-food dishes across dayparts,” Mills says.

For example, Amy Ruth’s, a New York City independent eatery, offers turkey wings smothered in a Southern-style braise.

As far as consumer trends affecting poultry sales at retail this year, it’s not surprising that convenience is expected to continue to drive growth in 2020.

“In 2019, we see the best pockets of growth for poultry coming from deli prepared foods driven by chicken sandwiches and pot pies and fully cooked meat — chicken tenders, bites, nuggets — in the meat department,” Nielsen’s Nelson says. “Additionally, chicken will continue to be lifted by the health-conscience consumer due to its overall health halo.”

As far as innovation goes, Nelson is seeing innovation in the value-added space for both chicken and turkey driven by pre-marinated/seasoned product. “Providing that next step, extra level of convenience to the consumer is important,” she says. “No consumer is looking for ways to make their lives less convenient.”

In turn, IRI reports that value-added products have outperformed conventional meat cuts over the last seven years, with growth at least doubling that of total meat sales.

“Chicken gets high marks from consumers on convenience and is used throughout the week on different occasions,” DuBois says. “Chicken is ‘feel-good food’ and an all-around winner for attributes related to preparation. Turkey is perceived as less convenient than chicken, but ground turkey has always found a niche that services the health and wellness concerns within households.”

Mintel’s Kamp agrees the innovations around convenience have really resonated with consumers. “Brands have focused product innovation on ready-to-eat refrigerated chicken strips and bites positioned for easy salads, wraps, etc.,” she says. “Similar product innovation that’s currently working are products that require no thawing or cutting, to reduce the amount of time and effort needed from consumers.”

Another trend positive for poultry’s growth is that consumers are actively seeking protein, with 39 percent of consumers reporting protein content is important to them when choosing healthy food, Mintel reports. But the growing group of consumers, who identify as flexitarians, or someone who is trying to eat less animal protein, are creating a demand for plant-based proteins. While poultry fits the bill for consumers’ protein interest — thanks to its healthy perception, wide availability and affordability — 19 percent of consumers report being interested in plant-based alternatives that taste like poultry, and 17 percent report they are interested in poultry options that are a blend of animal and plant protein, Mintel says.

“Poultry companies like Tyson and Perdue are releasing plant-based protein options that imitate the taste of poultry and products that are a blend of both animal- and plant-based protein, creating a wider competitive set for poultry, but also an opportunity for product development that combines both plants and poultry in products,” Kamp says.

“The protein marketplace is evolving, and we know that meeting the demands of today’s consumers looks different than in years past,” Breeding says. “Focusing on the health of our flocks, safety of products and new ways to try turkey are just some of the ways we are working to find balance and position the turkey industry for sustained growth going into 2020. This includes a new targeted project through NTF aimed at amplifying turkey’s retail presence and laying the groundwork for the continued growth of turkey in the barbecue/grilling space as well as developing innovative products.”

Turkey has been a fast follower behind chicken on the pursuit of raising birds without antibiotics. While chicken sales of birds raised with no antibiotics ever (NAE) is approaching 40 percent of total chicken sales, it’s about 11 percent for turkey, IRI reports.

“2020 will be a big year to see if the double-digit growth of NAE turkey continues as it grew 13 percent last year in a down year for turkey overall,” DuBois says. “If 2020 continues this torrid pace of growth, I’d expect it to follow the path of chicken long-term.”

IRI’s DuBois also thinks transparency of the poultry industry is an important consumer demand to address.

“Consumers expect to have access to full knowledge for how their food is raised, processed and delivered to the store,” he says. “This includes how and where animals were fed, housed and cared for as well as for how companies manage their stakeholders such as employees. Chicken and turkey processors have been leaders in changing how they feed their animals and how they communicate to consumers, and this drive for transparency has helped fuel chicken’s outperformance in particular.”

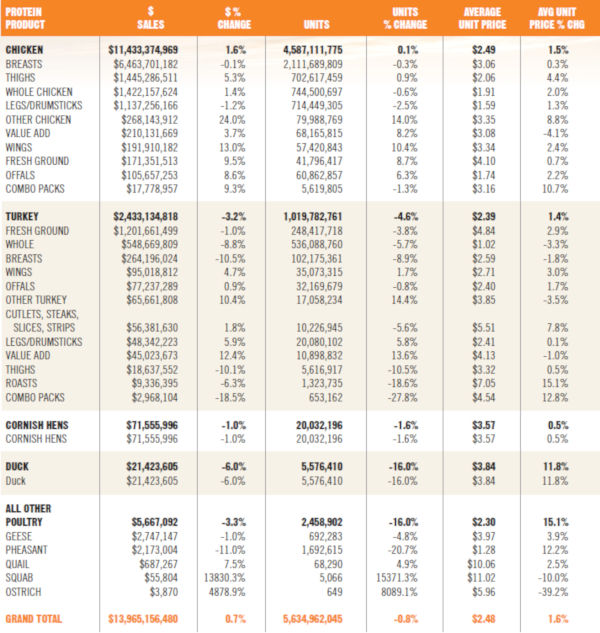

POULTRY PRODUCTS IN RETAIL

Source: Nielsen. All Nielsen tracked outlets not including convenience. The data reflects 52 weeks ending Nov. 2, 2019. View full-size chart

Export opportunities

The biggest opportunity for poultry growth in 2020 can be summed up in one word: China, says Tom Super, senior vice president of communications at the National Chicken Council, in Washington, D.C. Late last year, it was announced that China will be lifting its ban on poultry imports from the United States.

“China has banned all U.S. poultry since January 2015 due to an avian influenza outbreak in December 2014, even though the United States has been free of this disease since August 2017,” Super explains. “Lifting the ban has been a top priority of the U.S. poultry industry for the past four years.”

This action represents a significant opportunity for U.S. chicken producers. “At its peak, the annual value of poultry exports from the U.S. to China was $722 million for chicken,” Super says. “Renewed access to the Chinese market could result in $1 billion annually for chicken paws alone, and, due to China’s meat protein deficit as a result of African Swine Fever, there could be as much as another $1 billion of potential exports of other chicken products, including leg and breast meat.”

In terms of production, USDA forecasts chicken production this year to be little more than 1 percent more than 2019. “This expected increase is even more modest than the less than 2 percent USDA sees for 2019,” Super says. “USDA’s forecast of a plus 2 percent increase in chicken production in 2020 may prove somewhat conservative when the economic benefits of a very large export market like China being opened for business.”

In addition, a number of analysts think the six new or rebuilt chicken complexes that came online in 2019 or will do so in 2020 offer the potential to ramp up chicken production measurably beyond 1 percent. “Also, more than 100 plants are in the process of increasing their evisceration line speed from 140 birds per minute to 175,” Super says. “While moving toward the more efficient line speed will likely take all of 2020 and beyond to achieve, it does indicate that companies continue to see good demand for chicken at both home and abroad.”

One record that has continued to be broken annually since 2013 is chicken consumption. “Per capita chicken consumption in 2019 is slated by USDA to be 94.5 pounds, another record high,” Super says.

Exports remain a space where turkey can grow as well, and NTF will continue to focus its attention on expanding export markets in 2020, including bringing turkey to new customers in places such as Australia and Latin America. Access for U.S. turkey products to the Chinese marketplace represents a significant opportunity going into 2020 as well. “When the U.S. turkey industry last had access to this market, peak exports to China reached $71 million annually,” Breeding says. “It has been projected that U.S. turkey exports to China could reach $100 million following the ban being lifted.”

NTF also continues to support ratification of the U.S.-Mexico-Canada Agreement, which preserves the industry’s trade relationship with Mexico, the turkey industry’s largest export market, and presents new opportunities for export growth to Canada, Breeding says.

Further growth

With the current challengers in the meat space, such as meat alternatives, it is important for companies to focus in on the core benefits of their product: healthy, affordable, high-protein product. “Centered on that is ensuring your product stays relevant to your consumer core decision needs be it price, convenience, production claims, etc.,” Nielsen’s Nelson says.

In terms of promoting growth for turkey, the industry must find a way to be perceived as more convenient by consumers, IRI’s DuBois says.

“It just isn’t in enough rotations, and there’s major growth potential,” he says. “The hard part is that potential has been there for decades.”

Chicken forms continue to be dominated by major cuts that haven’t changed enough in the retailer case over the years as well.

“Manufacturers have come out with new value-added — diced, strips, etc. — but the great majority of the poultry case is made up of traditional cuts,” DuBois says. “It’s going to take some radical changes at retail to drive the growth.”

Consumer connection and communication will be the biggest key to growth for both chicken and turkey processors, DuBois says.

“If you look at packages in the meat case today, it’s extremely confusing for consumers to sort through the various claims, and most honestly don’t know the deeper meaning of the claims,” he explains. “The whole industry needs to understand which claims are most important to consumers and focus on the ones that will drive growth. Poultry packages today are kaleidoscopes of claims, and it’s not helping sales grow.”

Lunch also is an under-leveraged occasion for the poultry category and will be important to driving growth, Mintel’s Kamp says. “No more than 40 percent of consumers consume any fresh or frozen cuts of poultry for lunch,” she says. “Convenience cuts that don’t require cooking or thawing are one solution to easy, versatile lunch options and a strategic opportunity to ease consumers into reaching for poultry during the occasion.”

“It’s hard to say exactly what will happen in 2020 from a sales perspective as there are some big looming macros issues depending on what happens with trade negotiations as well as impacts of African Swine on the protein market,” she says. “However, from the consumer perspective, I expect to continue to see moderate growth, with larger growth focused in on areas that bring convenience to the consumer.”

In restaurants, Technomic’s Mills thinks chicken and turkey will continue to grow as they meet needs for health and innovation. “As the chicken category becomes more saturated, chicken-focused operators will continue to innovate to stand out,” Mills says. “As specialty chicken concepts continue to grow and consumer demand for chicken remains strong, expect other non-chicken chains to further invest in their chicken products.” NP

Report Abusive Comment