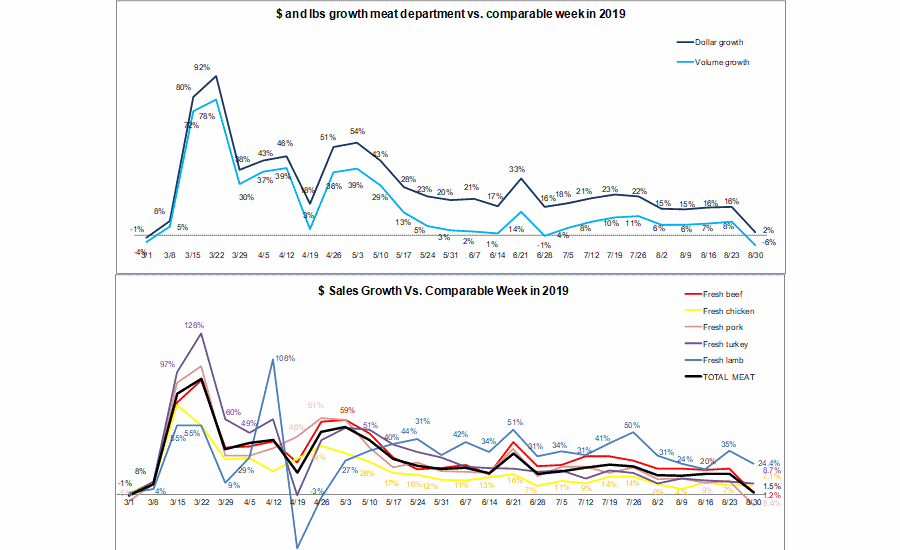

The last full week of August saw the smallest increases since the start of the pandemic across virtually all departments. Prior months had also shown weak final week of the month sales and, in this case, the results were further influenced by a much earlier Labor Day in 2019 that fell on September 2. That means the sales results of the week ending August 30th 2020 went up against the 2019 Labor Day sales. Labor Day has always been a massive holiday week for grocery — making it a much harder holiday to beat than ones that had more of a split retail versus foodservice nature in typical years, such as Mother’s Day. Additionally, sales were negatively affected by more extreme weather events, impacting large parts of Louisiana and Texas.

The net effect for the meat department was the first single-digit increase versus year ago since the week of March 15, at +1.5%. While at first glance this may seem like a disappointing gain, it is important to remember that this year’s everyday demand managed to beat last year’s holiday demand during one of the biggest grilling weekends of the summer. At the same time, the 1.5% increase in dollars was driven by inflation with meat volume down 6.0% versus year ago. Prices continued to drop in favor of the consumer, with an average of $3.76 per volume across all meats during the week of August 30 versus $3.80 the week prior. The week of August 30th 2020 had 6.3% fewer transactions compared to same week year ago when Labor Day drove an increased engagement.

So far during the pandemic starting March 15 through August 30, overall meat dollar sales are up 31.7% and volume sales have increased 19.1% versus the same period last year. This translates into an additional $8.7 billion in meat department sales during the pandemic, which includes an additional $4.0 billion for beef, $1.2 billion for chicken and $881 million for pork than the same period in 2019.

Dollar versus Volume Gains

The gap between dollar gains and volume gains narrowed to 7.5 percentage points — the smallest gap since mid- April and down from 19.1 points during the week of June 21st. After several strong weeks, processed meat sales were flat in dollars and off 10.1% in volume in going up against the 2019 holiday weekend.

|

Latest 1 week ending August 30, 2020 versus comparable week in 2019 |

Dollar gains |

Volume gains |

Volume/dollar gap |

|

Total meat |

+1.5% |

-6.0% |

-7.5 |

|

Total fresh |

+1.9% |

-4.8% |

-6.7 |

|

Total processed |

+0.2% |

-10.1% |

-10.3 |

Source: IRI, Total US, MULO, 1 week % gain versus YA

Price per Volume and Volume/Dollar Gap

IRI insights on the price per volume shows prices were still elevated the last full week of August versus 2019 levels, but much less so than during May and June. Pork, turkey and lamb prices are fairly close to last year’s levels with only ground beef showing double-digit inflation. Volume sales turned negative for the big grilling powerhouse meats, including processed meats, beef (in particular ground beef) and pork. Chicken was mostly flat, whereas the smaller proteins, turkey, lamb and exotic meats still had robust gains. Exotic meat, that includes bison, had the highest year-over-year volume gain, at +23.3%.

|

Average price per volume |

1 week ending 8/30 |

Volume vs. dollar gains w.e. 8/30 |

|||

|

|

Average |

Change vs. prior period |

Change |

Dollar gains |

Volume gains |

|

Total meat (fresh + processed) |

$3.76 |

-1.2% |

+8.0% |

+1.5% |

-6.0% |

|

Fresh beef |

$5.31 |

-0.4% |

+9.6% |

+1.2% |

-7.7% |

|

Ground beef |

$4.10 |

+1.7% |

+13.6% |

-2.6% |

-14.3% |

|

Fresh chicken |

$2.45 |

+1.4% |

+7.6% |

+7.1% |

-0.5% |

|

Fresh pork |

$2.69 |

-4.4% |

+3.1% |

-8.4% |

-11.1% |

|

Fresh turkey |

$3.36 |

-1.9% |

+2.0% |

+8.7% |

+6.6% |

|

Fresh lamb |

$8.22 |

-5.7% |

+3.5% |

+24.4% |

+20.2% |

|

Fresh exotic |

$4.25 |

-1.8% |

-3.6% |

+18.9% |

+23.3% |

Source: IRI, Total US, MULO, 1 week and 4 weeks ending August 30, 2020

Assortment

The slow and steady comeback in the number of items stalled out this week, at an average of 324 items per store selling. This is down about 17 items from prior year levels that saw a slight holiday bump in assortment.

|

|

Average weekly items per store selling for week ending… |

|||||

|

March (3/1-3/29) |

April (4/5-4/26) |

May (5/3-5/31) |

June (6/7-6/28) |

July (7/5-7/26) |

8/23 |

8/30 |

|

332 |

315 |

301 |

304 |

317 |

324 |

324 |

Source: IRI, Total US, MULO, average weekly items per store selling

Meat Gains by Protein

Pork was the only one of the fresh proteins that was down in dollars versus year ago during the week ending August 30, due to last year’s Labor Day. Lamb had the highest dollar gains, at +24.4% versus year ago levels.

The Pandemic Sales Performance by Area

Meat department sales were $1.23 billion during the week of August 30 — about $35 million lower than the week prior for a week-over-week loss of 2.8%. On the fresh side, beef accounted for 54.4% of dollars. Chicken was next at 26.4% of dollars. In a complete reversal from most of the pandemic weeks, the holiday effect prompted chicken to have the highest absolute dollar gain, at more than $16 million, followed by $6 million for beef. Pork sales were down $11 million versus year ago. Fresh chicken accounted for 92.6% of new dollars this week.

|

|

2020 Weekly $ sales gains versus comparable 2019 week ending… |

$ |

|||||||||

|

|

3/1 |

March |

April |

May (5/3-5/31) |

June (6/7-6/28) |

July (7/5-7/26) |

8/23 |

8/30 |

8/30 |

||

|

TOTAL MEAT |

-1% |

+54% |

+38% |

+32% |

+22% |

+21% |

+16.2% |

+1.5% |

$1.26B |

||

|

Fresh |

|

|

|

|

|

|

|

|

|

||

|

Beef |

0% |

+53% |

+42% |

+36% |

+27% |

+28% |

+20.5% |

+1.2% |

$531M |

||

|

Chicken |

+1% |

+41% |

+32% |

+21% |

+13% |

+12% |

+7.2% |

+7.1% |

$242M |

||

|

Pork |

-5% |

+56% |

+44% |

+32% |

+24% |

+21% |

+10.6% |

-8.4% |

$123M |

||

|

Turkey |

0% |

+72% |

+36% |

+43% |

+23% |

+17% |

+10.0% |

+8.7% |

$37M |

||

|

Lamb |

+1% |

+34% |

+8% |

+36% |

+39% |

+39% |

+34.6% |

+24.4% |

$9M |

||

|

Exotic |

+5% |

+92% |

+54% |

+61% |

+48% |

+36% |

+28.4% |

+18.9% |

$3M |

||

|

Processed |

|

|

|

|

|

|

|

|

|

||

|

Smoked ham/pork |

-6% |

+118% |

+20% |

+63% |

+35% |

+26% |

+15.7% |

+7.1% |

$15M |

||

|

Sausage |

0% |

+63% |

+42% |

+35% |

+24% |

+17% |

+18.9% |

+0.3% |

$120M |

||

|

Frankfurters |

-1% |

+76% |

+39% |

+20% |

+17% |

+14% |

+18.6% |

-9.3% |

$56M |

||

|

Bacon |

-6% |

+54% |

+48% |

+34% |

+18% |

+19% |

+20.7% |

+4.5% |

$112M |

||

Source: IRI, Total US, MULO, 1 week % change vs. YA

Regional Performance

Hurricane Laura affected meat department sales in Louisiana and Texas and likely other states as its path continued northward. As seen throughout the pandemic reporting, hurricane and other severe weather impacts tend to favor processed meat sales, while fresh meat sales fall far below average.

Grinds

As a holiday powerhouse, ground beef had a tough time going up against the 2019 Labor Day weekend sales, which led to declines in both dollars and volume. The other three grinds, turkey, chicken and pork, did extremely well. The performance is particularly remarkable for pork that saw total volume sales down 11.1% but ground pork volume up 10.2%. While a small percentage of sales this looks to be an indicator of some of the pandemic protein shifting having prolonged legs.

- Ground beef decreased -2.6% in dollars and declined -14.3% in volume

- Ground turkey increased 8.1% in dollars and +5.5% in volume

- Ground chicken, +21.8% in dollars and +21.4% in volume

- Ground pork, +11.4% in dollars and +10.2% in volume

What’s Next?

Next week’s report will the last in the weekly series IRI and 210 Analytics have produced since the week of March 15, after which the report series will continue on a monthly basis. Next week will also show the results of the 2020 Labor Day weekend sales, which should be impressive going up against an everyday week in 2019. In addition to the strong holiday demand, everyday demand is likely to remain above prior year levels for many weeks to come.

Source: 210 Analytics/IRI

Report Abusive Comment