The pandemic caused changes in virtually all shopping habits, from when and where people shopped to the types, amounts and brands they purchased. These changes were driven by anxiety over in-store visits that prompted fewer and shorter trips as well as by out-of-stocks, more meals at home and greater interest in food experimentation. Seven months since the onset of COVID-19, many of the pandemic shopping habits are trending back toward normal.

According to IRI’s latest survey wave of primary shoppers in late September, anxiety levels over in-store visits have decreased significantly, with 58% of shoppers feeling relaxed. This is an improvement of 15 percentage points since July. Additionally, two-thirds of shoppers now spend about the same amount of time shopping in the store as they did before the pandemic. Browsing for different items to try is also up a few points. These are all encouraging signs for new product launches and in-store merchandising once more catching the attention of shoppers.

While shopping patterns are normalizing, food spending at retail remains highly elevated across most departments. Meat remained king of the castle during the month of September. The month started off with Labor Day the week of September 6th. Despite being one of the biggest meat holidays of the year already, Labor Day saw tremendous dollar growth of 18.6% over year ago levels. Volume gains were +11.7% and the holiday recorded 11.5% more transactions compared to same week year ago. These results were positively influenced by the off-timing between the 2020 and 2019 holidays. However, if we were to compare the holiday weeks against one another directly, the 2020 performance remains impressive, up 15.9% in dollars and +8.5% in volume.

Sales during the remainder of the month were driven by everyday demand and it was strong. Dollar sales during September averaged +17.6% versus the same four weeks in 2019.

So far during the pandemic starting March 15 through October 4, overall meat dollar sales are up 28.3% and volume sales have increased 16.9% versus the same period last year. This translates into an additional $9.6 billion in meat department sales during the pandemic, which includes an additional $4.5 billion for beef, $1.3 billion for chicken and $957 million for pork than the same period in 2019.

Dollar versus Volume Gains

Processed meat had slightly higher gains in both dollars and volume during the month of September, albeit of a smaller base. In all, dollars increased 17.6% and volume 10.5% in September versus the same four week endings in 2019. The gap between dollar gains and volume gains remained right around 7 percentage points during September — the smallest gap since the start of the pandemic purchase patterns.

|

% sales change (September 9/6-27) versus year ago |

Dollar gains |

Volume gains |

Volume/dollar gap |

|

Total meat |

+17.6% |

+10.5% |

-7.1 |

|

Total fresh |

+16.8% |

+9.7% |

-7.1 |

|

Total processed |

+20.3% |

+13.3% |

-7.0 |

Source: IRI, Total US, MULO, % gain versus YA

Price per Volume and Volume/Dollar Gap

According to the IRI insights on the price per pound volume, prices continued to drop in favor of the consumer, with an average of $3.72 per volume across all meats during the month of September 2020. This was down 2.6% from the August average of $3.82. However, compared to year ago levels, meat prices were slightly higher in September, at +6.5%.

Beef and pork drove much of the inflation in May and June due to supply shortages. Come September, pork prices are a mere 2.8% higher than they were in September 2019 — resulting in pork being among the lowest areas of inflation together with exotic meats. Beef inflation has also moderated significantly, with the average price per volume now 5.8% over year ago levels. Turkey and lamb prices have the highest percentage increase in September 2020 versus year ago.

|

Average price per volume |

September (9/6-27) |

|||

|

|

August average |

September average |

Change September vs. August |

September change vs. YA |

|

Total meat (fresh + processed) |

$3.82 |

$3.72 |

-2.6% |

+6.5% |

|

Fresh beef |

$5.41 |

$5.15 |

-4.8% |

+5.8% |

|

Ground beef |

$4.12 |

$3.92 |

-4.9% |

+3.3% |

|

Fresh chicken |

$2.45 |

$2.40 |

-1.9% |

+3.6% |

|

Fresh pork |

$2.77 |

$2.72 |

-1.7% |

+2.8% |

|

Fresh turkey |

$3.39 |

$3.39 |

-0.2% |

+6.5% |

|

Fresh lamb |

$8.53 |

$8.47 |

-0.7% |

+7.0% |

|

Fresh exotic |

$4.27 |

$4.24 |

-0.8% |

-0.7% |

Source: IRI, Total US, MULO, % gain versus YA

Assortment

Assortment has nearly completed its comeback after dropping by more than 65 items during some of the tightest supply weeks in May and June. During the month of September, the average number of items per store was 328, which was down 3.1 percent versus year ago levels.

|

|

Average items per store selling for week ending… |

|||||

|

March (3/1-3/29) |

April (4/5-4/26) |

May (5/3-5/31) |

June (6/7-6/28) |

July (7/5-7/26) |

August (8/2-8/30) |

September (9/6-27) |

|

332 |

315 |

301 |

304 |

317 |

324 |

328 |

Source: IRI, Total US, MULO, average items per store selling

Meat Gains by Protein

The meat department has experienced a tremendous pandemic performance and sales continued to be highly elevated across proteins during the month of September. Lamb continued to have the highest percentage gains, at +27% versus the same month year ago, but this is off a very small base. Beef’s performance continued to be astounding, up 23% during September.

Chicken saw the smallest gains during the months of May through August, but it was turkey that gained the least during the month of September.

Beef, by far, had the highest absolute dollar and pound gains during the four September weeks, up $411 million in dollars and 52 million in pounds versus year ago. Chicken and pork follow in second and third place.

|

Absolute dollar and volume gains September 2020 vs. same period year ago |

Dollar gains |

Lbs gains |

||

|

TOTAL MEAT |

+$778M |

+17.6% |

+132M |

+10.5% |

|

Fresh |

+$571M |

+16.8% |

+97M |

+9.7% |

|

Beef |

+$411M |

+22.8% |

+52M |

+16.0% |

|

Chicken |

+$80M |

+8.7% |

+20M |

+4.9% |

|

Pork |

+$54M |

+11.6% |

+15M |

+8.8% |

|

Turkey |

+$10M |

+6.8% |

+101K |

+0.2% |

|

Lamb |

+$7M |

+26.6% |

+603K |

+18.2% |

|

Exotic |

+$2.5M |

+27.6% |

+603K |

+28.6% |

Source: IRI, Total US, MULO, 1 month % change, September 9 through September 26 2020 vs. YA

The Pandemic Sales Performance by Size

Meat department sales were $5.2 billion during the four September weeks — about $778 million higher than the same time period in 2019. On the fresh side, beef accounted for 56.3% of dollars. Chicken was next at 25.4% of dollars. Processed meats had a very strong month as well. Hot dogs led percentage growth at +26.2%, but sausage led in absolute dollar gains.

|

|

2020 $ sales gains versus comparable 2019 period |

|

||||||||

|

|

w.e. 3/1 |

March |

April |

May (5/3-31) |

June (6/7-28) |

July (7/5-26) |

August (8/2-30) |

September (9/6-27) |

||

|

TOTAL MEAT |

-1% |

+54% |

+38% |

+32% |

+22% |

+21% |

+12.7% |

+17.6% |

$5.2B |

|

|

Fresh |

|

|

|

|

|

|

|

|

|

|

|

Beef |

0% |

+53% |

+42% |

+36% |

+27% |

+28% |

+16.3% |

+22.8% |

$2.2B |

|

|

Chicken |

+1% |

+41% |

+32% |

+21% |

+13% |

+12% |

+7.4% |

+8.7% |

$998M |

|

|

Pork |

-5% |

+56% |

+44% |

+32% |

+24% |

+21% |

+6.8% |

+11.6% |

$520M |

|

|

Turkey |

0% |

+72% |

+36% |

+43% |

+23% |

+17% |

+10.2% |

+6.8% |

$153M |

|

|

Lamb |

+1% |

+34% |

+8% |

+36% |

+39% |

+39% |

+26.6% |

+26.6% |

$33M |

|

|

Exotic |

+5% |

+92% |

+54% |

+61% |

+48% |

+36% |

+28.2% |

+27.6% |

$11M |

|

|

Processed |

|

|

|

|

|

|

|

|

|

|

|

Smoked ham/pork |

-6% |

+118% |

+20% |

+63% |

+35% |

+26% |

+14.8% |

+11.5% |

$65M |

|

|

Sausage |

0% |

+63% |

+42% |

+35% |

+24% |

+17% |

+13.2% |

+20.0% |

$489M |

|

|

Frankfurters |

-1% |

+76% |

+39% |

+20% |

+17% |

+14% |

+9.7% |

+26.2% |

$218M |

|

|

Bacon |

-6% |

+54% |

+48% |

+34% |

+18% |

+19% |

+15.2% |

+19.3% |

$447M |

|

Source: IRI, Total US, MULO, % change vs. YA

Grinds

During September, the dominance of grinds in meat sales continued. Ground beef sales added $84.4 million versus year ago levels alone. Altogether, the four grinds listed below generated an additional $92.6 million during the four September weeks.

- Ground beef increased 11.5% in dollars and improved 8.0% in volume

- Ground turkey increased 5.5% in dollars and +0.2% in volume

- Ground chicken, +15.3% in dollars and +14.7% in volume

- Ground pork, +7.8% in dollars and +6.0% in volume

Market Shifts

The strength of beef and pork throughout the pandemic have resulted in a gain in market share when comparing the share of dollars during the week ending March 1 versus that during the month of September. Both have gained significantly in dollar and volume share. Chicken, while having the second-highest share, dropped several points in both dollar and volume shares.

|

Share of dollar sales |

Share of volume sales |

|||

|

|

Week ending 3/1 |

September (9/6-27) |

Week ending 3/1 |

September (9/6-27) |

|

Beef |

53.3% |

56.3% |

37.0% |

39.5% |

|

Chicken |

27.5% |

25.4% |

40.5% |

38.1% |

|

Pork |

12.9% |

13.2% |

16.5% |

17.6% |

|

Turkey |

4.4% |

3.9% |

4.8% |

4.2% |

|

Lamb |

0.9% |

0.8% |

0.4% |

0.4% |

|

Veal |

0.1% |

0.1% |

0.1% |

<0.1% |

|

Exotic |

0.3% |

0.3% |

0.2% |

0.2% |

Source: IRI, Total US, MULO, % of total meat department dollars | “All other” not reflected

What’s Next?

Everyday demand continues to hold between 10% and 15% above year ago levels as new COVID-19 case counts continue to rise and fall in different regions of the country. While everyday demand seems to have set into a new and elevated pattern, the holiday demand is expected to be vastly different.

According to the latest IRI primary shopper survey wave from late September, only 29% of consumers expect to host or attend a meal with extended family who do not live with them for Thanksgiving. This is down from 48% last year. Friendsgiving and traveling out of state are also more unlikely this year, as Americans are most likely to stay home and celebrate with immediate family, according to 34% of respondents. This will have a profound impact on grocery spending.

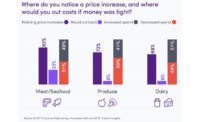

Early indications for December holiday celebrations and grocery spending suggest a similar impact as Thanksgiving, and even more are planning to cut back on groceries to save money as many are expecting higher food prices come November and December compared with the 2019 holiday season. Shoppers plan to spend less on groceries, gifts, and decorations across grocery, mass, club, dollar and especially drugstores and local small businesses. Online-only retailers are currently estimated to net a slight gain.

These predictions point to many potential changes for the meat department. Much like the pandemic-affected holidays to date, it is likely that the winter holidays will see small gatherings, which will affect meat choices. Additionally, less holiday travel will likely express itself in continued retail versus foodservice spending for those at home versus on the road.

Source: 210 Analytics/IRI

Report Abusive Comment