In an inflationary grocery market, fresh pork cuts are a relative value proposition as other meat categories’ price increases outpace pork.

Fresh pork sales chalked up modest growth from June 2021 to June 2022, weighing in at $593 million in June 2022, up 1% from a year ago, according to IRI sales data. That compares to the total fresh meat category’s $6.7 billion in June 2022 sales (up 5.7% from 2021).

The average price per pound in the meat department across all cuts and kinds (fixed and random weight) was $4.59 in June 2022, up 8.6% from a year ago, according to IRI. Fresh pork prices averaged $3.23 per pound vs. June 2021, up 10.1% vs. June 2021.

IRI data showed double-digit price inflation rates across much of the pork category. Other popular pork products price inflation surpassed fresh pork’s:

- Dinner sausage prices averaged $4.46/pound in June, a 16.4% increase over 2021.

- Breakfast sausage price inflation topped that, up 17.6% compared with year-ago pricing at $4.66 per pound for June 2021.

- Posting even sharper price inflation, bacon prices averaged $6.77 per pound, up 18.5% compared to a year ago in June.

Of the fifteen meat product categories IRI compared, smoked ham boasted the lowest average price per pound at $2.63 and experienced a comparatively mild inflation rate, up 7.2% from a year ago.

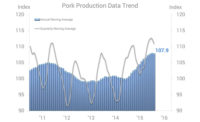

Producer pork prices were holding firm midway through 2022 on seasonally lower slaughter as well as lower hog carcass weights, according to the National Pork Board’s Profit Maximizer report compiled by Steiner and Co. Pork trim is mirroring year-ago trends, with the price outlook trending higher through early summer.

Pricing has received some support thanks to seasonal supply decline. NPB sees a strong U.S. pork export outlook for the second half of 2022, with steady/higher prices going forward.

For January through May 2022, exports accounted for 26.3% of total pork production and 23.4% for muscle cuts, down from 31.1% and 27.8%, respectively, in 2021, according to the U.S. Meat Export Federation.

NPB pork market research identifies the following market conditions currently influencing the market for pork and pork products:

Back ribs — After hitting record-breaking levels a year ago, back ribs have fallen to their lowest levels in five years. NPB says prices may need to remain low for a while longer before demand from retail and foodservice picks up, but for operators current prices present strong opportunities.

Ham — Prices continue to trade extremely firm. The combination of more boning/trimming at the packing plant, increased processing capacity through secondary trimmers, robust export demand from Mexico and lower slaughter have resulted in tight spot supplies for bone-in product.

Pork belly — NPB market research suggests belly prices are going to trend higher through the summer. However, larger freezer inventories will limit the upside for marketers.

.png?height=96&t=1647275041&width=96)

Report Abusive Comment