The United States has long been the dominant supplier of U.S. soy-fed pork to the Dominican Republic (DR), competing primarily with domestically raised pork. Exports have increased steadily since the DR implemented the Central America-DR-U.S. Free Trade Agreement in 2007, putting U.S. pork on course to enter the market at zero duty.

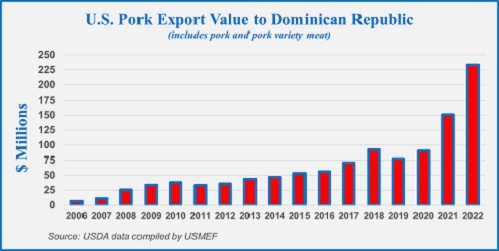

In 2006, the last year in which U.S. pork was subject to the DR’s 25% most-favored-nation tariff rate, U.S. exports were just over 4,000 metric tons (mt), valued at $6.6 million. By 2010, exports more than quadrupled in volume and reached $38 million in value and, in 2020, shipments reached nearly 40,000 mt, valued at more than $90 million. U.S. exports to the DR were record-shattering in 2022, coming in at 85,550 mt (up 46% from 2021), with value reaching $233.6 million (up 55%), according to USDA data compiled by USMEF.

African swine fever (ASF) sparked a significant decline in the DR’s domestic pork industry, and the impact does not appear to be short-lived. With nationwide control and eradication efforts ongoing, swine production in the DR fell by 28% year-over-year in 2022, and an additional 9% decline is projected in 2023, according to data available from this USDA Foreign Agricultural Service website. USMEF estimates that the DR’s self-sufficiency in pork production decreased from 61% in 2020 to just 32% in 2022.

With pork consumption remaining strong among DR residents and demand being further bolstered by a strong and fairly rapid post-COVID tourism rebound, the DR’s declining pork production paved the way for increased opportunities for U.S. pork in the country’s rapidly expanding retail sector and opened new avenues for communicating the attributes of U.S. pork directly to Dominican consumers.

“The spread of ASF in the DR is very unfortunate, and the U.S. industry is definitely supportive of the country’s containment and eradication efforts,” noted Lucia Ruano, USMEF representative in the DR and Central America. “But consumers have a rapidly growing appetite for high-quality protein, and U.S. pork is well-positioned to fill this need.”

While the DR was, at one time, primarily a destination for raw material used for further processing, Ruano says the market now offers a diverse range of opportunities for U.S. exporters. “The U.S. industry has made tremendous strides in supplying center-of-the-plate cuts to retail and foodservice clientele and convenience-based items that hold great appeal for consumers,” she said. “With the scope of pork cuts and products we are now featuring in the DR, this is a very exciting market that holds potential for further growth.”

Funding support for promotional activities in the DR is provided by the National Pork Board, the soybean checkoff and USDA’s Market Access Program and Agricultural Trade Promotion program.

Source: USDA data compiled by USMEF

Report Abusive Comment