Summer has arrived and with it the start of grilling season, outdoor entertaining and travel. According to the May Circana survey of 1,000+ primary grocery shoppers, summer travel may look a bit different this year. “While 20% of consumers expect they will travel a bit more than in the summer of 2022, inflationary pressures are challenging the travel plans of others,” said Jonna Parker, team lead, fresh for Circana (formerly IRI). “This means fewer/shorter trips and staycations — both opportunities for grocery retailers to create memorable moments at home.”

Other findings from the May Circana survey include:

- 67% of consumers who like to entertain at home plan cookouts/barbeque gatherings.

- Across entertaining, everyday and weekend occasions, two-thirds of shoppers plan to grill as much as (50%) or more (19%) than last summer. New grills (31%) and the enjoyment of trying new foods and new barbecue recipes (34%) are important drivers behind plans to grill more often, according to shoppers.

- “Many consumers mix and match items prepared from scratch with items that are semi- or fully-prepared when grilling,” said Heather Prach, VP of Education for the IDDBA. “Cross-merchandising stations can deliver that extra item in the basket during times when consumers are hyper-focused on sticking to the shopping list. Retailers have been successful in displaying product in the same case, but also by leveraging signage and coupons instead of moving physical products in the light of labor constraints.”

- 21% of consumers plan to watch sporting events together with friends this summer — opening the door to sports-focused cross-merchandising opportunities.

- 18% of shoppers plan to organize pool parties, weather permitting.

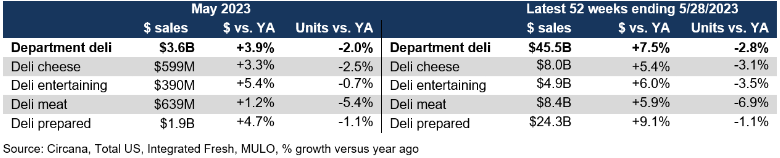

Deli sales

“Deli-prepared foods were not only the biggest seller in the deli department, but also had a strong year-on-year growth performance,” Parker pointed out. Deli-prepared foods only had mild unit pressure of -1.1%, in sharp contrast to deli meat that dropped 5.4% year-over-year. The power of holidays and special celebrations to prompt the additional splurge is evident in the sales performance of deli entertaining. Memorial Day celebrations helped boost dollar sales of dollar entertaining by 5.4% and while units were down slightly, larger trays and platters boosted volume sales by 2.6%.

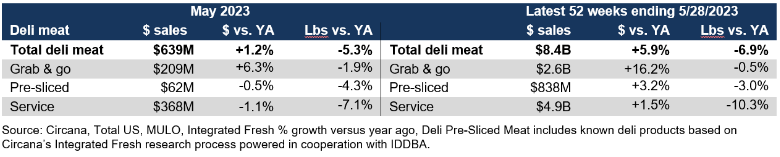

Deli meat

Deli meat sales (combined fixed and random weight) totaled $639 million in the four May weeks, up +1.2% in dollars but down -5.3% in pounds. Over the past few years, the share of deli meat generated by the service counter has dropped in favor of growing shares for grab & go and pre-sliced. This trend can also be seen in May 2023, with grab & go dollar sales up +6.3% versus service deli meat being down -1.1%.

Packaged lunchmeat (included in meat department sales) reached $493 million in May 2023. After many months of substantial, but inflation-driven dollar gains, May is the first month in which sales remained flat. Packaged deli meat saw pounds drop -8.5% versus year ago in May versus -5.3% for deli meat.

Deli entertaining

“Memorial Day week saw strong specialty cheese, charcuterie meats and pickles/relish (including olives) sales,” Parker said. “This underscores the continued opportunity in all things boards, whether charcuterie, butter or hummus boards. In-store and online inspiration tied to charcuterie endcaps or one-click recipe ideas can be a great way to inspire shoppers to partake in this ongoing trend.”

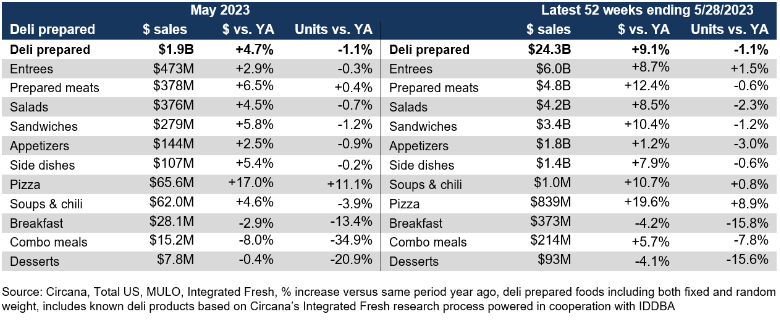

Deli prepared

“Experience, variety and convenience in combination with affordability are the big drivers for deli-prepared foods,” said Parker. “Consumers recognize deli prepared as being more cost-effective compared to their restaurant counterparts and most believe them to be just as good. However, many grocery stores continue to struggle with being on the radar when consumers run out of time or are simply not in the mood to cook. This is where reputation and being known for something can be that trigger to winning the out-of-home trip.” May winners include prepared meats and pizza, illustrating that deli-prepared foods can serve as one of the ingredients of a meal or replace the entire home-cooked meal.

What’s next?

The Fourth of July is around the corner and one of the biggest grilling holidays of the year. According to the May Circana survey, 65% of Americans engaged in some kind of special activity last year, led by friends/family get togethers (36%), day and weekend trips (36%) and cookouts (25%). This year’s plans are very similar.

The next report in the Circana, 210 Analytics and IDDBA performance series will be released mid-July covering the June sales trends. Please recognize and thank the entire food supply chain for all they do to keep supply flowing.

Date ranges:

2019: 52 weeks ending 12/28/2019

2020: 52 weeks ending 12/27/2020

2021: 52 weeks ending 12/26/2021

2022: 52 weeks ending 1/1/2023

Q4 2022: 13 weeks ending 1/1/2023

Q1 2023: 13 weeks ending 4/2/2023

March 2023: 5 weeks ending 4/2/2023

April 2023: 4 weeks ending 4/30/2023

May 2023: 4 weeks ending 5/28/2023

Report Abusive Comment