Consumer confidence remains subdued, according to the University of Michigan. Consumer confidence is one of the key indicators to help forecast the future strength of the U.S. economy and consumer spending along with it. The Meat Demand Monitor, developed by Kansas State University, echoes the marketplace sentiment with November showing a decreased Willingness-to-pay (WTP) for all five examined beef, pork and chicken items.

The monthly tracker’s November highlights include:

- 76% self-declare as regular consumers of animal protein, 8% consume a vegan or vegetarian diet and the remaining share considers themselves flexitarian, eating animal protein occasionally.

- Freshness, taste, price and safety remain most important when purchasing protein.

- 30% more consider price a top four out of 12 consideration than considering price a bottom 4 purchasing factor.

- Only 15% indicate their household finances are better than last year — leading to an ongoing emphasis on price in the purchase decision.

- Those indicating improved household finances report higher prior-day meal inclusions of beef, pork and chicken than those saying their finances are the same (45%) or worse (40%) than last year.

With value top of mind, consumers eye money-saving measures, with 83% having made one or more changes to their grocery shopping habits. According to Circana, 55% of grocery shoppers look for specials more often and 45% are cutting back on non-essentials. Private-brand interest remains strong, with 37% switching to own-brands more often.

As consumers still shift their dollars across items, brands, sizes, stores and restaurants, Circana and 210 Analytics take a deep dive into the numbers to understand the marketplace impact on meat and poultry trends. The report is made possible by Hillphoenix.

Inflation insights

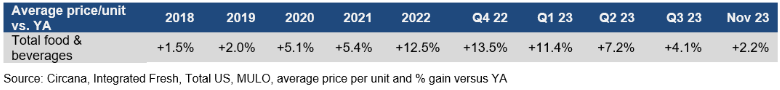

The price per unit across all foods and beverages in the Circana-measured multi-outlet stores, including supermarkets, club, mass, supercenter, drug and military, increased by 2.2% in November 2023 (the four weeks ending 11/26/2023) versus November 2022. While this is the lowest increase in a long time, consumer concern persists due the cumulative impact of three years of inflation. The November 2023 prices were 25.6% higher than those in November 2020.

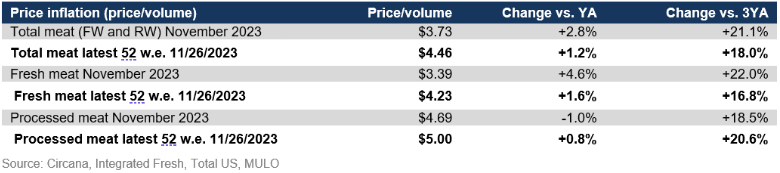

The average price per pound in the meat department across all cuts and kinds, both fixed and random weight, stood at $3.73 in November 2023, which was up 2.8% from the levels seen in November 2022. Processed meat tends to have the higher prices, but its average price per pound was up less than fresh meat versus November last year.

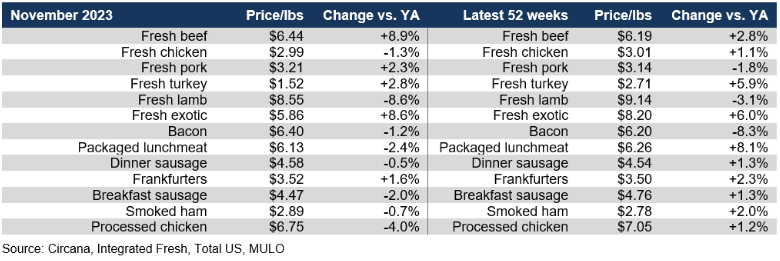

Chicken retail prices continued to drop, reflecting an average price per pound of $2.99. This was down 1.3% versus November of 2022. November also brought year-on-year deflation for lamb, bacon, packaged lunchmeat, dinner sausage, breakfast sausage, smoked ham and processed chicken, whereas the renewed inflation in beef continued. The average retail price of beef increased by 8.9% per pound on supply constraints.

Meat sales

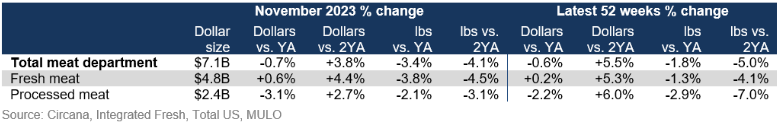

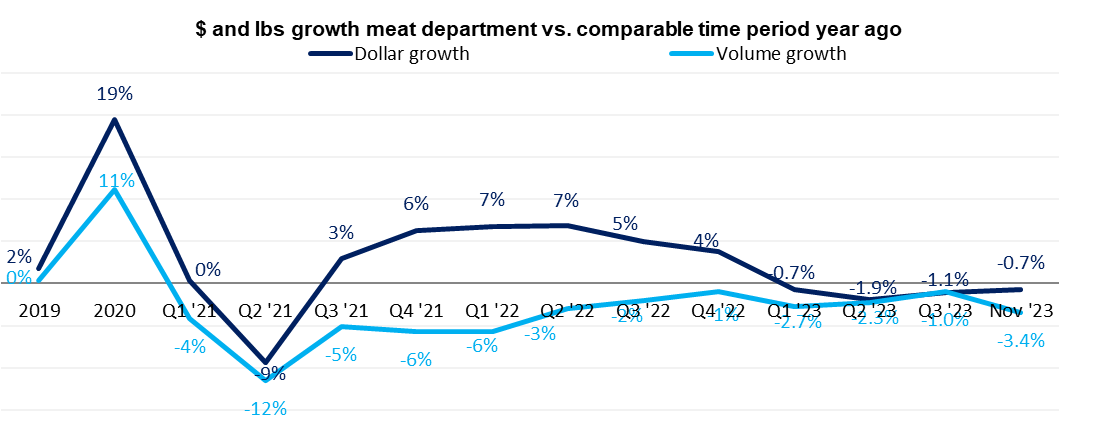

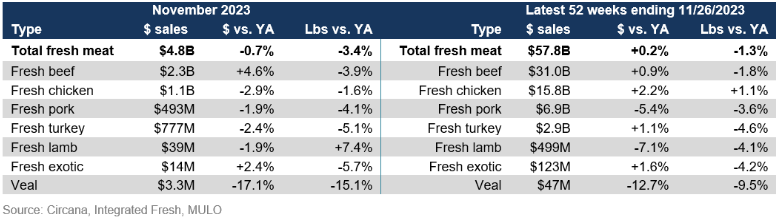

In November 2023, the inflationary boost did not offset the 3.4% pullback on volume resulting in meat dollar sales being down 0.7% year-on-year. November pound sales dropped 3.4% versus last year’s levels, with a slightly better performance for processed than fresh meat.

The volume pressure is closely tied to consumers purchasing meat and poultry less often along with spending slightly less per trip despite 2.8% inflation.

The volume pressure is closely tied to consumers purchasing meat and poultry less often along with spending slightly less per trip despite 2.8% inflation.

Volume was trending closer to year ago levels until the fourth quarter of 2022, but recovery stalled come 2023. Pounds sales trended closely behind year-ago levels in all of the third quarter, but dropped sharply in November — a month void of major national holidays affecting the meat department. Rising prices are driving a gap between pounds and dollars once more.

Assortment

Assortment

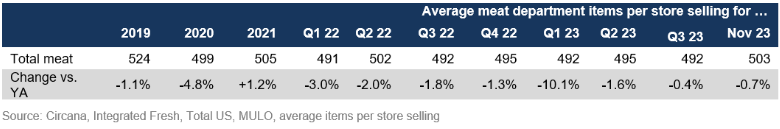

Meat department assortment, measured in the number of weekly items per store, averaged 503 SKUs in November 2023 — the highest level in months due to holiday assortment, though down compared to year-ago.

Fresh meat sales by protein

November sales experienced dollar declines for turkey, pork and beef. Lamb’s more favorable prices boosted pound sales by 7.4% but it was not enough to drive dollar gains.

Turkey sales are highly related to Thanksgiving purchases and consumers’ focus on price and promotions moved dollars closer in to the holiday as consumers await the deep Thanksgiving price points. While the last two November weeks drove gains in dollars and pounds, they were not able to offset the double-digit declines experienced earlier in the month.

Whole bird turkey sales were down compared to year-ago levels by 4.4% in dollars and 5.2% in pounds. As such, whole bird turkey took back some of the share from turkey breast, that had fared well in the past few years when party sizes were smaller. Turkey breast dollars were virtually unchanged however, pound sales were down by more than 12%. Ground turkey and turkey wings grew in both measures.

The sales patterns for smoked ham were very similar to those seen in turkey. During the first two weeks of November, both dollar and volume sales were down substantially versus the same weeks in 2022. Comparisons started to improve in the third week of November and sales tracked in positive territory the week of Thanksgiving.

Smoked ham generated $342 million in November, led by spiral cut that contributed $180 million. Spiral cut hams also grew in both pounds and dollars. Bone-in experienced the largest declines, down double digits in pounds and dollars.

Processed meat

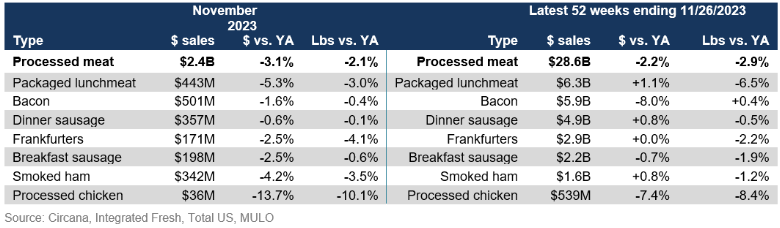

November processed meat sales were half that of fresh meat, at $2.4 billion. Dollar sales were down by 3.1% versus November 2022, while pounds decreased 2.1%. In the 52-week view, dollar sales gains dropped 2.2% behind year ago levels, mostly driven by deflation in bacon and a drop in pound sales for processed chicken.

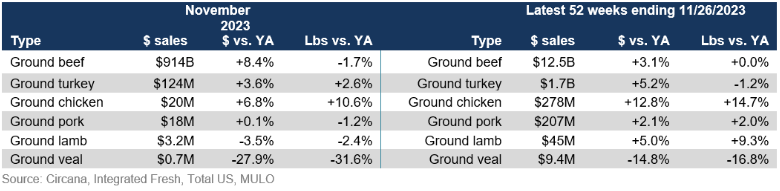

Grinds

While ground beef pounds decreased 1.7% in November, it outperformed whole muscle beef. Smaller grinds, including turkey and chicken, gained in both pounds and dollars in November. Ground pork sales fell below year ago levels in the shorter-term view, but continue to be an area of growth in the 52-week view.

What’s next?

Looking toward December holiday season, the majority of consumers expect to celebrate in similar fashion as they did last year. This includes similar expectations for the size and nature of home-cooked meals for family and friends. The November sales results confirm that holidays are an important reason to splurge a little, but this may not be enough to offset the everyday declines in spending.

The next performance report in the Circana, 210 Analytics and Hillphoenix series will be released mid-January 2024 to cover the December sales trends. To learn more about Circana’s meat and poultry sales and shopper measurements, please contact: FreshFoods@circana.com. Please thank the entire meat and poultry industry, from farm to store, for all they do.

Date ranges:

Q2 2023: 13 weeks ending 7/2/2023

Q3 2023: 13 weeks ending 10/1/2023

September 2023: 4 weeks ending 10/1/2023

October 2023: 4 weeks ending 10/29/2023

November 2023: 4 weeks ending 11/26/2023

Report Abusive Comment