U.S. beef exports set annual records for both volume and value in 2022, according to year-end data released by USDA and compiled by USMEF. Pork exports finished lower year-over-year, but export value was the third largest on record, trailing only the highs reached in 2020 and 2021. Pork exports continued to gain momentum in December, led by another outstanding performance in Mexico. While lamb exports slowed in December, 2022 shipments were sharply higher than the previous two years, approaching the pre-COVID levels of 2019.

Despite slowing toward the end of the year, beef exports reached 1.47 million metric tons (mt), up 2% from the previous high in 2021. Export value climbed to a record $11.68 billion, up 10% from 2021 and nearly 40% above the previous five-year average. The U.S. exported a record share of its record-large beef production in 2022, and at higher prices. Beef exports achieved annual records in many individual markets, including South Korea, China/Hong Kong, Taiwan, the Philippines, Singapore, Colombia, Guatemala and the Dominican Republic.

In December, beef exports trended lower than a year ago at 112,707 mt, down 7%, while value fell 21% to $782.6 million. The December decline was due in part to a sharp drop in exports to China/Hong Kong, where demand had been constrained by persistent zero-COVID policies. China lifted most COVID restrictions in early December and resumed some international travel in early January. Along with the recent easing of COVID-related cold chain regulations and inspections, these changes offer a more optimistic demand outlook for 2023.

“2022 was a [groundbreaking] year for U.S. beef’s international presence, with global demand stronger than I’ve seen in all my years in the industry,” said USMEF President and CEO Dan Halstrom. “Late in the year, exports certainly felt the impact of persistent headwinds in our large Asian markets, including depressed trading partner currencies and COVID-related challenges in China, but the long list of countries in which records were set showcases the industry’s focus on diversifying export markets. While the year ahead will be challenging due to supply constraints, the exchange rate situation has improved[,] and we still see room for growth in the foodservice sector as more regions continue their gradual rebound from COVID.”

Pork exports finished 2022 on a decidedly upward trajectory as December shipments reached 244,718 mt, up 13% year-over-year and the second largest of 2022 (slightly below November). December export value climbed 14% to $687.3 million. These results pushed 2022 exports to 2.67 million mt, down 8.5% from a year ago, while export value was $7.68 billion — down 5% from the record achieved in 2021.

Pork exports to Mexico ended 2022 on a very high note, setting a volume record in December on the way to a record-breaking year. December exports also trended higher year-over-year to China/Hong Kong, the Dominican Republic, the Philippines and Australia, and set a value record in Central America.

“The Mexican market has been a star performer for U.S. pork for many years, but the 2022 results were truly remarkable,” Halstrom said. “In the face of growing competition in Mexico, the U.S. pork industry has expanded product offerings and found innovative ways to meet the needs of processors, retailers and foodservice operators. In addition to Mexico, it is gratifying to see such a broad range of markets contributing to our recent export growth, making the prospects for 2023 very promising.”

2022 beef exports reach new heights in several key markets

A solid December performance capped a record-shattering year for beef exports to Korea, which climbed 4% year-over-year to 291,748 mt. 2022 export value was $2.7 billion, up 13% and setting an all-time record for any single destination. In December, exports increased 12% from a year ago to 24,084 mt, though value trended lower at $192.3 million (down 10%). Throughout the pandemic, beef export growth to Korea has been driven by soaring retail demand in both traditional venues and e-commerce. The foodservice sector could receive a boost from Korea’s further easing of COVID restrictions, including the removal of the nationwide indoor mask mandate at the end of January.

Beef exports to China/Hong Kong were also record-large in 2022, with volume totaling 278,294 mt (up 16% year-over-year), valued at $2.55 billion (up 22%). But December was a difficult month, as exports fell more than 30% from a year ago in both volume (14,863 mt, down 31%) and value ($132 million, down 33%). China announced sweeping changes to its COVID policies in early December, removing many restrictions on domestic travelers and consumers, and later removed restrictions on cold chain products and international travel. But these changes came amid a massive wave of COVID cases that steadily climbed throughout the month before peaking in most major metropolitan areas in early January.

While beef shipments to Taiwan slowed in the fourth quarter, exports still set new annual records for both volume and value. Exports totaled 64,818 mt, up 3% from a year ago and 2% above the previous high reached in 2020. Export value climbed to $746.9 million, breaking the previous (2021) record by 12%.

Exports of U.S. beef variety meat set an annual value record of $1.24 billion, up 15% from a year ago, despite a slight decline in volume (298,492 mt, down 1%). Export value growth was led by Japan ($534.5 million, up 6%), China/Hong Kong ($175.8 million, up 97%), Egypt ($90 million, up 31%), Korea ($54.9 million, up 45%), Canada ($24.3 million, up 43%), the Philippines ($16.7 million, up 162%) and Chile ($6.9 million, up 61%). Value was also slightly higher to Mexico ($266.6 million, up 1%).

Other results for U.S. beef exports in 2022 include:

- Led by record shipments to the Philippines and Singapore and strong growth in Vietnam, beef exports to the ASEAN region jumped 20%, reaching 63,252 mt, while value increased 56% to just under $450 million. Despite significant tariff disadvantages, U.S. beef achieved widespread growth in the region as exports also set an annual record in Cambodia.

- Beef exports to the Middle East increased modestly in volume (66,433 mt, up 3%) but climbed an impressive 34% in value to $297.2 million. In Egypt, the leading destination for U.S. beef livers, exports slipped 4% to 48,026 mt, but value still climbed 28% to $94.2 million. For beef muscle cuts, export growth was driven by Saudi Arabia, Qatar, the United Arab Emirates, Israel, Kuwait and Bahrain.

- A record performance in the Dominican Republic and a continued rebound in the foodservice and hospitality sectors helped drive beef demand in the Caribbean, where exports totaled 28,588 mt (up 14% year-over-year), while value climbed 25% to $239.3 million. Exports to the Dominican Republic increased 19% to 9,438 mt, valued at $97.6 million (up 24%). Exports were also record-large to the Leeward-Windward Islands and Trinidad and Tobago, and trended higher year-over-year to the Bahamas, Netherlands Antilles and Barbados. Exports to Jamaica declined slightly in volume, but value jumped more than 40% to $23.6 million.

- Beef demand in Colombia continued to strengthen in 2022 as exports reached a record 9,844 mt, up 5% from a year ago, driven by growth in muscle cuts. Export value increased 18% to $47.9 million, also a record. Colombia is now the top volume market in South America for U.S. beef and second to Chile in value.

- Coming off a record year in 2021, beef exports to leading volume market Japan took a step back in 2022. Exports declined 4% to 308,735 mt, while value fell 2% to $2.32 billion. Beef variety meat exports to Japan — consisting mainly of tongues and skirts — were lower in volume (54,670 mt, down 12%) but still climbed 6% in value to $534.5 million.

- Beef export value equated to a record $447.58 per head of fed slaughter in 2022, up 10% from the previous high achieved in 2021. Exports accounted for 15.2% of total beef production and 13% for muscle cuts only, up from 15% and 12.8%, respectively, in 2021.

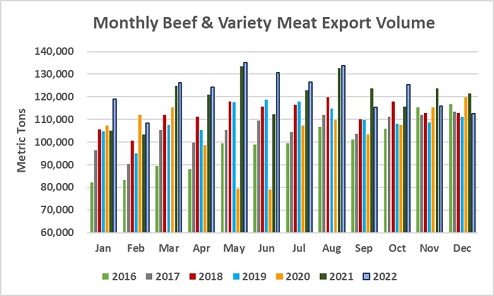

Monthly Beef & Variety Meat Export Volume chart

Monthly Beef & Variety Meat Export Volume chart

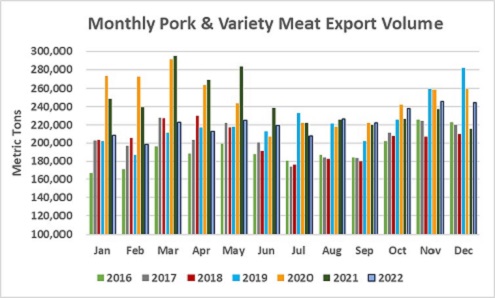

Monthly Pork & Variety Meat Export Volume chart

Monthly Pork & Variety Meat Export Volume chart

Pork highlights include $2 billion year for Mexico, value record for variety meat

Following a huge performance in November, pork exports to Mexico posted another volume record in December at 90,175 mt, up 13%. December export value was $198.3 million, up 42% and the third highest on record. These results pushed 2022 exports to a record 959,701 mt, up 10% from a year ago, while export value soared 21% to $2.03 billion, topping the $2 billion mark for the first time. Demand for U.S. pork is surging despite heightened competition in Mexico, where imported pork, beef and poultry from all eligible suppliers have entered at zero duty since May, and duties will remain suspended through the end of this year. Mexico also recently opened for the first time to Brazilian pork, provided that it originates from approved plants in the state of Santa Catarina and goes directly into further processing.

Pork exports to the Dominican Republic also closed 2022 with remarkable momentum, posting the second largest volume on record in December at 9,466 mt (up 80% year-over-year, trailing only November 2022). December export value more than doubled from a year ago to $28.8 million, up 125%. Exports to the Dominican Republic set annual records in both volume (85,551 mt, up 46%) and value ($233.6 million, up 55%). The Dominican Republic also temporarily suspended import duties on red meat and poultry in June, which attracted more Canadian and European pork. But the decree suspending these duties has expired, meaning the U.S. is once again the only major pork supplier with duty-free access, while imports from other major suppliers are subject to the Dominican Republic's most-favored-nation rate of 25%.

Pork exports to China/Hong Kong were slow in the first half of 2022 but strengthened notably in the second half. This trend continued in December as exports reached 56,230 mt (up 66% year-over-year), valued at $137.7 million (up 49%). While this was largely driven by demand for variety meat (see below), pork muscle cut exports to the region also increased 53% to 20,522 mt, valued at $55.9 million (up 75%). For the full year, pork and pork variety meat exports to China/Hong Kong were down 26% to 542,443 mt, valued at $1.39 billion (down 20%).

Following another excellent performance in December, pork variety meat exports averaged a record $10.15 per head slaughtered in 2022. December volume was 54,056 mt, up 54% from a year ago, while export value increased 35% to $124.4 million. In both volume and value, December exports were the third largest on record. 2022 exports of U.S. pork variety meat totaled 530,290 mt, up 2% year-over-year and the second largest on record, while export value was record-high at $1.27 billion (up 3%). Exports to China/Hong Kong set annual records for both volume (338,467 mt, up 3% year-over-year) and value ($841.1 million, up 4%), while shipments also increased to the Philippines, Japan, Korea, Guatemala, Colombia, the Dominican Republic and South Africa.

Other results for U.S. pork exports in 2022 include:

- Exports to South Korea increased 5% from a year ago to 174,553 mt, valued at $608.1 million — up 9% and the highest since 2018. Korea also broadened access for several pork suppliers last year by opening a 70,000-mt, duty-free quota for imported pork, and recently announced a 10,000-mt duty-free quota for the first half of 2023. Imports from the U.S., the European Union and Chile already enter Korea at zero duty, but Canadian, Mexican and Brazilian pork can benefit from the quota.

- Though exports to Colombia fell slightly short of the 2021 record, it remains a critical destination for U.S. pork — both for further processing and in the country’s rapidly expanding retail and foodservice sectors. 2022 exports to Colombia were 4% lower year-over-year in both volume (101,828 mt) and value ($247.6 million).

- Similar to Colombia, pork exports to Central America fell below 2021’s record levels but were the second largest on record at 119,169 mt (down 15% year-over-year), valued at $338.1 million (down 10%). December exports to the region were up slightly from a year ago in volume (15,054 mt, up 1%), while value soared 21% to a record $44.6 million.

- December pork exports to the Philippines reached 3,217 mt, up 44% from the low volume posted a year earlier, while value climbed 76% to $10.2 million. For the full year, exports to the Philippines were still down 43% to 45,007 mt, valued at $133 million (down 35%). The Philippines traditionally maintains the highest duty rates of any major pork importer. But since mid-2021, imported pork cuts have been subject to duties of 15% in-quota and 25% out-of-quota — down from 30% and 40%, respectively. The reduced rates were recently extended through the end of 2023, expanding opportunities in this price-sensitive market.

- While Japan remains the second largest value market (behind Mexico) for U.S. pork exports, shipments trended lower in 2022. Exports to Japan were down 10% year-over-year to 356,228 mt, with value declining 13% to $1.47 billion. Similar to other Asian markets, U.S. pork faced intense price competition from European pork in Japan, particularly contributing to the decline in U.S. exports of ground seasoned pork. However, U.S. competitiveness is expected to improve in 2023.

- Pork export value equated to $61.26 per head slaughtered in 2022, down 2.5% year-over-year (the December per-head average was $66.74, up 22% and the second highest of 2022). Exports accounted for 27.5% of total 2022 pork production, down about two percentage points from a year ago. The ratio for muscle cuts was 23.7%, down from 26% in 2021.

Strong year for lamb exports, led by Caribbean and Mexico

Despite a slowdown in December, exports of U.S. lamb muscle cuts finished 2022 sharply higher year-over-year at 2,225 mt, up 59% and the largest since 2019. Export value increased 49% to $13.2 million, also the highest since 2019.

Growth was led by strengthening demand in the Caribbean, where exports increased 47% to 1,043 mt, valued at $7.5 million (up 32%). Exports trended higher to the region’s three leading markets: the Netherlands Antilles, the Dominican Republic and the Bahamas. Exports also increased substantially year-over-year to Mexico, Canada, the Philippines and Taiwan.

Complete 2022 export results for U.S. pork, beef and lamb are available from USMEF’s statistics web page.

For questions, contact Joe Schuele or call 303-547-0030.

Notes

- Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

- One metric ton (mt) = 2,204.622 pounds

- As noted the past several months, USMEF has raised concerns in recent years with USDA about export data collected by the Department of Commerce for lamb variety meat to Mexico. Reported volumes have declined dramatically since July, suggesting that the data reported in prior months and years were disproportionately high. USMEF is therefore focusing year-over-year comparisons on lamb muscle cuts only.

- U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place).

Source: U.S. Meat Export Federation; USDA

Report Abusive Comment