July was another month of single-digit food and beverage inflation for U.S. retail. Yet, the Circana (formerly IRI) sales numbers show little to no improvement in grocery unit and volume sales. The sustained levels of inflation, record credit card debt and low savings rates are resulting in continued subdued purchases despite an uptick in promotions.

Circana’s household engagement insights tell an interesting back story. Hyper-focused on sales specials, consumers are shopping more often and across more stores. At the same time, inflation continues to provide a small boost to the average shopping ring for most departments. However, the increase in the average basket is below the rate of inflation and has been for a while. This is caused by consumers balancing their budgets by buying on deal, switching to private brands, finding smaller packages, and above all else, buying less altogether. The average number of items bought on each trip has been on a downward trajectory for more than two years.

Circana’s July survey of 1,000+ primary grocery shoppers sheds further light on consumers’ reactions to the marketplace.

- Special occasions and holidays still have the ability to boost spending. July Fourth celebrations provide a good example: 33% of consumers celebrated with friends and family and 25% organized barbeques or cookouts. In all, 58% of consumers did something out of the ordinary during the holiday weekend, with similar expectations for the upcoming Labor Day weekend.

- The strength of traditional holidays means opportunity in inventing your own. One of the best-in-class examples of inventing your own holiday is Amazon’s Prime Day. The July Circana survey found that 82% of consumers are familiar with Amazon Prime Day. Among Prime members (64% of consumers), 58% planned to shop for items such as apparel (25%), electronics (24%), personal/beauty care (22%) as well as items in pet, paper products, foods and beverages.

- While looking to save on restaurant-prepared meals, consumers still enjoy the occasional help. In July, 77.3% of meals were home-cooked. This is lower than in the winter months, but typical of summer patterns. When enjoying restaurant food, fewer people ate on premise (49%) in July than those ordering takeout (45%) and/or delivery (16%). This is a key opportunity for retail to be the “plus one” on items such as beverages, desserts and sides.

- Although the rate of inflation has moderated in the past four months, 89% of consumers still perceive grocery prices as being much (60%) or somewhat higher (29%) when compared to last year and 95% remain concerned over their ability to afford groceries. This has 53% of consumers chasing grocery specials, 46% cutting back on non-essentials and 31% switching to private brands, coupons or switching to lower-cost brands versus what they normally buy.

The sales numbers, engagement stats and survey findings all illustrate a complex marketplace in which consumers continue to shift their dollars across items, brands, sizes, stores and restaurants. Circana and 210 Analytics take a deep dive into the numbers to understand the marketplace impact on meat and poultry trends. The July report is made possible by Hillphoenix.

Inflation insights

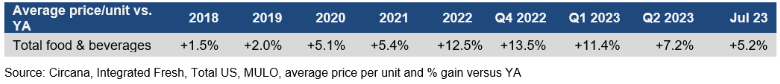

The price per unit across all foods and beverages in the Circana-measured multi-outlet stores, including supermarkets, club, mass, supercenter, drug and military, increased by 5.2% in July (the four weeks ending 7/30/2023). The high level of consumer concern lies in the cumulative effect of many months of high inflation. When comparing July 2023 to July 2020, prices have increased by 24.4%.

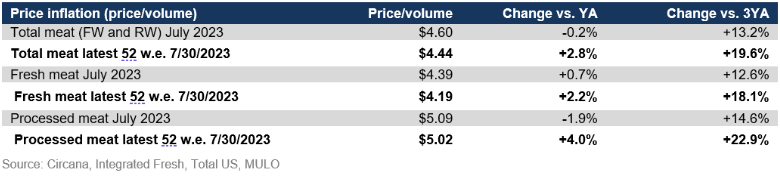

The average price per pound in the meat department across all cuts and kinds, both fixed and random weight, stood at $4.60 in July 2023, which was virtually unchanged from the levels seen in July 2022. Pricing was slightly higher for fresh meat but processed meat prices came down 1.9% from July 2022 levels, primarily driven by bacon and sausage.

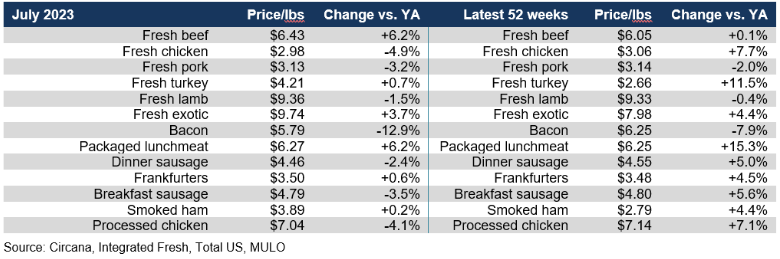

After months of double-digit inflation, chicken price at retail caught up with the decreases seen in wholesale. The average price per pound for chicken in July stood at $2.98, which was down 4.9% versus July of 2022. Turkey prices were virtually flat for the first time in many months. The big difference in July was the average retail price of beef that increased by 6.2% after several months of deflation.Deflation did persist for bacon and sausage.

Meat sales

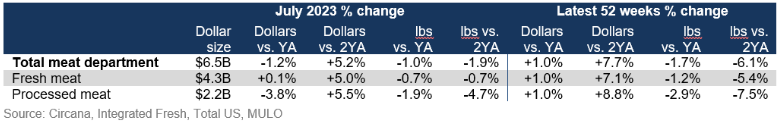

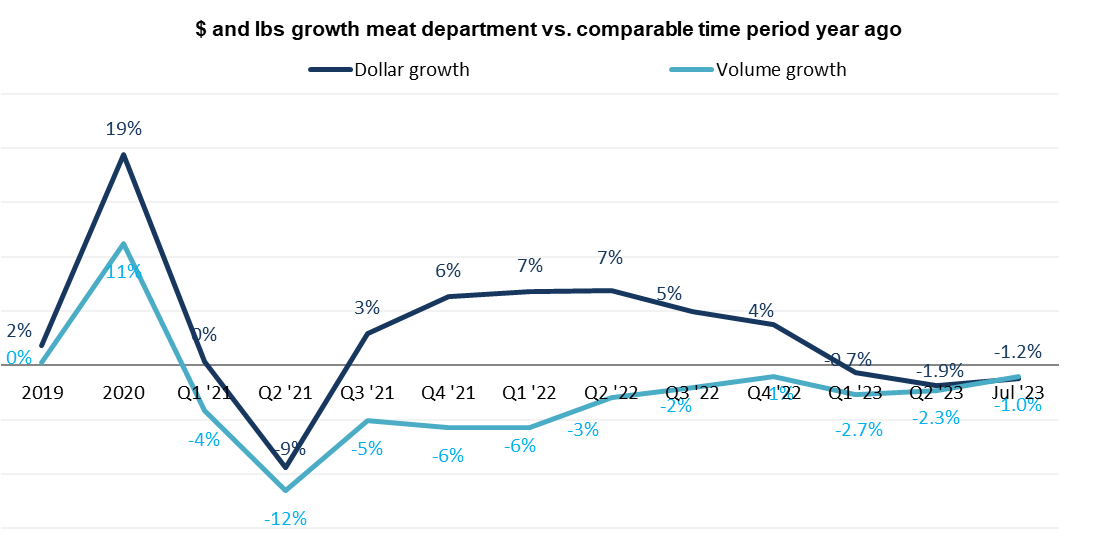

In July 2023, flat prices in combination with fewer units and pound sold than last year resulted in meat dollar sales being down 1.2% year-on-year. On an annual basis, meat sales still tracked 1.0% ahead in dollars. On the flipside, the pound performance improved. While pounds were down 1.0% in July versus their year-ago levels, this was better than the 1.7% decline seen in the 52-week performance. The July Fourth week showed strong results: dollar sales increased by 2.8% year-over-year and pounds improved as much as 4.3%. The other three July weeks were down in dollars, units and pounds — yet again illustrating the power of holidays and celebrations.

Volume was trending closer to year ago levels until the fourth quarter of 2022, but recovery stalled come 2023. Pounds sales trended between 2% and 3% behind the prior year levels for the first six months of the year and moved within 1% in July on strong holiday sales. Because of strong inflationary conditions having turned into deflationary or flat prices, the dollar and volume lines are starting to trend close together.

Assortment

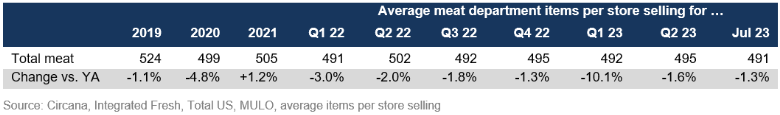

Assortment

Assortment, measured in the number of weekly items per store averaged 491 meat and poultry SKUs in July 2023. This was down 1.3% compared to the assortment in July 2022.

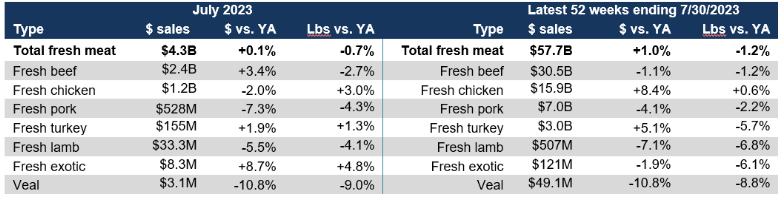

Fresh meat sales by protein

The improved pound performance can be seen for both fresh and processed meat. In July pounds were down 0.7% versus July 2022 whereas in the full-year view, pound sales decreased by 1.2%. The difference in the dollar performance is also affected by the very different levels of inflation/deflation. For instance, the performances of the two biggest sellers, beef and chicken, were very different in July. Whereas beef experienced a 2.7% decrease in pound sales, chicken pound sales increased 3.0%. These are fairly typical recessionary and inflationary patterns. Chicken and fresh exotic (including bison) were the only two areas that increased pound sales in July 2023. Chicken was the only species to accomplish pound growth in the 52-week look.

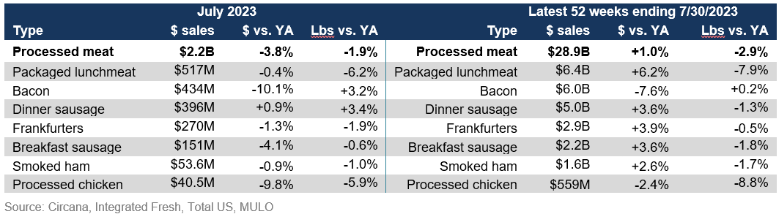

Processed meat

July 2023 processed meat sales were about half that of fresh meat, at $2.2 billion. Dollar sales were down by 3.8% versus July 2022, while pounds decreased 1.9%. In the 52-week view, dollar sales did stay ahead of year-ago levels by 1.0%, whereas the pound performance was pulled down by package lunchmeat and processed chicken. Interestingly, the latter has had a stellar performance in the frozen food aisles.

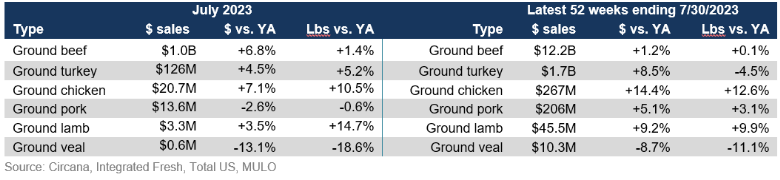

Grinds

In the past year, grinds generated $12.2 billion, with 85% of dollars and pounds being generated by ground beef. The ground beef performance exceeds that of total beef with an increase in pounds in both the short and longer-time periods. Additionally, ground chicken, turkey and lamb gained in pounds in July as grinds bring affordability and versatility to the meat department.

What’s next?

A moderating rate of inflation typically means a boost in sales. However, aside from strong holiday week sales, everyday sales have not yet shown signs of recovery but rather point to strength in grinds and some of the cheaper types and cuts. New patterns typically take a few months to develop, so the August and September reports will show the true effect of lower inflation/deflation.

The next performance report in the Circana, 210 Analytics and Hillphoenix series will be released mid-September 2023 to cover the August sales trends. To learn more about Circana’s meat and poultry sales and shopper measurements, please contact: FreshFoods@circana.com. Please thank the entire meat and poultry industry, from farm to store, for all they do.

Date ranges

Q2 2023: 13 weeks ending 7/2/2023

July 2023: 4 weeks ending 7/30/2023

Report Abusive Comment