The numbers tell the story: Burgers are a bonanza for foodservice operators.

In fact, 78 percent of sandwich consumers purchase a burger from a restaurant or foodservice location at least once a month, which is more than any other option, according to the 2020 Sandwich Consumer Trend Report, from Technomic, a Chicago-based food industry research and consulting firm.

In addition, more than 80 percent of consumers say they love or like to eat hamburgers or cheeseburgers, reports Datassential, a Chicago-based market research firm.

A Sizzling Sector

How to Keep Burgers a Foodservice Favorite

A Powerful Push for Plant-based Patties

“Burgers are consumers’ favorite sandwich and is the one they most commonly consume, and burger chains represent the largest restaurant menu category,” says Charles Winship, Technomic senior research analyst. “There are a lot of opportunities” in the sector.

Yet, foodservice outlets must offer more than traditional burgers if they are to escalate activity, analysts say. A large and growing base of consumers seek novel and exciting options.

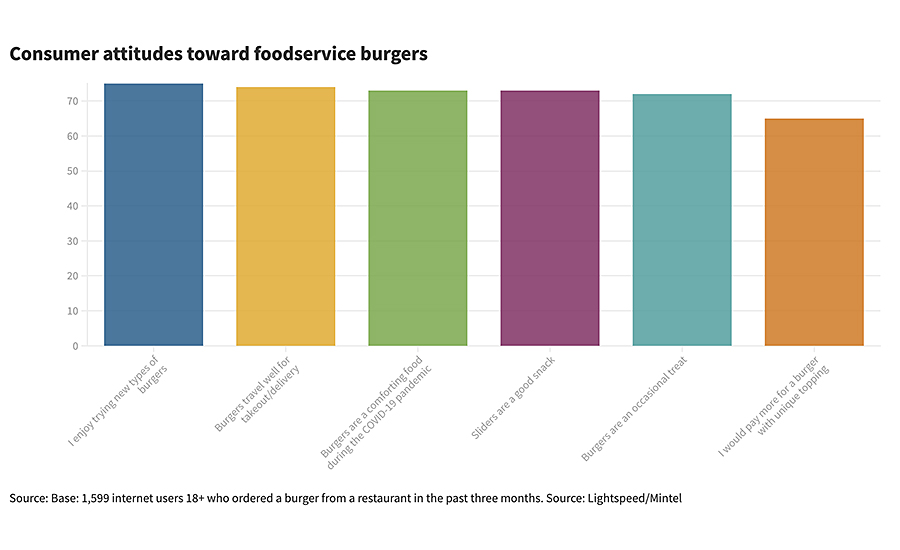

“For many, prolonged periods of at-home meal consumption and preparation will eventually turn into cooking fatigue,” says Emma Allmann, junior analyst for Mintel Group, a Chicago-based global market research firm, in Mintel’s November 2020 Burger Trends: Including Impact of COVID 19 U.S. report. “Operators are in a great position to appeal to consumers with unique and flavorful burgers they’re not likely to prepare themselves or have the ingredients for at home.”

About 67 percent of consumers, for instance, say the ability of a restaurant to customize is very important when choosing a burger outlet, Datassential reports, and 40 percent of consumers say all burger components are equally important. As a result, operators should experiment with new flavors of protein, cheeses, buns, sauces and toppings, says Mark Brandau, Datassential group manager.

Keep track of the trends

“Consumer interest in culinary trends as straight forward as upscale sauces or new varieties of cheddar is driving demand that restaurants should accommodate,” he says. “Consumers have considerable interest in culinary trends around burgers, but very few restaurants are adopting those trends. That means there is a lot of low-hanging fruit for differentiating the burger lineup.”

While more than 50 percent of respondents in a Datassential consumer survey report interest in next-level types of cheddar, for instance, only a quarter of operators have high-end cheddar on their menus. Forty-one percent of respondents also say they would like to try burgers with waffles or doughnuts in place of a bun, and 41 percent admit interest in sampling higher-end Wagyu beef burgers.

Consumers’ desire for burger sat breakfast and brunch, meanwhile, also is outpacing the number of outlets offering such selections, despite the items nearly doubling their penetration on foodservice menus over the past four years, Datassential reports.

Category innovation is ongoing as operators look for ways to incorporate on-trend ingredients, flavors and cuisines into the popular burger format, says Maeve Webster, president of Menu Matters, an Arlington, Vt.-based food industry consulting firm. Macaroni and cheeseburger appearances on restaurant menus, for instance, grew 72 percent in the past four years, while steam-grilled sliders on menus are up 12 percent, Datassential notes.

In addition, Webster says plant-based options are the fastest growing burgers in restaurants and range from lab-based meat analog selections to more whole ingredient-based choices such as black bean burgers. Plant-based burger penetration is up 1,150 percent over the past four years, and about 10 percent of restaurants that serve burgers have a plant-based option, Datassential reports. “Plant-based burgers are the meteoric growth story in the category,” Brandau says.

Make price and performance a merchandising priority

Foodservice operators also are increasingly offering burgers with non-beef animal proteins, including pork, lamb and poultry, Webster says, along with different sauces, toppings and condiments. She says, for example, more burgers are available with sriracha and chipotle-based sauces, as well as bacon jam, maple and soy sauce-based condiments. Varieties of ranch dressings, pimiento and other cheeses, and jalapeno peppers and other produce toppings also are becoming more prominent, Webster says.

“There is a range of innovation in the burger space, from operators introducing their own version of tried-and-true favorites, like bacon burgers, to healthy, plant-based alternatives, to signature burgers with innovative flavor profiles,” Winship says.

In addition, more chains are launching burgers with spicy flavors, he says. They include the Queso Burger from Sonic Drive-In, the Fiery Famous Star from Carl’s Jr. Restaurants and the Sweet Heat Burger from B. Good.

While such alternatives are helping to meet the greater consumer interest in variety, the burgers also must be economical to meet the expectations of most customers, analysts note. Affordability is one of the most important factors when deciding where to go for 59 percent of consumers say, Technomic reports. But 35 percent of consumers strongly agree that they are willing to pay more for premium toppings, Technomic reports, and 48 percent of consumers say they are willing to wait longer for a build-your-own burger.

Another 47 percent of consumers also state they are concerned about the quality and freshness of burgers ordered for delivery, Technomic reports.

Consumers cite value and customization as the most important factors when ordering a burger away from home, Brandau says., while taste and quality are the top preferences when preparing burgers at home. Nevertheless, he says that because the burger sector is “a very crowded and mature category of the food industry,” restaurant operators can stand out from competitors by offering quality selections rather than the lowest menu prices.

“Quality indicators like grass-fed, Grade A or organic fetch a burger premium,” Brandau says, adding that about half of all consumers are willing to pay a premium for grass-fed beef, high-grade beef or meats from different breeds of cattle.

Restaurant chain B. Good offers a line of flexitarian burgers, with several plant-based options and a turkey burger that is blended with mushrooms. Courtesy of B. Good.

One size does not fit all

The importance of supporting a strong burger initiative will vary by restaurant and is dependent in part on operators’ specific foodservice and prepared-food strategies and their customer base, Webster says. “Burger programs won’t be appropriate for all operators,” she says, adding that those with burger programs must meet strong customer expectations if they are to remain competitive.

Competition is fierce, with 42 percent of consumers reporting they have a preferred restaurant for burger occasions, Technomic notes. Approximately 60 percent of foodservice outlets report burgers are profit centers for them, Datassential adds.

Webster says operators should intensively study their competition when creating a differentiation strategy that could encompass such variables as quality, uniqueness, innovation, price and value.

Regardless of the menu offerings, maintaining a strong restaurant burger program can be challenging, Webster notes. Operators, for instance, may find it difficult to offer consistently high-quality burgers during busy periods, she says.

“Burgers that are built poorly will not travel well and can create quality issues that will be hard to come back from,” she says. “The burger category is very competitive, and patrons will not tolerate poorly executed programs.” NP

Report Abusive Comment