Will the year ahead be a Goldilocks time for chicken producers? Will the supply/demand balance prove to be not too hot, not too cold, but just about right in terms of continuing to provide consumers with an adequate supply of wholesome, affordable chicken while producers experience favorable margins?

As is most often the case, the answer to the path forward depends on developments on both sides of the demand/supply of the equation.

The beef cycle is now in a downward trend in terms of production at least through 2025. Drought conditions in much of cow/calf country have damaged pastures and wheat forage options. These challenges, coupled with tight hay supplies, are forcing many ranchers to trim their cow/heifer herds. As a result, USDA is forecasting a significant decline in beef production next year.

As David Meloni with Datum FS said recently at the 2023 Chicken Market Summit, "I don't know if the chicken industry has ever been in a better position to provide value to foodservice over the next 18 months."

In addition, many hog producers have not experienced positive net margins for quite some time. At least three states are now requiring certain sow farrowing conditions that add to operating costs and marketing uncertainty.

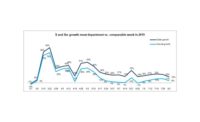

According to USDA data, chicken producers are being disciplined in stepping up production as they weigh the market impact of output adjustments for competing meats. At the same time, agricultural animal producers are cautiously optimistic that the coming harvest for corn and soybeans will continue to trend toward a somewhat adequate supply, which should allow for lower feed costs from the elevated levels experienced in recent years.

Although analysts sometimes argue chicken production can ramp up in six or seven weeks, the current situation is not that straightforward. The hatchery supply flock is not carrying hen numbers above current needs for hatching eggs. Also, hatchability is struggling to return to a percentage more in line with historical performance. If market conditions consistently signal more chicken production is in order, above the somewhat modest estimate for 2024 by USDA, it will take time for more day-old pullet chicks to mature into productive laying hens.

Chicken companies realize that with record-high average per capita chicken consumption at over 100 pounds, a major marketing key will become more important. While the likely coming gap in competing meats should encourage consumers to give chicken more attention, developing innovative and good-tasting further processed products will need to find success to keep the consumption trend upward, both at retail grocery and foodservice. During the recent pandemic, home meal preparers gained greater appreciation for value-added chicken products that made at-home dining more convenient. That appreciation continues to grow.

Gen Z is also coming of age. This large group of consumers born between 1997 to 2012 want greater choices and more immediate satisfaction. They have expressed a strong preference for chicken in their diets. According to a recent National Chicken Council survey, 72% of Gen Z respondents said they either eat chicken all the time, or it is part of their regular diet. Tailoring new products to Gen Z tastes will be important, especially for the away-from-home market.

Ground chicken has made steady progress in gaining consumers’ acceptance. If ground beef finds it more difficult to fit into strained household food budgets, ground chicken will become a more popular and natural alternative, and not just for burgers. Barbecue, tacos, and pulled and shredded chicken meat, especially thigh portions, can hit the dinner plate with convenience, healthfulness, and value.

Foodservice operators are understanding that as the beef supply tightens, chicken can offer significant help with their menu choices. Even before the change in the current beef cycle, chicken sandwiches were proliferating across much of the quick-service and casual-dining market. Chains that had only considered limited chicken choices or no chicken on their menus are discovering success with chicken sandwiches, chicken tenders and variations of chicken strips. Chains that have a history of chicken sandwiches are rolling out 2.0 versions to freshen their menus and better meet the stepped-up competition. After a bit of tepid demand for chicken wings, the tide has turned, with wings finding stronger demand going forward.

While all of these signs point to measured optimism, there are some significant challenges ahead. The chicken industry has pulled through hurricanes, droughts, high feed costs, record input costs, and COVID, but the biggest obstacle to our continued success just might be our own government.

The chicken industry is a model of American innovation and efficiency. Although I am a bit biased, there is no more important food source in America. Chicken is healthy, sustainable, and affordable. Chicken supports millions of jobs and thousands of rural communities. Chicken provides nourishing, affordable protein for Americans.

But overzealous and misguided regulations coming out of the U.S. Department of Agriculture threaten to take chicken off the plate for millions. And those most vulnerable would be first in line: lower-income earners, children who receive free and reduced-cost school meals, and needy individuals who rely on food banks to feed their families. With soaring across-the-board inflation, the looming threat of recession, and geopolitical disruption, there has never been a worse time for needless governmental regulation. In fact, U.S. poverty spiked last year, with child poverty more than doubling, the U.S. Census Bureau reported in September, the largest year-over-year increase on record.

The National Chicken Council will continue to work to ensure that any federal regulatory requirements are based in science and common sense, are achievable, and do not jeopardize the industry efficiency we have worked so hard to build.

The Goldilocks story has bearish connotations, but despite some likely volatility for the U.S. economy, food inflation, and even on the supply side, there are good reasons to be bullish about the future of the chicken market and the temperature of the porridge in the chicken industry’s bowl.

Mike Brown is president of the National Chicken Council.

Report Abusive Comment